Ethereum (ETH) is a decentralized network for executing and verifying transactions that use lines of code called smart contracts. Smart contracts on Ethereum allow users to define and settle transactions without the need for a third party.

Although Ether is the second largest cryptocurrency in the world, not very many people understand how it works. Hence, this Ethereum guide is designed to help you understand the purpose and functions of the world’s largest smart contract platform.

We cover the following Ethereum components:

- What is Ethereum?

- Ethereum History

- What Makes Ethereum Different?

- How Does Ethereum Work Anyway?

- Ethereum Use Cases

- Advantages of Ethereum

- Disadvantages of Ethereum

- Proof-of-Stake and Ethereum?

- How to Stake Ethereum

- Ethereum vs Bitcoin

- How to Buy Ethereum

- Frequently Asked Questions (FAQs) About Ethereum

What is Ethereum (ETH)?

Ethereum is a decentralized blockchain network that securely executes and verifies transactions using lines of code referred to as smart contracts. These smart contracts allow participants to transact with each other without a third party involved.

The Ethereum network has a native coin Ether (ETH). ETH is used as a unit of value in the Ethereum ecosystem and is required as gas (transaction fee) for users to get their transactions processed.

Learn More: The Difference Between Crypto Coins and Tokens

A Brief History of Ethereum

The whole idea behind Ethereum was initially started in 2013 by a Russian-born Canadian programmer called Vitalik Buterin. Hence, he is often referred to as the main founder of Ethereum. Other co-founders of the project include Gavin Wood, Charles Hoskinson, Anthony Di Iorio, and Joseph Lubin.

At an early age, Buterin was already into Bitcoin. In fact, he was among the early adopters of the world’s largest cryptocurrency. At the time, Bitcoin was the only cryptocurrency, and its major use case was to serve as an electronic cash that can be transferred between two people without an intermediary.

However, at age 17 in 2011, Buterin began to imagine a platform that went beyond Bitcoin’s financial use cases and he released a whitepaper in 2013 describing what would eventually become Ethereum.

In 2014, Buterin and the other co-founders of Ethereum launched a campaign to gain traction. They sold about 60,000,000 ETH tokens to investors through an initial coin offering (ICO), raising 31,000 BTC (app. $18.3 million at the time).

The Ethereum Frontier network was launched in 2015. Not too long after that, developers started to write smart contracts and develop decentralized apps on the network. Miners also began joining the Ethereum network to help secure the blockchain and earn ETH from mining blocks.

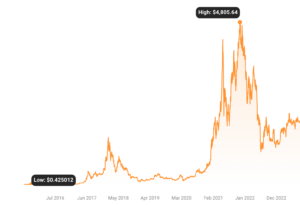

Ethereum (ETH) Price History

Ethereum is one of the most successful cryptocurrencies in the market. Since its launch, the project has gained tremendous value, recognition, and adoption.

When the network was launched, Ether was less than a dollar. Today, ETH is around $3,000, making it one of the best-performing assets in the past decade.

(Source: CoinStats)

At the time of writing this Ethereum guide, the all-time high ETH price was $4,878, reached on November 10, 2021. At its peak, the asset had a $570 billion market capitalization.

What Makes Ethereum Different?

Ethereum is a decentralized blockchain platform that enables peer-to-peer transactions. While this is akin to other cryptocurrency projects, it has other features that make it unique.

Unlike Bitcoin, which has limited use cases, the Ethereum blockchain was built to support other decentralized applications (dApps). In other ways, developers can create and run dApps on the network.

Ethereum was the first mover in the smart contract sector, and it serves as a home for so many blockchain projects. It is classified among first-generation blockchain networks and remains the leading platform for developers.

How Does Ethereum Work Anyway?

Understanding the technology behind the Ethereum network will help us answer the question: How does Ethereum work? Ethereum’s functionality is driven by its use of smart contracts, consensus mechanisms, and the Ethereum Virtual Machine (EVM), amid other general features common among cryptocurrencies.

Smart Contracts

Smart contracts are lines of code that are stored on the blockchain. They are created to be implemented automatically when fixed terms and conditions are met.

The native programming language of Ethereum is called Solidity. Solidity is similar to other programming languages like C++, JavaScript, Python, etc.

