Marathon Digital Holdings, the premier Bitcoin mining entity globally, has not liquidated any of its Bitcoin holdings over the past month, despite the cryptocurrency’s persistent downturn.

As detailed in their operations report released on July 3, the company’s Bitcoin reserves stood at 18,536 BTC, valued over $1.1 billion.

Future Bitcoin Holdings Strategy

The firm has expressed intentions to not only preserve but also augment its Bitcoin holdings through acquisitions in the open market and by capitalizing on other opportunities to enhance Bitcoin yield.

However, it has also signaled the possibility of selling off some of its Bitcoin in the future to support its operations, manage its treasury, and meet other corporate needs. The trading actions of large Bitcoin holders like Marathon have substantial potential to impact the cryptocurrency’s market price.

This influence is particularly significant in the context of the upcoming 2024 Bitcoin halving, which will reduce block rewards by half, potentially compelling miners to offload more Bitcoin to sustain their operations.

Marathon’s market valuation currently exceeds $6.25 billion, making it the world’s most substantial Bitcoin mining firm, a full 62% larger than its nearest competitor, CleanSpark, which boasts a market capitalization of $3.85 billion according to CompaniesMarketCap data.

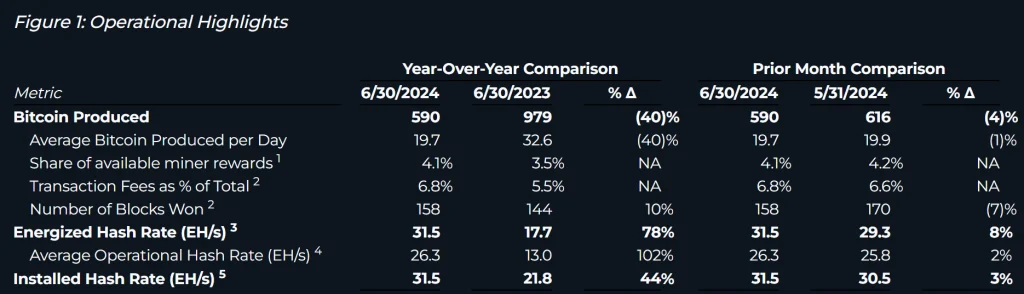

Over the past year, Marathon has effectively doubled its operational hashrate to 26.3 exahashes per second (EH/s), a milestone primarily attributed to operational improvements at its Ellendale facility, which came fully online at the start of July.

Fred Thiel, CEO of Marathon Digital, reported that their proprietary mining pool outperformed by capturing 158 blocks during the month, reflecting a 10% increase over the previous year.

Thiel affirmed the company’s trajectory to hit a target hashrate of 50 EH/s by the end of 2024, bolstered by ongoing enhancements at their sites, including the adoption of immersion cooling technology and the latest generation hardware.

Industry-Wide Updates and Strategic Shifts

Across the industry, other Bitcoin mining firms have been disclosing their operational statistics following the April halving event, which prompted a strategic shift towards investment in the latest-generation infrastructure and long-term energy procurement deals.

Riot Platforms, another major player in the mining industry, managed a 19% increase in Bitcoin mining activity from May, netting 255 BTC in June compared to 215 BTC the previous month. This figure, however, was about half of what it mined in the same period last year, a direct consequence of the halving event.

Riot not only surpassed its second-quarter power target by reaching a 21.4 exahash per second (EH/s) hash rate but also announced it had received $6.2 million in power credits from the Texas power grid, slightly down from the previous month.

Cipher Mining, in its continuous expansion, noted a 6% increase in Bitcoin production in June, continuing its 30-megawatt expansion at its Texas data centers known as Bear and Chief Mountain.

“At Bear, we have now received and installed all the new mining rigs, and we expect to finish installing the remainder at Chief later this month,” stated Tyler Page, CEO of Cipher Mining, in the company’s report.

Mining Output and Technological Advancements

Conversely, Marathon witnessed a small downturn in its mining output, with a 4% decline from May, mining 590 BTC compared to 616 BTC.

Despite this, Marathon remains on track to meet its end-of-year target of 50 EH/s, fueled by upgrades like the integration of the latest-generation machines and cooling systems.

One particular transaction generated a fee of 0.85 BTC, significantly above the usual rate, primarily due to Marathon’s technological edge with Slipstream, which optimizes the processing of large or unusual Bitcoin transactions.

Bitdeer, a U.S.-listed mining firm, also experienced a slight decline in its Bitcoin mining output, producing 179 BTC in June, down 2.7% from May.

Despite this decrease, Bitdeer remains optimistic about hitting its proprietary hash rate target of 11.8 EH/s by the end of the year through additional processor deployments in its Texas and Tydal, Norway facilities.

As the landscape of Bitcoin mining continues to evolve in response to reduced block rewards and market fluctuations, strategic decisions by these firms will be critical in shaping the future dynamics of the cryptocurrency market.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us