For over a year, artificial intelligence (AI) and AI stocks have dominated investment trends on Wall Street like no other. AI involves using software and systems that replace human operations and have the capability to autonomously learn and improve, making them increasingly adept at their functions. This technology has applications across nearly every industry and sector.

The cryptocurrency market has also demonstrated its capacity to significantly boost investor portfolios. It reached a peak market value of $3 trillion in 2021. Despite experiencing a downturn in recent years, the market is rebounding as investors anticipate lower interest rates and a strengthening economy, prompting a renewed interest in growth investments such as cryptocurrencies.

Top 5 AI Stocks Ready To Surf On This World-Changing Technology

However, those who prefer the stock market need not feel left out of substantial growth opportunities. In fact, some stocks currently offer even greater potential than cryptocurrencies, particularly in the rapidly growing field of artificial intelligence (AI).

The AI sector is expected to grow beyond a $1 trillion market by the decade’s end, with investors strategically positioning their portfolios to capitalize on this growth. Let’s examine five AI stocks that are poised to outperform their cryptocurrency counterparts.

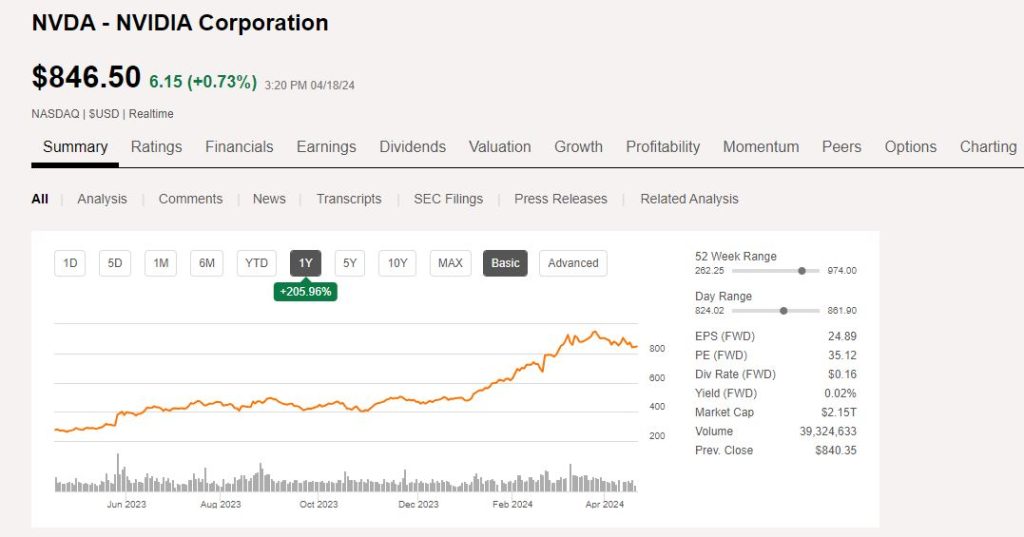

Nvidia

Nvidia (NASDAQ: NVDA) shares have already skyrocketed in triple digits over the last year, yet this leading AI stock might still have significant growth potential. Nvidia dominates the AI chip market with an 80% share, and its strong brand and continuous innovation are likely to sustain this position.

Companies regularly choose Nvidia as their preferred supplier, underscoring its reliability. Recently, alongside the announcement of its Blackwell architecture which introduces the most powerful AI chip to date, Nvidia received high praise from Tesla’s CEO Elon Musk, who remarked on the unmatched quality of Nvidia’s hardware for AI.

The imminent release of this new architecture, coupled with increased investment in research and development, underscores the promising outlook for Nvidia’s financial performance. This has already translated into substantial increases in revenue and net income, reflected in last year’s earnings reports.

Given these factors, Nvidia’s stock, currently priced at 35.12 times forward earnings estimates, appears to be a great buy-and-hold opportunity with the potential for continued growth.

