Lately, there has been a lot of talk about Decentralized Finance, or DeFi for short. It is a new concept that involves an uncensored, free, direct financial system free from banks and bankers.

More and more people are showing interest in DeFi and in this article, we’ll take a look at the top 10 DeFi apps to look out for in 2020.

But just before we get to that…

What is Decentralized Finance?

The traditional financial system, with banks and bankers, is centralized. Now, banks and bankers have been around for a long time and there is no denying that they have a lot of power and influence on the economy.

Banks have helped individuals, businesses and whole countries grow by giving loans and credits, providing standardized instruments such as checks and credit cards, controlling money influx and offering security.

But not everything is good in this scenario. There is also a dark side to traditional banking. This dark side was exposed when many people found out the role banks (or, rather, the great banking corporation’s and baker’s greed) played in causing the 2007-2009 economic recession.

Since then, plenty of people have been wondering if the time has come to create a new financial system, free from banks and bankers.

Bitcoin taught us that currency doesn’t have to be centralized, depending on governments or banks. And when Ethereum introduced smart contracts in blockchains, it opened the door to creating decentralized finance applications that could eventually cut out banks from the picture.

What does DeFi offer users?

Let’s take a look at the basic services a traditional bank offers:

- Money lending: One of the first services offered by the earliest financial institutions was lending. As early as 2000 BCE merchants would lend grain to farmers and traders. Modern banks supply funds to individuals and businesses via loans or credits.

- Deposits and withdrawals: Since the days of the Roman Empire, proto-banks accepted deposits from customers for safekeeping, which could then be withdrawn upon request. These transactions were written down in ledgers. In time this was the origin of the checking and savings accounts that modern banks offer today.

- Currency emission: In the early days of banking, each institution had the authority to emit its own currency in the form of notes that certified that the holder had the right to withdraw a certain amount of gold or other goods from the issuing bank. In time, these notes became exchangeable among different banks, which would pave the way for modern banknotes and state currencies as we know them now.

- Currency exchange: This is another service that has been around since the days of the Roman Empire.

- Standardized financial instruments: banks must agree on which financial instruments (such as checks, credit cards, debit cards, wire transfers, etc.) will work within an economy and issue them to customers.

There are, of course, many other services banks offer. Some to the general public, some to institutions and some very specialized. Some services are offered only by certain types of banks. But the services listed above are, in a nutshell, the ones more common to the general public. A Decentralized Finance system must offer, at least, these same instruments.

Let’s see how this works in DeFi

- Blockchains are, by definition, distributed ledgers. Blockchains also generate rewards in the form of tokens that can be sent or traded among users. Each user has a wallet address on a blockchain, and tokens can be sent from one wallet to another. Some tokens can also be staked in a blockchain. Staking tokens will temporarily make them unavailable for immediate transactions but generate interest for the token’s owner. Thus, things like accounts, savings, currency emission, deposits, and withdrawals are all covered by blockchains.

- As for currency exchanges, there are many cryptocurrency exchange sites. Some only exchange between crypto tokens, while others allow trading between crypto and fiat currencies.

- There are already several money-lending services that use smart contracts to enable direct peer-to-peer lending. For example, EthLend allows users to lend or borrow money using cryptocurrency tokens as collateral.

- In regards to standardized financial instruments, some steps are being taken. Some exchanges already offer crypto debit or prepaid credit cards and their adoption is spreading at a fast rate. Although the emission of these cards is necessarily centralized (someone has to make the card, after all), these services make crypto-backed, decentralized finance a lot easier to use.

So the basic financial products for day-to-day use are already there, so average users can start their transition to decentralized finance. Now we have to take a look at the top 10 DeFi apps to look out for in 2020.

Top 10 DeFi apps to look out for in 2020

These apps are listed in no particular order. Some are money-lending applications, others are exchanges, credit or insurance applications, so there should be something in this list for everyone.