Individual users can communicate with a smart contract by submitting transactions that carry out a function established on the smart contract. This therefore means that, with smart contracts, two users can transact with each other without an intermediary. Smart contracts cannot be deleted and interactions made with them cannot be reversed, proving their immutability.

Consensus Mechanism

Consensus on a blockchain is achieved when all the nodes on the network arrive at an agreement on a single data. It has to do with validation of transactions. Ethereum currently uses a consensus mechanism similar to that of Bitcoin called Proof-of-Work (PoW).

How does PoW function? When a miner in the network solves a hash problem, it gets rewarded with some amount of ETH and wins the right to add the next block to the blockchain. This process gets repeated around every 12 seconds on the Ethereum network. PoW usually consumes a lot of energy compared to other consensus mechanisms.

Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is a computational system that developers utilize in creating decentralized applications (dApps) on the Ethereum network. Developers achieve this by writing smart contracts using Solidity.

The Solidity code is then converted into low-level machine instructions, commonly referred to as opcodes, which are understood and executed by the EVM. Ethereum’s EVM stores all account data and smart contracts.

EVM is one of Ethereum’s most coveted features as it allows developers to easily launch applications across other compatible networks. Examples of EVM compatible networks include Polygon, Avalanche, BNBChain, etc.

Ethereum Use Cases

Bitcoin was created to serve as a form of digital cash, enabling people to send money anywhere around the world. Ethereum was created to serve more purpose than that. Here are the major use cases for Ethereum.

Decentralized Autonomous Organizations (DAOs)

A decentralized autonomous organization is a community-driven system with no central authority. DAOs can be likened to traditional organizations that are managed by boards, committees and executives. The difference though is that DAOs are not overseen by a limited group. So how does it run?

DAOs are regulated solely by their individual members who collectively make decisions pertaining to the future and progress of the project. This is possible because DAOs use smart contracts to define and enforce the rules of the organization.

To gain membership into a DAO, a user needs to buy the project’s cryptocurrency and hold it. Holding the asset grants users membership and also gives them the power to join other members of the DAO in any form of voting or decision-making regarding the organization, according to the amount of the asset they hold. This system enables everyone in the organization to make a contribution.

It is noteworthy that many DAOs run on the Ethereum blockchain. The first decentralized organization, driven by ether, was dubbed The DAO. It enabled users to send money from anywhere anonymously and then the owners were rewarded with tokens, granting them voting rights in the organization. The DAO ultimately failed following an early and controversial hack incident in 2016.

Despite the failure of the earliest DAO experiment, the idea of DAOs is very much alive. Most decentralized protocols such as Compound, Aave and BitDAO implement a DAO model to allow token holders to govern key improvement decisions.

Token Sale

The Ethereum network supports crowdfunded token sales, previously conducted using an initial coin offering (ICO) model. Today, token sale events have different names including Initial decentralized offering (IDO) and initial farm offering (IFO).

New blockchain projects conduct token sales to generate capital for growth and development. Users who are interested in the project can then choose to partake in the fundraising event by sending coins to a designated address in exchange for the newly launched token. The token may have some use cases relating to the service rendered by the project, which the investor gets to benefit from. Or it may serve as an involvement in the project.

A major disadvantage of decentralized token sales is that most of them are usually unregulated. For that reason, investors need to diligently research before crowdfunding a project. While some token sales have yielded huge returns for investors, many others have led to significant losses.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is an ecosystem of financial applications built on blockchain technology.

DeFi protocols are built on public blockchain, with Ethereum being a primary network for hosting them. Since these platforms are decentralized, they are managed by a community of users.

DeFi enables users to perform various financial activities such as earning interest, borrowing, lending, buying insurance, trade derivatives and many more. This makes DeFi better than traditional banks as it allows users to access its service without any paperwork or third party, while still being pseudonymous.

Non-Fungible Tokens (NFTs)

A non-fungible token (NFT) is a digital asset that is not directly exchangeable for another. They are often designed as collections, with each token possessing unique features that make them distinct from others.

Ownership of an NFT is validated only on the blockchain. NFTs can be utilized in so many ways such as verification of authenticity of art, academic and medical files, etc. It can also be used in gaming, music, and even tweets.

