Layer 2 (L2) tokens have seen significant increase in market values in recent developments inside the crypto space.

Notable tokens include Optimism (OP), Arbitrum (ARB), and Polygon (MATIC) noted notable price rises of 35%, 17%, and 14% respectively, therefore highlighting a strong time of expansion for these digital assets.

STRK Token’s Remarkable Surge: What You Need to Know

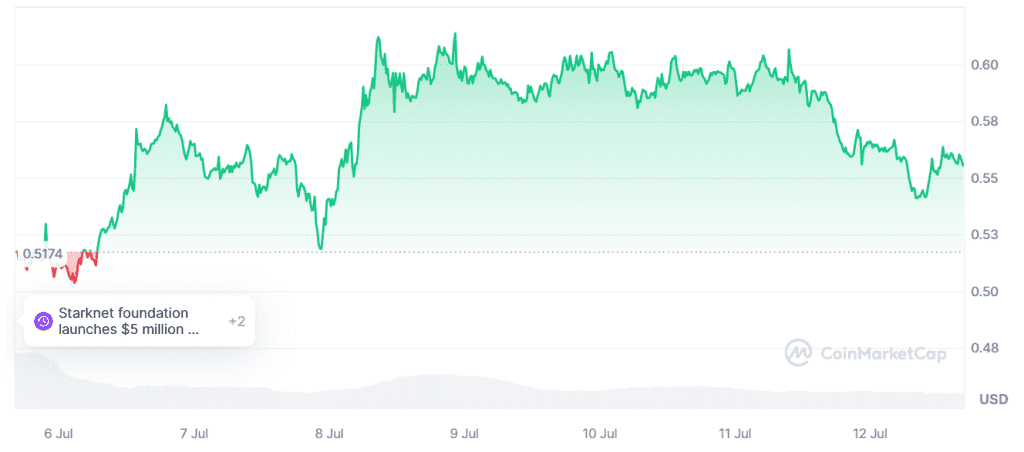

One of the top performers was STRK, the exclusive token of the ZK-Rollup platform Starknet, which showed a respectable 16% increase in value. The market price of STRK started to rise on July 5 after it had recovered from its record low of $0.46.

According to the most recent trade data, STRK is trading at $0.55, up more than 19% from its recent low.

Alongside this surge, there was a noticeable rise in the volume of transactions. On July 11, Starknet’s daily transactions reached a seven-day high of $38.31 million, a 15% increase from $33 million the day before.

Such spikes in transaction volumes point to increased investor interest in the asset and more market activity, both of which are positive factors for maintaining price gains.

Not only does the increased demand for STRK show up in spot markets, but it has also resulted in more activity in derivative markets. The entire amount of outstanding futures contracts for the token is shown by its futures open interest, which increased by 10% last week to $51.35 million.

Is a Price Correction Looming? Key Indicators to Watch

An increase in futures open interest typically indicates that traders are more optimistic because more of them are opening new positions in expectation of future price increases. Nevertheless, there are indications that the present rise may be failing despite these encouraging market data.

The Aroon Up Line of STRK, a measure for determining if an item is likely to reverse or continue its present trend, is 0% when analyzed. A 0% reading indicates that the asset’s most recent price peak was reached some time ago, and that no new highs have been reached subsequently.

This signals that the uptrend may not have the momentum to continue. Due to its lack of upward velocity, STRK may see a price correction.

Crypto Boom or Bust? STRK’s Surge at Risk of Collapse

The swings seen in STRK draw attention to the inconsistent character of the crypto market, where fast rises in asset values can soon be followed by losses, therefore reflecting the speculative and uncertain atmosphere that defines trading in digital currencies.

Although STRK has seen a notable 19% rise and more trading activity, signs point to possible obstacles to maintain steady progress.

The asset hasn’t made new price highs recently, hence the Aroon indicator shows a declining uptrend. If this negative outlook continues, STRK might fall back to around $0.51, showing just how unpredictable digital assets can be.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us