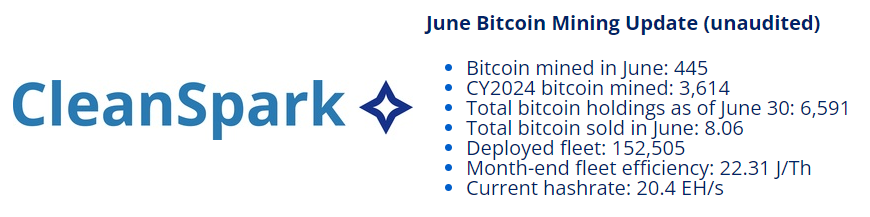

In a recent development, CleanSpark announced a notable increase in its bitcoin mining production, having mined 445 bitcoins in June, which is an uptick from the 417 bitcoins mined in May.

This progress helped the company surpass its mid-year operational hashrate target of 20 exahashes per second (EH/s), largely due to the strategic acquisition of five new mining sites located in Georgia.

Financial Performance and Site Contributions

The company also reported the sale of 8.06 bitcoins in June, fetching an average price of approximately $67,514 per bitcoin. Throughout the month, CleanSpark maintained an average hashrate of 17.85 EH/s.

The new Georgia sites contribute 60 megawatts (MW) of infrastructure, featuring power purchase agreements specifically designated for interruptible-load with load balancing capabilities. These agreements are designed to provide a mutual advantage for both the utility providers and the power grid.

Zach Bradford, CEO of CleanSpark, expressed his enthusiasm about the company’s growth trajectory.

“Achieving over 20 EH/s in operational hashrate marks a significant milestone as we aim for 50 EH/s and beyond. This milestone is a testament to our focus on enhancing our bitcoin mining operations and revenue, while other miners in the industry face challenges and consider selling their businesses to maximize shareholder value,” he said.

Comparing year-over-year figures, the 445 bitcoins mined in June show a slight decline from the 491 bitcoins mined during the same period last year. However, this difference is relatively minor, especially considering the impact of the bitcoin halving event this past April, which reduced the mining reward by 50%. The halving, a protocol designed to occur every four years, cuts the rewards miners receive for verifying transactions on the Bitcoin network.

Looking ahead, CleanSpark anticipates its operational capacity to reach 100 megawatts by year-end. To date, the company has mined a total of 3,614 bitcoins this year and held a reserve of 6,591 bitcoins as of June 30.

Stock Performance and Strategic Acquisitions

Amid these operational successes, CleanSpark’s shares experienced a slight downturn, trading down by 3.8% at the time of the announcement. This decline mirrored a broader decrease in bitcoin prices, which fell 2.2% over the same period, as reported by The Block’s bitcoin price page.

Furthermore, CleanSpark expanded its portfolio with the acquisition of GRIID Infrastructure, a fellow bitcoin mining entity, for a deal worth $155 million.

The purchase agreement includes an exclusive hosting arrangement for all currently available power, securing an additional 20 MW of production power for CleanSpark.

Bradford remains optimistic about the company’s future, especially with its expansion into Tennessee.

“With the GRIID acquisition, we are set on a firm course to replicate our Georgian success in Tennessee over the next three years, aiming to establish over 400 MW of infrastructure backed by long-term power contracts. Our operations in Tennessee are projected to exceed 100 MW by the end of this year, with a goal of reaching 400 MW by 2026,” he commented in a statement.

This strategic expansion and consistent operational growth underscore CleanSpark’s commitment to strengthening its position in the bitcoin mining industry, even as it navigates the fluctuations and challenges inherent to the sector.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us