NFTs can be created on Ethereum or on other blockchains that support this functionality. Examples of leading NFTs today include CryptoPunks, Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC). These top three NFTs run on the Ethereum blockchain.

GameFi

GameFi is simply a combination of the words “game” and “finance.”

GameFi was created as a means for game players to earn cryptocurrencies while gaming. This is possible because such games are built on the blockchain. With this incentive, players are motivated to progress to higher levels in the games they play.

GameFi platforms can choose to set various instructions that must be met by players to enable them to play or qualify to earn. While some platforms allow their players to earn rewards directly from the games they play, others may require gamers to invest a small amount to gain access to the game and its rewards.

Gamers can earn rewards such as cryptocurrencies and NFTs like virtual land and yachts. Users can rent out these items to generate more revenue.

A popular blockchain-based gaming project is Axie Infinity, which was originally built on the Ethereum network but later migrated to the Ronin Network, an Ethereum-linked sidechain.

Advantages of Ethereum

The Ethereum network has seen increased adoption because of the following advantages:

Decentralization

The decentralized nature of Ethereum enables the distribution of knowledge and trust among users in the network while eliminating the need for a central authority to moderate transactions. Although the Ethereum Foundation oversees major upgrades to the network, the underlying blockchain has been widely adopted and is less susceptible to hostile takeovers.

Permissioned networks

The Ethereum network was developed in a way that allows for the existence of public and private networks. A permissioned network is one that is not publicly accessible by users unless they are granted access by the ledger administrators. With this feature, various corporate organizations can utilize the permissioned network to carry out their businesses.

Tokenization

Any asset that has been registered in a digital form can be tokenized on Ethereum. One of the most popularly used Ethereum token standards is ERC-20. Instead of running on their own individual blockchains, ERC-20 tokens run on the Ethereum blockchain. There are also other token standards on the network, such as the ERC-721 that supports the creation of non-fungible assets.

Liquidity

The term liquidity is used to describe the ease of exchange between two assets. At this time, ETH is highly liquid as it can easily be converted to fiat and other cryptocurrencies. ETH market capitalization is close to the same as popular financial institutions such as Bank of America and Mastercard.

Interoperability

Interoperability in blockchain refers to the means through which various blockchains share information and communicate with each other, granting access to their data. At this time, there are several cross-chain bridges that support the Ethereum blockchain. With these bridges, Ethereum users can migrate ERC-20 tokens to other networks such as Solana, BNBChain, Polygon, Terra etc.

Recommended Read: What is Terra (LUNA)?

Disadvantages of Ethereum

The Ethereum network currently faces a number of limitations. The most prominent ones include:

Ethereum’s Programming Language

Solidity, as mentioned earlier, is the native programming language of Ethereum. It is difficult though to find courses in Solidity that can be learnt by individuals with little or no prior knowledge on the subject. This brings about a limitation to the growth of the network.

At the same time, it is worth mentioning that Ethereum’s Solidity is gradually becoming popular. Hence, this limitation is likely one that will go away as the network gains traction.

Issues With Scalability

Scalability has to do with the ability of the Ethereum mainnet to handle a growing number of transactions in the blockchain network. At this time, the Ethereum network can only handle 12-15 transactions per second. Hence, the network is slower and more expensive with increased usage.

Bitcoin was created with the aim of serving as a digital payment system. Ethereum, on the other hand, was created to serve diverse purposes, such as having a ledger, smart contracts, and so on, all of which may lead to errors, malfunctions and even hacks.

There have been cases where hackers exploited bugs on Ethereum, which by extension affects other projects that run on the network.

