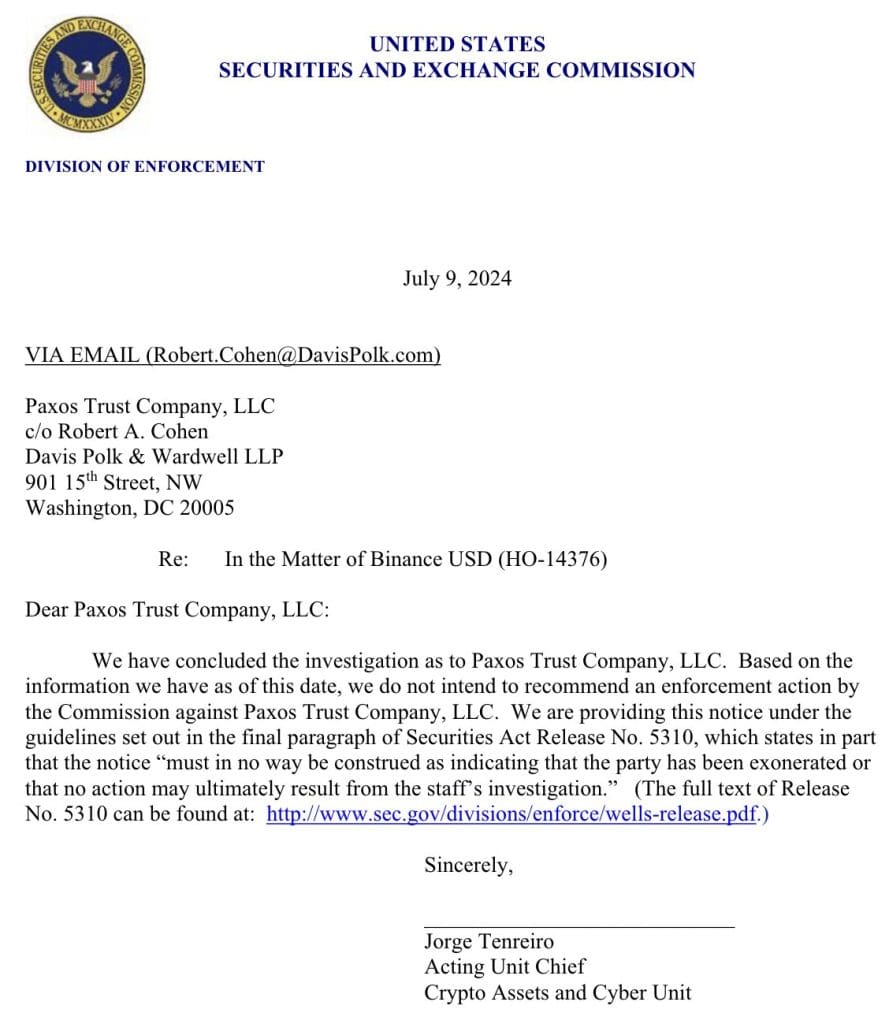

In a major turn of events in the bitcoin space, the Securities and Exchange Commission (SEC) decided lately to stop looking at Paxos, a New York-based stablecoin issuer.

Presented by Jorge Tenreiro, the interim chief of the SEC’s crypto assets and cyberunit, this statement suggested that Paxos will not be subject to any enforcement measures.

Initial Investigation and Allegations

The end of this research signifies a possible change in the regulatory scene for stablecoins, usually digital assets linked to and supported by stable sources like the U.S. dollar.

Research into Paxos began after the SEC issued a Wells notice in February 2023, citing potential enforcement action related to the BUSD stablecoin, which Paxos issues for Binance.

Allegations that BUSD, linked to the U.S. dollar, ought to be regarded as an investment contract and so a security led the SEC to investigate.

This was predicated on the idea that, given the expectation of profits, revenues from BUSD’s reserves were distributed to Binance users in the form of yields, therefore categorizing it under securities.

On June 28, however, the regulatory viewpoint seemed to change in line with a federal court ruling supporting Binance. The court decided that BUSD’s sales did not constitute a securities offering, thereby dismissing the allegations against violations of securities laws.

This legal triumph for Binance seemed to affect the SEC’s later choice to remove their earlier charges against Paxos.

The answers of this research not only clarify the regulatory situation of BUSD but also greatly help Paxos. Head of strategy at Paxos, Walter Hessert, revealed great relief and hope in an interview following a decision.

He pointed out that the closure of the SEC’s investigation cleared a big cloud of uncertainty hovering over the business for more than a year, therefore impeding possible alliances and expansion prospects, most notably with regard to big companies like PayPal.

Implications for the Stablecoin Industry

Maintaining its usual caution, the SEC refrained from commenting on the termination of the inquiry, therefore supporting its policy of not publicizing continuing or finalized investigative findings.

This quiet is in line with the past approach of the agency toward regulatory control of newly developed financial technologies.

The stablecoin industry, which comprises other well-known companies as PayPal and VanEck, depends on this evolution. The industry has negotiated a difficult regulatory environment lacking clear legislative direction notwithstanding its expansion.

Congress has not yet passed particular laws specifically addressing the growing class of digital assets, leaving numerous legal and practical questions about stablecoins in a regulatory gray area.

Traditionally, securities are distinguished by the money invested in a joint venture with a realistic hope of rewards resulting from the labor of others. Stablecoins like BUSD, which are meant to keep parity with the dollar rather than create returns, may defy simple classification.

Potential for Regulatory Clarity

This natural variation has inspired discussions over whether stablecoins belong in a new, unique class of financial tools or should be controlled as securities.

Given that the SEC’s latest ruling may set a standard for how comparable issues are handled going forward, it could encourage even more regulatory clarity.

Furthermore, it could inspire additional businesses to join the stablecoin market or extend their current operations, therefore supporting the expansion of the industry both inside the United States and maybe elsewhere.

The outcome of the Paxos case is likely to influence the broader bitcoin industry, potentially driving companies towards jurisdictions with clearer regulatory environments or compelling them to develop new products in such locations.

Every legislative decision taken as the terrain changes will be widely observed and could influence the future direction of how digital assets are perceived, controlled, and included into the worldwide financial system.”

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us