1. MakerDAO

Maker is constantly ranked among the top DeFi applications. Maker is the governor of the DAI crypto token. DAI is one of the so-called “stablecoins,” which are tokens that are soft-tethered to a fiat currency. Specifically, DAI is tethered 1 to 1 with the US dollar, so 1 DAI equals 1 USD. Stablecoins allow users to benefit from the decentralized, borderless benefits of cryptocurrencies without the extreme fluctuations of the crypto market.

Besides its DAI cryptocurrency, Maker also offers two well-received services: Maker CDP, a collateralized debt position portal and Oasis, a portal that allows users to trade tokens, borrow and save money using DAI.

2. ETHLend

ETHLend is a money-lending platform that allows users to borrow money from peers using crypto tokens as collateral. For example, if you hold some Ether and need some money to start your own businesses but don’t want to sell you tokens, you could go over to ETHLend and borrow the funds you need setting your Ether as collateral. If you can pay off your loan, then you will still own your tokens. Crypto tokens used as collateral aren’t held on ETHLend servers, but rather in smart contracts on the Ethereum platform, keeping them safe.

3. Uniswap

Uniswap is a simple smart contract on the Ethereum platform that allows users to quickly and automatically trade ERC20 tokens. For example, one could use Uniswap to exchange Ether (ETH) for Basic Attention Tokens (BAT).

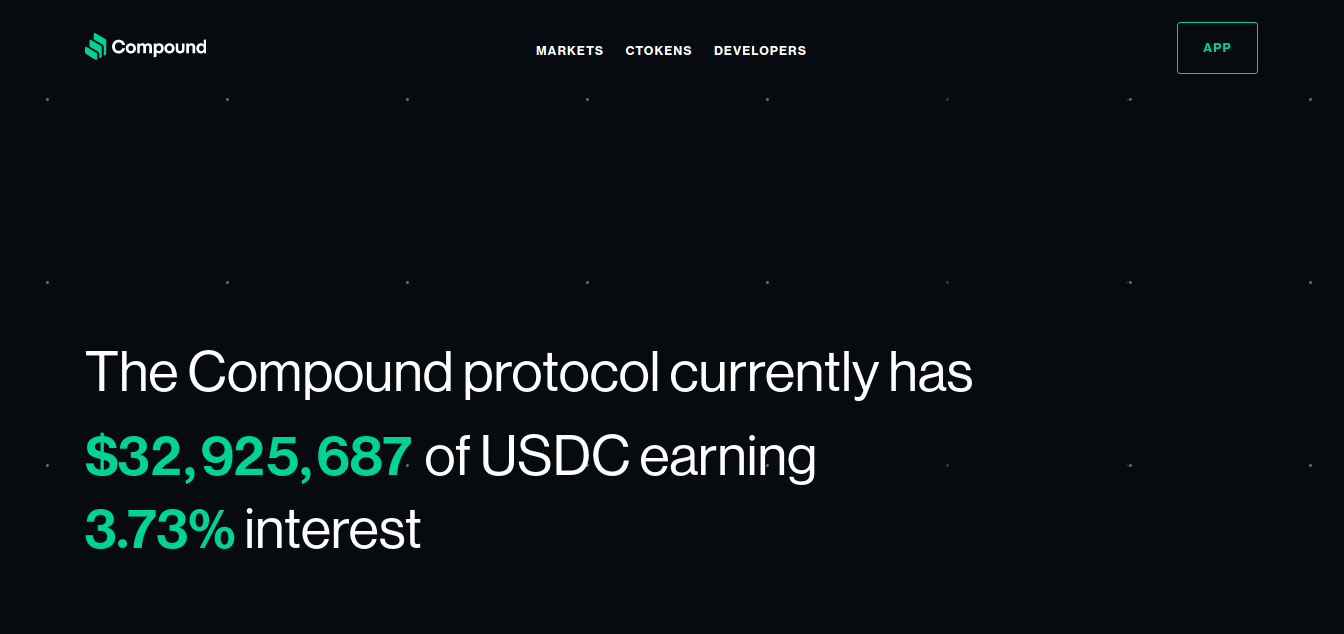

4. Compound Finance

Compound Finance is a money market protocol running on the Ethereum blockchain. Like ETHLend, it allows users to borrow money, but instead of direct peer-to-peer transactions, Compound is based on a liquidity pool. Users who want to lend money contribute tokens to the pool and start earning interest immediately.