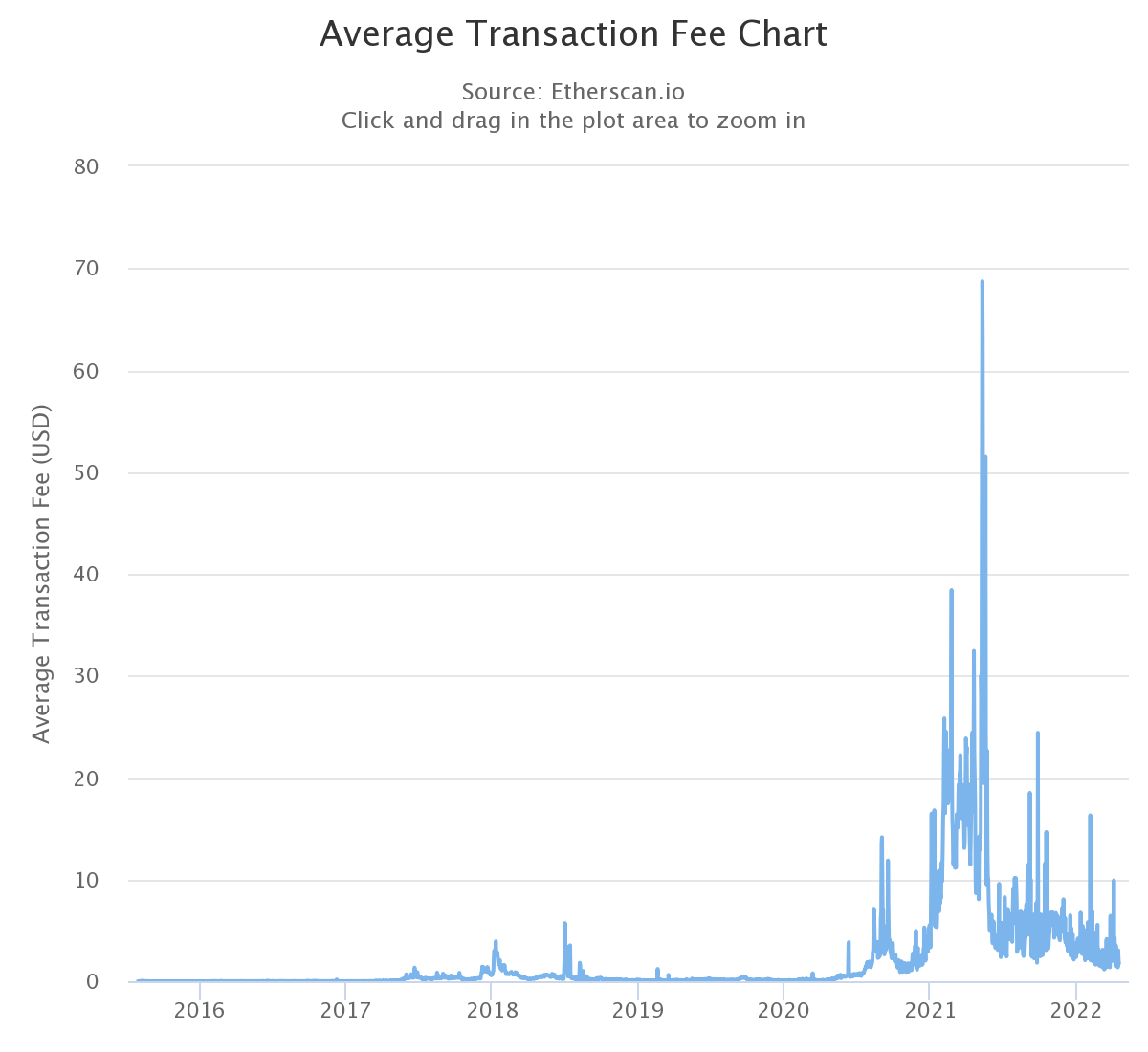

High Network Fees

Due to scalability issues, an overload of transactions can lead to ridiculously high gas fees that makes the network inaccessible to the average user.

During such peak hours, a single Ethereum transaction could cost as much as $1,000, a high figure compared to major competitors such as Solana ($0.005), BNBChain ($0.3), and Polygon ($0.01).

Proof-of-Stake and Ethereum

As demand for Ethereum blockspace grew, it became evident that more was required to make the network cheaper, faster, and more efficient. This effort led to the development of a plan that allowed Ethereum to switch from its native Proof-of-Work consensus mechanism to one based on Proof-of-Stake (PoS). Ethereum.

Proof-of-Stake is a consensus mechanism that enables fast and cheaper transactions. Ethereum developers argue that PoW is better than PoW in its functionality, although this is not entirely proven.