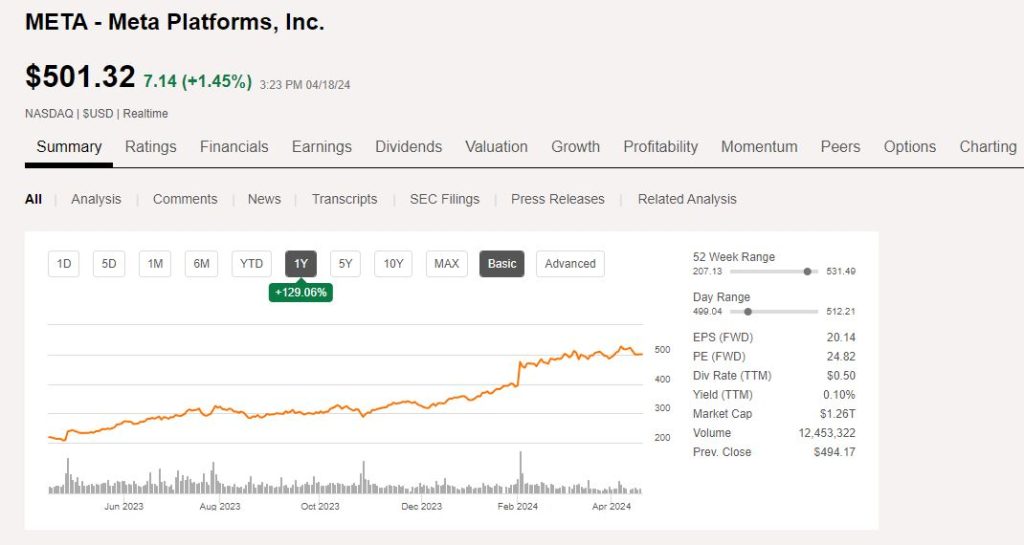

Meta Platforms

Meta Platforms (NASDAQ: META) primarily generates its revenue through advertising, attracting advertisers to its popular social media platforms including Facebook, Messenger, WhatsApp, and Instagram. These platforms collectively engage over 3.1 billion people daily.

The substantial user base has provided Meta with an increasing revenue stream, which has also translated into profit. Currently, Meta is intensively focusing on artificial intelligence (AI), intending to integrate this technology throughout its products and services for the foreseeable future. The company has prioritized AI in its investment strategy, aiming to equip itself with 600,000 graphics processing units by year-end.

Meta has also developed its own large language model, Llama, and is actively working on its advancement with Llama 3. This development underpins new products like the conversational assistant, Meta AI. Due to Meta’s commitment to open-source practices, its software has the potential to set industry standards.

With significant aspirations in AI, Meta has everything to become a dominant player in the field, making it an attractive investment at 24 times forward earnings estimates.

