Over the last 24 hours, the price of XRP has increased by 3.5%, indicating a strong recovery in the larger cryptocurrency market.

This increase in value corresponds with a recovery that started on July 8 and was driven by institutional investments after a decline that was sparked by problems with Mt. Gox.

Institutional Investments Fuel Crypto Resurgence

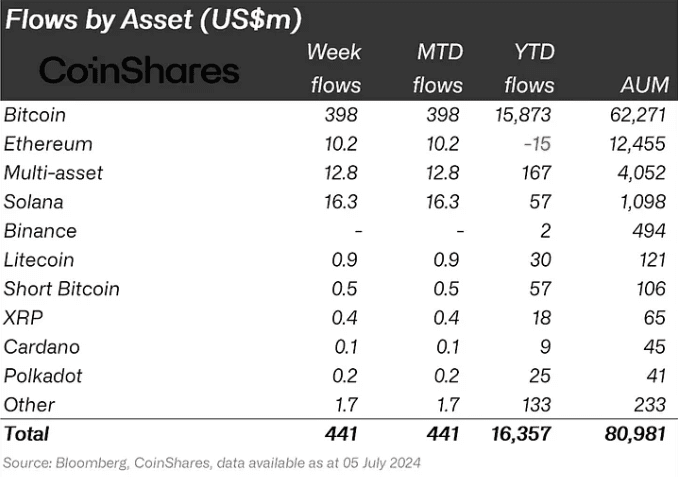

A platform that manages digital assets, CoinShares, reports that the recovery is in line with large inflows into cryptocurrency funds, totaling $441 million, during a week that saw an 11.28% decline in the value of bitcoin.

Specifically, during the week ending on July 5, investment funds that prioritize XRP attracted $400,000 in capital. Since this story was published on July 8, the trading pair XRP/USD has increased by about 10%.

According to James Butterfill, a researcher at CoinShares, investors saw the recent market decline—which was sparked by Mt. Gox’s actions and the German government’s sales—as a favorable time to buy.

The spike in interest in XRP and kindred cryptocurrency funds corresponds with heightened speculation on Wall Street regarding a potential Federal Reserve rate decrease in September.

This theory was prompted by the July 5 employment report, which was poorer than anticipated and eventually had an impact on market movements. Since its bottom on July 5, the spot market for XRP has recovered impressively, with returns of almost 16%.

This opinion was further supported on July 10 by Jerome Powell, the US Federal Reserve Chairman, who gave a dovish perspective and hinted at a cautious approach to future rate hikes during his appearance before Congress.

Whale Activity Signals Confidence in XRP

Technically speaking, XRP’s recent increases also align with a surge in holdings among its biggest investors, referred to as “whales” informally. In the past day, there has been a discernible increase in the quantity of XRP owned by organizations with 100 million to one billion tokens.

On the other hand, ownership in the range of 10 million to 100 million tokens decreased. In the meantime, ownership by organizations possessing more than one billion tokens have stayed steady, suggesting that smaller investors may be strategically accumulating XRP in order to advance into more lucrative investing categories.

In addition to a technical market correction, this strategic accumulation is taking place as XRP has recovered from a “oversold” situation. This phrase describes a situation in which an asset’s relative strength index (RSI) falls below 30, frequently leading to a comeback.

Furthermore, the price recovery for XRP is following a pattern that resembles movements seen in April as it tests the lower limit of its dominant falling wedge formation as a support line.

The next anticipated objective for XRP in July, if this pattern continues, may be close to the wedge’s upper limit, at roughly $0.45, which would indicate a 5% increase from the stock’s current price.

The US market for cryptocurrencies is also keeping a careful eye on events since political developments there have the potential to greatly influence future legislation pertaining to cryptocurrencies.

Upcoming Regulatory Discussions Could Shape XRP’s Future

Amidst these happenings, XRP has attracted a lot of attention, especially because of a conversation that could affect its market and regulatory standing.

U.S. Representative Ro Khanna is organizing a roundtable discussion on cryptocurrency in Washington, D.C., where guests include Mark Cuban and representatives from the White House.

With the potential to influence the regulatory environment, this meeting seeks to address important concerns in the cryptocurrency industry.

Brad Garlinghouse’s expected analysis of the Ripple v. SEC case is a major topic of interest because it will probably affect the direction of XRP’s pricing and how regulators view it.

With a passing reference to Bitcoin’s place in the larger cryptocurrency conversation, the attendance of celebrities such as Anthony Scaramucci at these talks serves to highlight the industry as a whole.

XRP: Market Signals Suggest Potential

The current state of the market and significant institutional investment have given XRP the appearance of a potentially lucrative asset. The asset shows strong indications of a bullish trend, with $400,000 moving into funds that track XRP early in July and a robust 3.5% jump in just one day.

Recoveries in other markets and speculation of a potential rate cut by the Federal Reserve support this increase, suggesting a favorable economic environment for XRP’s growth.

In addition, forthcoming regulatory talks in the United States, namely a cryptocurrency roundtable featuring prominent figures in the sector such as Ripple CEO Brad Garlinghouse and Mark Cuban, have the potential to elucidate and constructively mold the regulatory environment surrounding XRP.

These elements, along with a technical recovery from a “oversold” state, make XRP an appealing choice for investors hoping to profit from the peculiarities of the cryptocurrency market.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us