In PoS, there are validators responsible for the addition of new blocks, just the way PoW has miners. Validators are selected at random to create or validate blocks. To become a validator, a user needs to stake 32ETH using a self-staking method or stake any amount of their choice using a liquid staking solution.

Some key benefits of PoS include its low consumption of energy to validate blocks, its speed in processing more transactions, and the availability of more nodes in the system, as hardware requirement is not as heavy as it was for PoW.

Ethereum developers finally launched the Ethereum PoS chain on December 1, 2020. However, it was not until September 15, 2022, that Ethereum fully merged its PoW chain with the newly built PoS one, marking the end of the legacy consensus model.

How to Stake ETH

Cryptocurrency staking often involves a holder delegating that designated amount of coins to help support the blockchain network and validate transactions. The user is then rewarded with some amount of crypto from the annual percentage rate (APR), according to the amount staked and the duration it was staked.

As Ethereum adopts a PoS consensus mechanism, it gives the cryptocurrency the ability to get staked. The most convenient ways Ethereum can be staked are through a centralized exchange platform, self-staking, or using a liquid staking solution.

Exchange Staking

This refers to staking on any centralized exchange (CEX).

CEX is a trading platform that serves as a third party between users and their crypto funds. It enables users to buy, sell and hold their cryptocurrency funds.

An advantage of CEXs is that cryptocurrency wallets can be retrieved if lost, giving the user access to their lost funds. This is something that is not possible with non-custodial wallets.

Cryptocurrency staking is another feature that can be explored on CEXs. When a user stakes a portion of their coin or token on a centralized exchange, the platform informs the user about the terms and conditions governing the process. Once the user agrees, the crypto then gets locked for the indicated duration or can be manually unlocked. When locked in, interest gets accrued on the cryptocurrency, which serves as a passive income for investors.

There are many centralized exchanges today. These include Binance, Coinbase, Kraken, etc.

Solo Staking

The Ethereum Foundation describes solo staking as “the gold standard for staking” on Ethereum. This method of ETH staking requires the user to become a validator by staking a minimum of 32 ETH and then taking care of the responsibilities of validations, which are generating and approving new blocks in the system.

However, investors will need to stake their ETH until the initial phases of Eth 2.0 have been rolled out. This means that staked ETH cannot be released until that time, which is currently unknown. Hence, this method of staking is beneficial majorly for long-term investors who don’t mind their funds being locked for a significant period of time.

The minimum amount to be staked ( 32 ETH) is also a scare for investors who do not have that amount of money to partake in being a validator.

Liquid Staking

Liquid staking is a process through which users get to stake an Ethereum amount of their choice and unstake whenever they choose to.

This is achieved when investors receive a tokenized form of the staked ETH. The tokens can function like actual ETH, as they can be sent wherever the user wants while still keeping the liquidity active and receiving rewards.

A good example of a liquid staking solution is Lido Finance. This solution helps solve the problems associated with Ethereum staking. When a user stakes any amount of ETH in Lido, they receive a tokenized version called sETH tokens which enables them to earn rewards through lending, collateral, and more.

When users withdraw from liquid staking solutions, they get a reward proportional to the amount of cryptocurrency they staked. This makes the liquid staking method the most efficient among the three methods of staking Ethereum.

Ethereum vs Bitcoin

The difference between the two largest cryptocurrencies has been a debate for a long time, especially amongst people who are new to the industry. The two leading crypto assets have their similarities and differences.

Both cryptocurrencies are built on blockchain and both run on independent networks. Bitcoin and Ether are listed on almost every cryptocurrency trading platform and they fall into the category of top digital assets in the world. They are used as a medium of exchange and for cross-border transfers.

However, the Ethereum blockchain was developed to serve as a smart contract platform to host decentralized applications while the Bitcoin protocol was designed to function as a peer-to-peer electronic cash system.

Additionally, although Ethereum currently uses a PoW consensus mechanism, the network plans to migrate to a PoS. As reported in April, lead Ethereum developer Tim Beiko said the smart contract platform is in its final chapter of PoW.

Recommended Read: What is Bitcoin (BTC)?