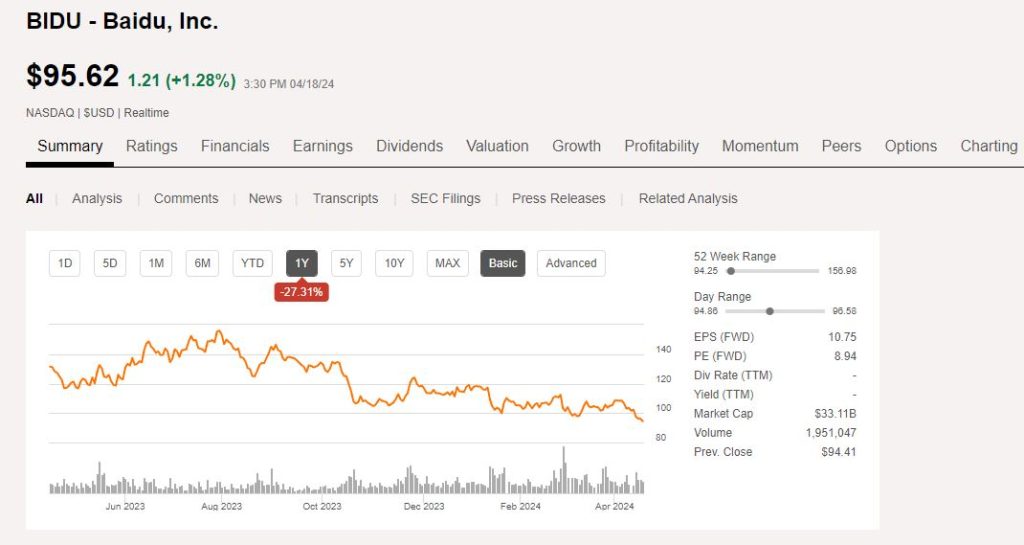

Baidu

China’s Baidu (NASDAQ: BIDU) is one of those AI stocks that could potentially outperform Nvidia in terms of returns. Benchmark analyst Fawne Jiang has reiterated a price target of $210 for Baidu shares on multiple occasions. With Baidu’s stock closing at $94.41 on April 17, this represents a possible increase of 122%.

Baidu is appealing to investors primarily because its robust business model is expected to continue producing substantial operating cash flow, even in the event of an AI market downturn. Historical trends show that nearly every major new technology investment experiences an initial bubble, and AI stocks are likely to follow this pattern.

The core of Baidu’s revenue generation is its internet search engine, which held a 60.44% market share in China as of March, data from GlobalStats indicates. Over the past nine years, Baidu has consistently captured between 60% and 85% of the domestic internet search market in the world’s second-largest economy, positioning it as an optimal platform for advertisers.

Currently, Baidu’s growth is driven by two main AI initiatives: its AI cloud services and its intelligent driving division. The Baidu AI Cloud ranks among the top four cloud infrastructure services in China, promising continued growth as corporate spending on cloud services expands.

Additionally, its subsidiary, Apollo Go, stands as the world’s most successful autonomous ride-hailing service. As of January 2, 2024, Apollo Go has completed over 5 million autonomous rides.

With over $28 billion in cash, cash equivalents, and investments, and trading at a historically low eight times forward-year earnings, Baidu presents a compelling investment opportunity. Thus, Jiang’s ambitious price target seems well within reach.

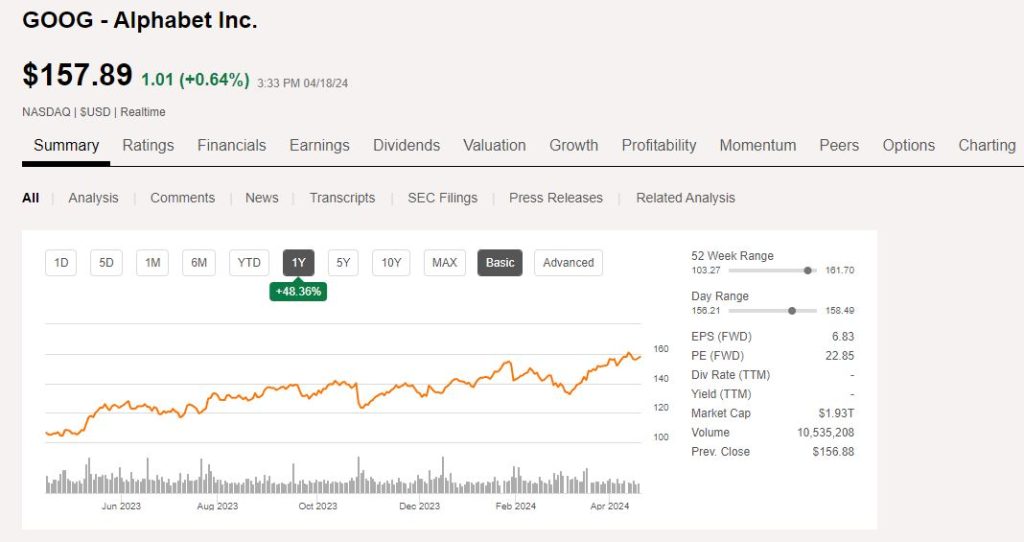

Alphabet

You might primarily associate Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) with its main source of income: Google Search. This platform is a magnet for advertisers who are willing to pay to showcase their products or services, as it provides a straightforward way to reach a wide audience, thanks to Google Search’s command of over 90% of the worldwide search market share.