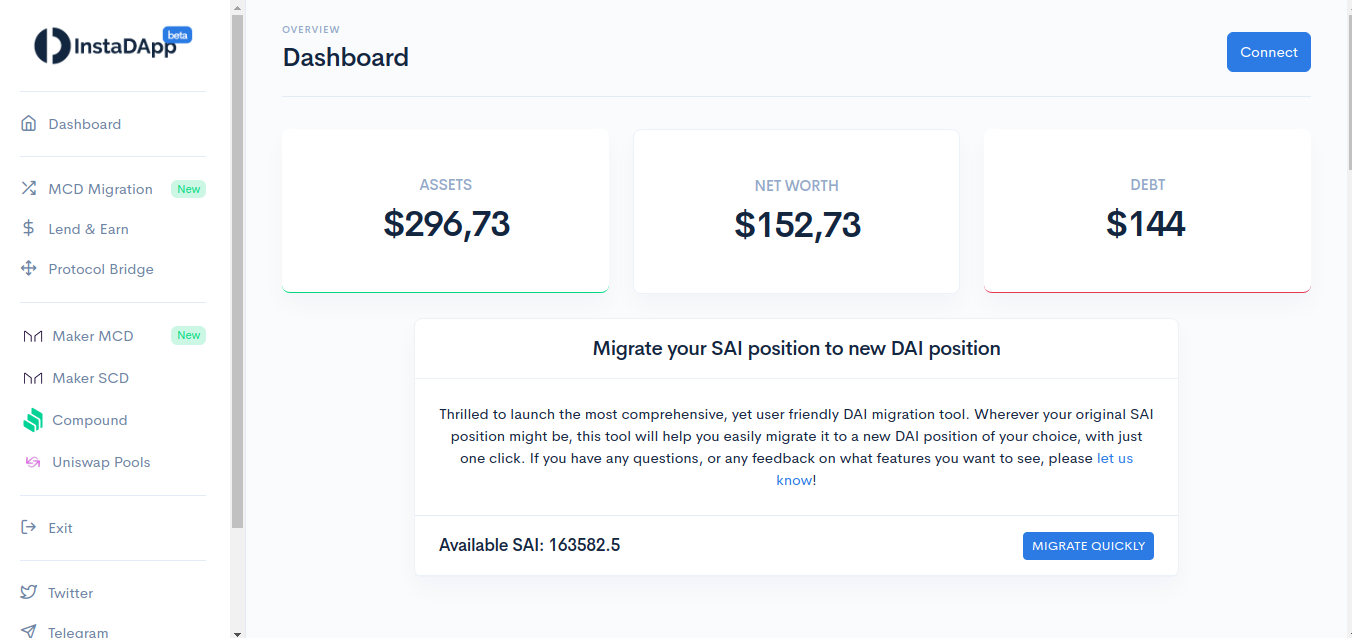

5. InstaDapp

InstaDapp also ranks consistently among the top DeFi apps. Based in India, this app aims to make transactions easier for average users by rolling several services into a single easy-to-use dashboard. Currently InstaDapp links with MakerDAO, Uniswap, and Compound.

6. Synthetix

This is a decentralized market that allows users to buy and trade “synthetic assets,” which are tokens that are pegged to different assets, including cryptocurrencies, fiat currencies, and even gold and silver.

7. Colendi

Some experts have estimated that around 40% of the world’s population is unbanked. Unbanked people have no access to credits or other traditional financial tools. Colendi aims to solve this problem by creating a democratic, decentralized credit scoring system that allows anyone to receive micro-credits, even if they are unbanked.