How to Buy ETH

Interested investors can purchase ETH like any other cryptocurrency from trading platforms such as Coinbase, Kraken and Binance. To buy Ether, you will need to create and verify an account with the exchange.

This Ethereum guide uses Binance as an example to show you how to purchase the cryptocurrency:

Step-by-Step Guide on How to Buy Ethereum on Binance

Step 1: Create a Binance account

Creating an account is simple. You can create an account on Binance from your computer or smartphone. The exchange also has an app for Android and iOS devices.

You will need to submit your personal details, such as name, email, and phone number, to create an account.

Step 2: Verify your Binance account

Binance requires users to verify their accounts via a know-your-customer (KYC). You will need to verify your email address and phone number as well as your identity. Binance accepts government-issued ID cards such as driver’s licenses and international passports.

Step 3: Buy Ethereum

Once your account has been verified, you will be able to purchase ETH or any other cryptocurrency of your choice. But first, you will need to fund your Binance account.

Deposit Fiat Currency

You can deposit fiat into your Binance account through bank transfer or card (credit or debit). However, this option is not available to everyone. After funding your account, you can purchase the amount you want, according to your available balance.

Using Peer-to-Peer (P2P)

In countries and regions where banks are banned from directly serving crypto entities, investors can convert their fiat to crypto through peer-to-peer platforms. This method involves buying ETH from other crypto traders on Binance while you transfer the funds to them through a bank or other available methods.

Frequently Asked Questions About Ethereum

How many ETH coins are there?

According to Etherscan, 118.7 billion ETH have been issued and are currently in circulation.

Ethereum has been tagged as a cryptocurrency with unlimited supply. This is different from Bitcoin, which has a fixed amount of supply of 21 million BTC. Every four years, Bitcoin supply gets halved, with the next halving scheduled for 2024. While Ethereum does not have such a feature, ETH supply is expected to decline as the network moves to a PoS mechanism.

Who owns the most Ether?

The company with the highest amount of ether is Grayscale Ethereum Trust with about 2.5 million ETH (worth $8.2 billion) in its portfolio. Grayscale is a digital asset management firm that provides market insight and investment exposure to investors, enabling them to invest their funds in crypto assets.

The company that comes second on the list of most-owned ETH is crypto exchange Kraken. The trading platform allows users to buy and sell different cryptocurrencies. Kraken holds over 2 million ETH, equivalent to $6.8 billion.

Next on the list is Binance, the world’s largest crypto exchange. The company holds 1.9 million ETH worth about $6.4 billion.

When Did Ethereum Move to Proof-of-Stake?

Ethereum developers released the Ethereum PoS chain on December 1, 2020. However, it was not until September 15, 2022, that Ethereum finally merged its PoW chain, completing the move to PoS.

What is Ethereum Layer 2?

Ethereum layer 2 solution attempts to solve the network’s scalability issue. Often a separate blockchain strongly linked to Ethereum layer 1, a typical layer 2 blockchain is designed in such a way that it regularly communicates with Ethereum and shares its workload.

Ethereum layer 1 takes care of the security, decentralization, and network data, while layer 2 takes care of the system’s scalability. By removing the burden of processing transactions, layer 1 becomes less congested, transactions get to be processed faster and less gas fees get consumed.

Examples of Layer 2 Ethereum-linked networks include Polygon, Optimism, and Arbitrum.

Can Ethereum overtake Bitcoin?

Ethereum cannot overtake Bitcoin in the short term. However, there is the potential to do so in the long term. Speculators feel Ethereum will overtake Bitcoin in the future. Currently, Bitcoin holds a market cap of $831 billion, while Ethereum has a market cap of $391 billion. This gap will require time and real effort from Ethereum to overtake Bitcoin.

Can I get rich with Ethereum?

The cryptocurrency market promises a lot of wealth, so it is possible to become rich by investing in Ethereum or any other good cryptocurrency project. Those who invested in Ethereum in 2015 and held their position to date are undoubtedly wealthy today. However, the crypto market is highly volatile and also the playground for hackers, so it is possible for investors to lose their investments to market volatility or hacks.

All in all, conduct due diligence, protect your wallets, always do your research, and invest what you can afford to lose unless, of course, you’re a big risk taker.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us