Advancements in AI are poised to enhance Google Search further, improving the advertising process for marketers. Alphabet has recently introduced its most advanced AI model to date, Gemini 1.5, which it is integrating throughout its operations. In the realm of search, generative AI is now delivering quicker results and more extensive information on specific topics, which should encourage repeated use and sustained advertiser investment in search ads.

Alphabet also stands to gain significantly in the AI Stocks sector through its cloud division. Google Cloud provides clients with AI chips and a variety of other products and services to support their AI initiatives. Last year, the company made thousands of product improvements using AI, contributing to Google Cloud securing or enlarging contracts with prominent businesses like McDonald’s and Verizon.

Currently, Alphabet shares are trading at 22.85 times projected earnings, representing an excellent opportunity for investors looking at a robust long-term investment.

Mobileye Global

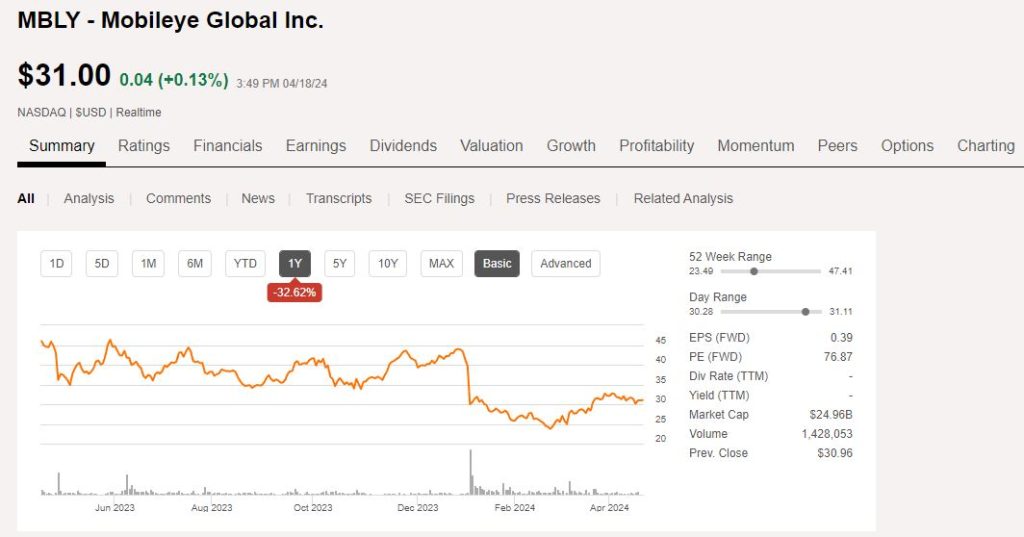

Another important company in the AI Stocks sector that you should pay attention to in terms of investment returns is Mobileye Global (NASDAQ: MBLY), a developer of advanced driver assistance systems (ADAS) and various autonomous driving technologies. Citigroup analyst Itay Michaeli projects that the company’s stock could reach $72, marking a 132% increase from its closing price on April 17.

Unlike Baidu, which has a significant portion of its cash flow protected even if the AI sector falters, Mobileye heavily relies on the robustness of the U.S. economy and ongoing growth in AI-driven sales.

Mobileye’s technologies are integral to next-generation vehicles, which are increasingly dependent on advanced technology for operation. Thus, the vitality of the automotive market is crucial for Mobileye’s success. However, the company faces challenges as domestic demand for electric vehicles (EVs) declines, prompting automotive giants such as General Motors and Ford Motor Company to scale back their EV production plans.

On a positive note, Mobileye remains consistently profitable, maintaining a healthy flow of operating cash. It ended 2023 with around $1.2 billion in cash and no debt, positioning it well to continue its innovations regardless of economic conditions. The company also benefits from historical trends where periods of economic growth in the U.S. and globally tend to last longer than downturns.

Despite these strengths, Mobileye Global has substantial growth to achieve to justify a share price of $72, which would imply a market capitalization of $58 billion.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us