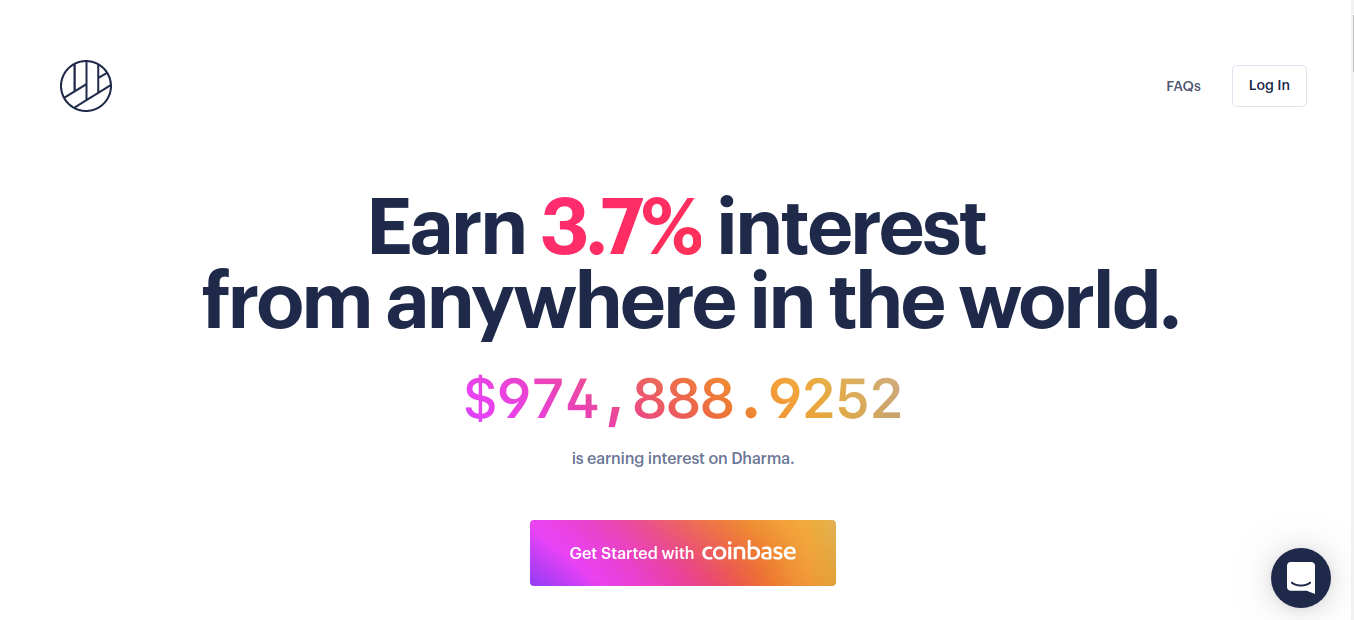

8. Dharma Protocol

This is another crypto-backed money-lending platform. In this regard, it is a direct competitor to both ETHLend and Compound Finance. Its rapid growth during the past year makes this app one to watch in 2020.

9. Nexus Mutual

If there is one thing that makes some users wary about decentralized finance is that if something goes wrong with a smart contract or tokens are stolen or wallets hacked, there is no central company to call; no 1-800-SAVETHEDAY hotline and there aren’t many crypto-insurance companies around.

This is exactly the space that Nexus Mutual seeks to occupy. They began their operations in May 2019 providing insurance services for the purchase of value-storing contracts on the Ethereum blockchain. In a little over six months, they have already locked over 1.5 million USD in value.

