Ethereum is one of the top losers in the top 10 during the previous intraday session. It opened trading at $1,633 but retested the $1,600 support and flipped it. Afterwards, it dropped to a low of $1,548. Although it saw a slight recovery, it ended the session at $1,580 which signifies a more than 3% loss.

With the current session in view, the apex altcoin is yet to register any significant increases. After its failed attempt at the highlighted barrier, it retraced to a low $1,551. Following a high of $1,595, this marks the second day of ETH failing to reclaim the lost level.

The massive drop was in response to the news that a wallet belonging to the Ethereum Foundation sold some of its assets. The non-profit organization’s actions spread panic across the crypto market with crippling effects on other cryptocurrencies.

Following the dip a few days into October, much speculations are out about how the altcoin may perform.

The previous month was the first green after two months of significant downtrend. It kicked off trading at $1,645 but made an attempt at the $1,700 resistance but failed as it faced strong corrections at $1,693. Afterward, it retraced to a low of $1,531 before a rebound. In the end, the asset closed September at $1,671 which signifies a less than 2% increase. Will ETH surge higher this month?

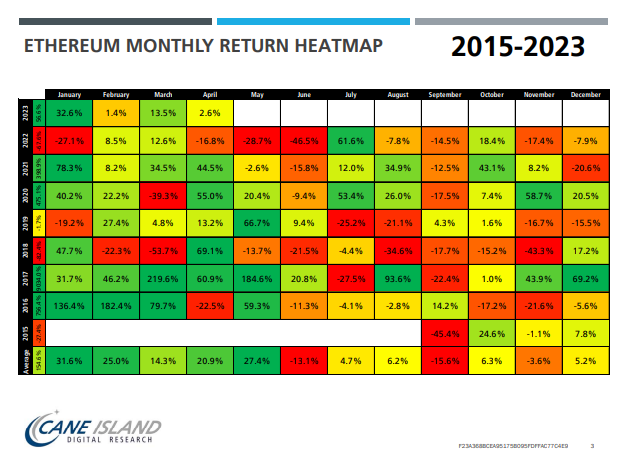

Records Show Ethereum May Gain 6%

The ninth month of the year is one of the most bearish for the asset as on average, it loses more than 15%. However, it defied the odds during the previous month as it registered small gains. It gained almost 2% and peaked close to $1,700.

Historically, October is a positive month for the asset. On average, ETH gains more than 6%. A closer look at the trend reveals that there is no clear pattern of the losses. Nonetheless, the biggest loss the coin incurred in the tenth month was in 2016 when it dropped by more than 17%.

On the other hand, Ether gained 43% in 2021; the highest during the session under consideration. Going by the average, many may expect a more than 6% surge this month. This may send price above $1,700.

Key Levels to Watch

Vital Resistance: $1,700, $1,900, $2,030

Vital Support: $1,520, $1,400, $1,150

A closer look at the chart suggests several key levels to watch over the next few days. With respect to resistance, the coin may retest the $1,700 barrier in the coming days it may experience a surge in buying volume. The main catalyst for this may be a fundamental across the crypto market. Nonetheless, the said markis one of the toughest as previous attempts at it failed. As a result, it may serve a key support once it flips.

Although far-fetched, the $1,900 is another important level to watch. Based on previous price movements, once the previously highlighted mark breaks, it is next in line. Will it get a test? An attempt at this may guarantee a retest of the $2k resistance.

On the other hand, ETH may experience reversals in prices that may send prices to retesting supports. One of the first lines of defense is the $1,520 barrier. Over the last three months, the trend for the apex altcoin is a deeper low than the previous month. However, all the downtrends failed to drop below $1,500 with most stopping at the highlighted mark.

This time may be different as deeper low may mean a retest of the $1,400.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us