This week, the decentralized finance (DeFi) sector faced a downturn more pronounced than the general cryptocurrency market’s fluctuations.

The DeFi Index saw a significant drop, losing 9% from its Monday peak, while the broader cryptocurrency index experienced a 5% decline over the same period. The sharper decline in the DeFi sector underscores its heightened volatility compared to the broader cryptocurrency ecosystem.

Pendle’s Sharp Decline and Increased Short Positions

Pendle, a DeFi protocol that offers crypto yields in the form of tradable tokens, exemplified this trend with its governance token falling sharply by over 20% during trading sessions on Tuesday and Wednesday.

This stark drop was accompanied by an increase in short positions, as traders bet on further declines. Alongside this, Pendle’s total value locked (TVL)—a key metric in DeFi indicating the total capital held within the protocol—plummeted by $3 billion, according to data from Defillama.

Industry experts have pinpointed the cause of these withdrawals to the unattractive yields offered by upcoming pools. Rob Hadick, a general partner at venture capital firm Dragonfly, noted, “Yields aren’t very good for future pools at the moment so people withdrew versus rolling [over].”

This statement highlights a broader issue within the DeFi space, where the allure of high returns often leads to volatile capital flows. Earlier in the year, Pendle had benefited from an airdrop and points farming bonanza, which attracted a considerable amount of temporary capital.

However, as these programs concluded, the protocol saw a rapid exit of funds, underscoring the challenge DeFi faces in retaining liquidity without continuous incentives.

Optimism Amidst Challenges

Despite these challenges, there remains a sense of optimism about the future of DeFi.

Joshua Lim, co-founder of principal trader Arbelos Markets, shared in an interview: “While there will be TVL noise in the short run due to specific points programs lapsing, we’re hearing excitement around upcoming tie-ups, including the Symbiotic-Ethena-Mellow partnership, which should attract fresh inflows.”

This comment suggests that strategic partnerships and new innovations could be pivotal in revitalizing interest and investment in the DeFi sector.

The decline wasn’t isolated to Pendle alone; other major DeFi platforms such as Aave (AAVE) and the liquid staking protocol Lido (LDO) also saw their tokens underperform, dropping 10%-15% during the same period.

The market movements coincided with large-scale token transfers to the cryptocurrency exchange Binance, likely for sale. An observer noted significant transfers of $6.2 million worth of LDO and $4.5 million in AAVE, according to blockchain data on EtherScan.

Consolidation in the Cryptocurrency Market

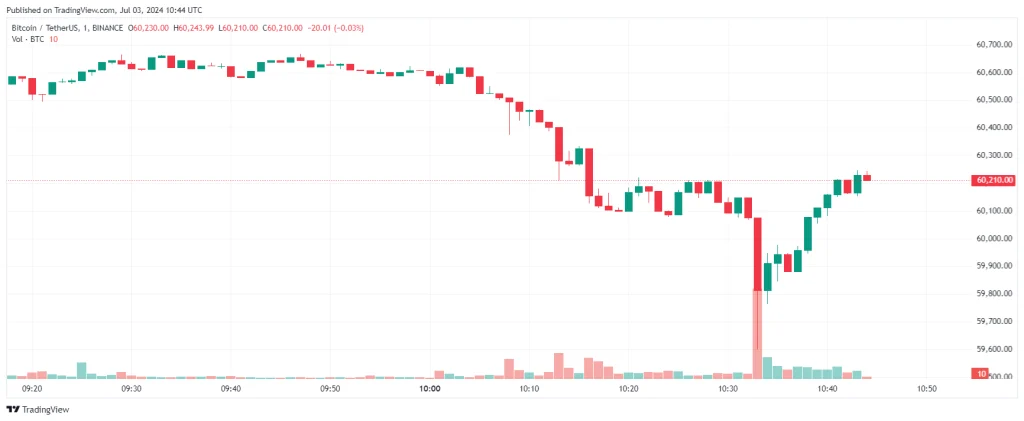

This period of downturn in DeFi aligns with a broader consolidation in the cryptocurrency market. Major cryptocurrencies like Bitcoin (BTC) and Ether (ETH), often seen as bellwethers for the market, traded range-bound below their March peaks.

Bitcoin, in particular, dropped below the significant $60,000 threshold on July 3, signaling a potential prolongation of the current price consolidation phase. This decline marked a significant shift, as Bitcoin had previously been eyeing a breakout above $70,000, which could have set the stage for new all-time highs.

The fall in Bitcoin’s price below $60,000 may be linked to the commencement of creditor repayments by the defunct Mt. Gox exchange, which is speculated to begin releasing $9 billion worth of BTC.

This potential influx of Bitcoin into the market could exert downward pressure on prices. The founder of digital asset hedge fund Capriole Investments, Charles Edwards, highlighted a notable on-chain movement of Bitcoin, which he attributed to Mt. Gox, potentially impacting market sentiment.

More than $9.4 billion in Bitcoin is owed to approximately 127,000 Mt. Gox creditors who have been waiting over a decade to recover their funds. As these repayments begin, it could prompt a significant number of investors to sell their holdings, further influencing the market dynamics.

However, this potential sell-off may be balanced by the institutional inflows into U.S.-based spot Bitcoin ETFs, which have amassed over $52.5 billion in BTC since their launch in January, as per data from Dune Analytics.

This institutional support suggests a robust demand that could help stabilize the market despite potential disruptions from large-scale distributions like those from Mt. Gox.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us