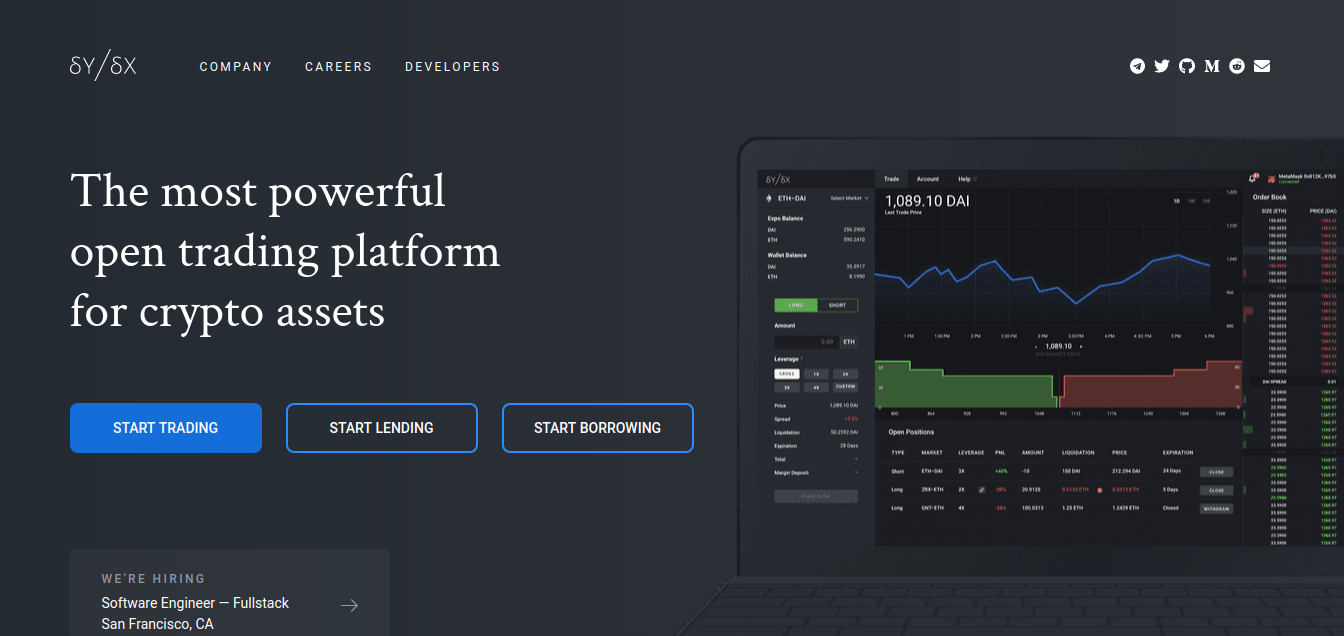

10. dYdX

There are many crypto trading platforms out there, but dYdX aims to be the most powerful one of them. Besides regular trading services, dYdX offers margin trading, borrowing and lending of crypto tokens and portfolio management all in one single application.

Concluding…

When Ethereum introduced smart contracts into blockchains it opened up a world of possibilities for creating all kinds of applications. Now there are thousands of applications running on Ethereum alone and hundreds of others on alternate smart-contract-capable blockchains like EOS. Some of these applications are the beginnings of a decentralized financial system that will eventually offer users all the services of traditional financial systems without banks, bankers or other intermediaries.

In these early times, interest rates are a lot higher than they will probably be once mass adoptions start, so this might be a good time to invest. If you have some extra crypto tokens lying around, you might consider lending them or contributing to lending liquidity pools of these top 10 DeFi apps to look out for in 2020.

If you’re looking to start your own business and are holding some crypto, consider using them as collateral for a loan instead of selling them and then taking your funds to a conventional bank. DeFi can provide most of the services you need. Banks have been the center of financial systems for over 500 years, but maybe the time is coming for them to step aside.

Originally from Venezuela, Jesús is a Biochemistry professor turned cryptocurrency aficionado. Having been involved in the space with various projects to writing about topics like decentralized apps and blockchain technology, Jesús enjoys writing original thought pieces to make crypto more accessible to the masses.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us