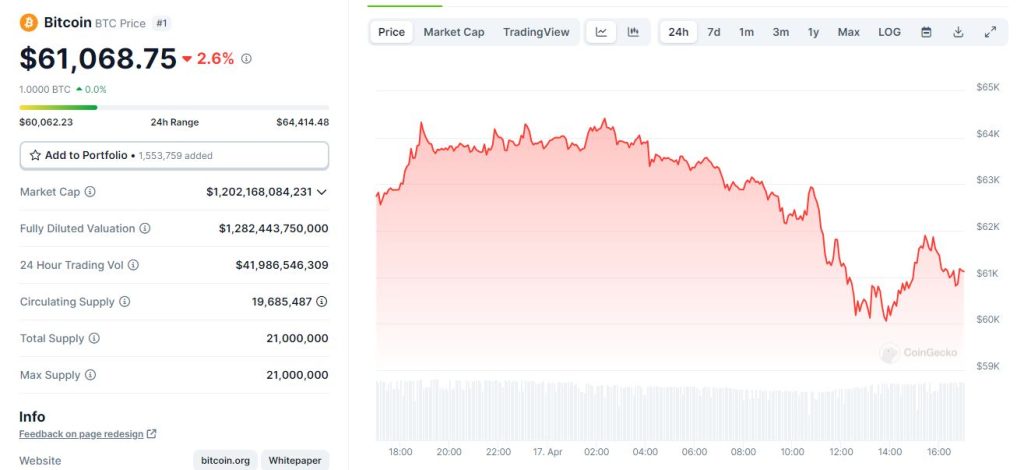

Bitcoin (BTC) has relinquished all gains from its rebound after Saturday’s rapid sell-off, dropping below the $60,000 mark during the Wednesday (April 17) morning U.S. trading session.

Earlier on the day, Bitcoin had recovered to over $64,000, but it later fell to a low of $59,900. This represents a decrease of more than 3% in the last 24 hours, marking its lowest price since early March. At the time of reporting, it was trading at $60,200.

Ether (ETH), the second-largest cryptocurrency by market capitalization, also experienced a significant drop, falling below $3,000 with a 2.5% decline during the same timeframe.

Bids Under $60k Mark Could Halt Bitcoin’s Price Decline For a While

At Binance, the most active trading pair, BTC-USDT, displayed a spot market order book with bids predominantly under $60,000, surpassing the number of sale orders. This pattern suggests a robust demand at that price level, potentially preventing further declines in the short term.

The downturn observed today confirms that the cryptocurrency sector is in a cooling-off period following a sustained rally that reached its peak last month. Bitcoin has shed over 15% since achieving its most recent all-time high, and some altcoins have retreated by 40% to 50% from their recent peaks. This type of retraction aligns with patterns seen in previous bull markets, according to data from Glassnode.

Also, according to Joel Kruger, a market strategist at LMAX Group, the behavior of Bitcoin investors indicates that market weakness may persist as large investors have not yet started purchasing the cryptocurrency at its current lowered prices. Kruger’s Wednesday market update highlighted that recent blockchain data reveals major Bitcoin holders are delaying increasing their stakes during the current dip, hinting at potential further weakness or consolidation before the market rebounds.

Kruger pointed out that a critical technical level for Bitcoin is $59,000, a major support zone that saw prices recover twice in March. He noted that if Bitcoin maintains above this level, it positions the cryptocurrency to potentially reach new highs and approach the $100,000 mark. Conversely, a decline below $59,000 could undermine the short-term bullish outlook and lead to a significant correction, potentially pushing prices down to the $45,000 to $50,000 range.

This Halving Is Proving To Be Different From The Others

There has been considerable debate regarding the uniqueness of this year’s Bitcoin halving event compared to previous occurrences. Uniquely, the cryptocurrency’s price peaked a month prior to the halving, a phenomenon not observed in earlier cycles.

Sam Callahan, a senior analyst at Swan Bitcoin, a firm specializing in Bitcoin financial services, mentioned that Bitcoin is currently experiencing a consolidation phase. He attributed the recent price fluctuations to short-term traders speculating on the results of the upcoming, much-anticipated halving event. Callahan also advised that while short-term volatility is to be expected for investors in Bitcoin, the cryptocurrency’s long-term trajectory remains decidedly positive.

Historically, Bitcoin halvings have led to an increase in the cryptocurrency’s price. For example, the price of Bitcoin was $12 before the 2012 halving and rose to $44 100 days later and $135 after 300 days. Following the 2016 halving, the price increased from $658 to $1,551 over the same period. Most recently, in the 2020 halving, Bitcoin’s price escalated from $8,601 to $50,941 within 300 days.

According to CoinDesk, Goldman Sachs advises caution ahead of Bitcoin’s next halving due to the unpredictable macroeconomic environment. The team from Goldman’s Fixed Income, Currencies and Commodities (FICC) and Equities cautioned that while historical halvings have led to price increases, the duration to peak prices varied significantly, suggesting that past trends should not be blindly followed given current macroeconomic conditions.

Amidst market volatility and investor anxiety, Rennick Palley, Founding Partner at crypto venture capital firm Stratos, remains bullish on Bitcoin’s long-term prospects. He identified the volatile period before the halving and previous high prices, which often require two to three attempts to overcome, as short-term challenges. However, he expects Bitcoin to surpass these hurdles by mid-summer and potentially reach over $150,000 by 2025.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us