The crypto and blockchain industry was barely known a few years ago, but today, it has gained a lot of popularity around the world, and worth over $223 billion. Since the release of the bitcoin whitepaper by Satoshi Nakamotactive in 2008, many successful, innovative projects have hit the market and many more will be released before the end of this year and in coming years.

If you’re reading this article right now, that means you’ve somehow gotten involved with cryptocurrencies and blockchain technology, and you’ve heard the term ICOs. ICOs stands for Initial Coin Offerings in the crypto space.

ICOs have become a trending topic in the crypto community because they offer people the opportunity to invest in some innovative and promising ideas before they become successful and popular like Uber and Tesla – imagine if you have had a chance to invested in one of these at the early stage years back.

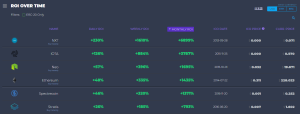

Well, before we go deeper, just take a look at the chart below.

As you can see, you could have bought 1 unit of Ethereum during its ICO period in 2014 for just $0.031, but today, you’ve to spend over $200 to purchase 1 unit of ether which is like over 1400% ROI. Also, in 2015, NEO was sold at $0.032, and it’s currently worth over $19, which mean you could have made a Return of investment of over 1600% if you had invested in its ICO.

There have been a lot of other successful projects like Ethereum and NEO, and the incredible ROI one could get from investing in these projects is one of the reasons why ICOs are interesting. At first, when these projects and technologies came up, only a few believed in them, and people thought everything “crypto” was a joke. However, today, these technologies have been developed and adopted by many people.

What is an ICO?

An Initial Coin Offering (ICO) is a technique used by blockchain-related companies to generate investor funds for their project. ICO is very similar to an Initial Public Offering (IPO) where you buy shares to become part of the owners of a company. But in the case of ICO, you’re not going to become part of the owners of the company in the future.

The primary difference between the ICO and IPO is that ICO projects must have a connection with blockchain technology.

No one owns the ICO market. It is largely unregulated and makes it easy for anyone to organize an Initial Coin Offering. Before a company is listed for IPO by the traditional exchanges, the firm has to meet up with some sort of regulatory standard, but this does not exist in the ICO market.

Traditionally, when a company wants to raise money, they approach rich investors to put their money in the company and do Series of Funding. However, now that there are cryptocurrencies and smart contracts, companies can raise funds with a new method called the ICO. With an ICO, the project team will write a whitepaper and put down their ideas, and they will be able to launch their ICOs on different crypto-related platforms and invite investors to invest in their idea. So it’s literally just like investing in promising technologies and ideas before they become popular and successful.

What Are ICO Tokens?

ICO tokens are units of the native cryptocurrency offered by the blockchain smart contract project that you want to invest in. These units are usually named after the project or its founders, example SUNex tokens, Pcoins, and so on.

How Do ICOs Work

Creating any form of decentralized application or high profile blockchain project requires a dedicated team, hard work, marketing, and of course, a lot of money.

For companies to raise this money for their project, they organize ICOs and appealingly present them to attract investors. If people are convinced about a project as stated in the whitepaper and believe that it could work, then they buy the project’s tokens for a certain amount.

ICO token prices are usually pegged in Ether (ETH) because many of the new decentralized applications are built on the Ethereum blockchain. However, some projects add support prices that allow interested investors buy with Bitcoin or Litecoin.

To invest in an ICO, you have to send some BTC, LTC, ETH or any other cryptocurrency supported by the project to their designated wallet. In exchange, the project will send the amount of its tokens that you paid for to your wallet. Many smart contracts require that you provide an ERC-20 token compatible wallet for this purpose.

Reasons For Buying ICO Tokens

There are primarily three reasons for purchasing ICO tokens

- To resale the token at a higher price in the future when the project has become successful.

- To enjoy discounted fees or get short-term profits from pre-token sale period.

- To use the token to access some premium features offered on the project’s decentralized applications. These usable tokens are called utility tokens.

Tips When Investing In ICOs

While investing in an ICO can be incredibly profitable, there are also some risks attached because you’re investing in ideas and companies that are not yet developed so you could lose some money. In fact, there have been many cases where projects shut down after raising funds through an ICO so it is important to always do your own research before investing in any ICO.

While doing your research, pay close attention to these facets.

Rate The ICO Whitepaper

A whitepaper is basically the core foundation of an ICO project and usually describes the theory behind the innovation a company seeks to make.

An ICO whitepaper is a detailed explanation that shows that problem that the project is trying to solve with the aid of blockchain technology and details of how they plan to do it. This information is usually found on the official website of the project.

The basic contents of an ICO whitepaper include

- A related problem and a detailed solution that the project is offering.

- A detailed description of the proposed product and the system architecture upon which it is built.

- Brief information regarding the team behind the idea

- Further information about the ICO: how much funding will be raised, the project roadmap, etc.

Project Competitors

Most successful blockchain projects have competitors. Find out what the new project is doing differently from their counterparts.

ICO Project Team

Who are the people behind the idea and project? Investors should always try to find out whether the named individuals have worked on similar projects in the past or have the expertise that they claim to have.

The Project Road Map

Study information about how long the team plans to work on the project and consider whether they can realize the funds and personnel to do so.

Fund Allocation

ICO whitepapers contain information on how the team plans to use funds realized from the ICO. Consider if the fund distribution is wise and attainable.

Check Their Social Media Presence

Social media networks are incredible ways to find out more information about an ICO reputation.

Conclusion

Now that you know exactly what an ICO is, it’s important that you also know that ICO markets are largely unregulated and for this reason, you’ve to be careful with where you put your money.

Check out our list of active and upcoming ICOs, pick out the best ones, and remember to always do your own research before investing in any ICO. If you can carefully research ICOs, then they can also be a great way for you to start investing in cryptocurrencies.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us