In a notable transaction facilitated by Fountain, a brokerage specializing in high-value NFTs, one of the rare Alien CryptoPunks was purchased for 4,000 ETH, which is approximately $12.5 million.

This sale, involving CryptoPunk #635, occurred on Thursday and was announced by the NFT art collection, CryptoPunks. Remarkably, this marks the third time in the past two months that an Alien Punk has fetched over $10 million, proving the high value and continued investor interest within this specific collection on the Ethereum blockchain.

CryptoPunk #635 Is The Fourth Highest-Value Piece In The Entire Collection

CryptoPunk 635, recognized as one of only nine alien-themed punks, represents a highly rare asset within its collection, achieving the fourth highest sale value to date. Originally owned by the creators at Larva Labs, this particular piece was most recently auctioned at Christie’s Contemporary Art Evening Sale in May 2021.

The transaction for CryptoPunk 635 to its latest, albeit anonymous, owner was managed by Fountain, a broker known for handling high-value NFTs. In a statement released on Thursday, the NFT project expressed pride in their involvement, extending congratulations to both the seller and the new owner.

CryptoPunk 635, the Alien originally owned by Larva Labs and sold at the Christie’s Contemporary Art Evening Sale in May 2021, has just been acquired by an anonymous collector in a deal brokered by Fountain. We’re honored to have played a small role in this sale. Congratulations… pic.twitter.com/glisy3MZpv

— Fountain (@Fountainxyz) April 25, 2024

How It All Started For The CryptoPunk Collection

CryptoPunks, established in 2017 by Canadian developers Matt Hall and John Watkinson, represents a pioneering digital art project consisting of about 10,000 unique characters. Inspired by the cyberpunk aesthetic, these digital artworks are created through algorithmic generation, ensuring no two pieces are identical. These collectibles, which predominantly feature human figures, also include rare depictions of zombies, apes, and aliens, adding to their uniqueness and appeal.

The project operates on the Ethereum blockchain, allowing for decentralized ownership and transaction of these digital assets. This feature ensures that each CryptoPunk can be securely owned and traded without intermediaries. Recently, one of the alien-themed CryptoPunks was sold for $16.03 million to an anonymous buyer, marking it as the second-highest sale in the collection’s history. In another powerful transaction, a piece from the CryptoPunk series fetched a staggering $23.7 million.

Despite This Record-Breaking Transaction, ETFs Are Actually Losing Their Traction

The value of the CryptoPunks collection, measured in Ethereum (ETH), has plummeted significantly from its 2021 peak. On October 8, 2021, the lowest-priced CryptoPunk was valued at 113.9 Ether, approximately $408,000, but this has since dropped to just 36.9 Ether, or about $117,000, marking a 70% decrease in value.

Similarly, the Bored Ape Yacht Club (BAYC) has seen a dramatic drop in its floor price, from 128 Ether in the previous year to merely 15.5 Ether, reflecting a 90% reduction. This decline in value is a common trend across various Non-Fungible Token (NFT) collections.

Despite achieving record trading volumes on April 30, 2022, driven by the release of Yuga Labs’ Otherside metaverse collection, which exceeded 200,000 Ether in trading volume on its first day, the overall NFT trading volume has since fallen sharply. According to data from DefiLlama, the total daily trading volume has diminished by 99%, currently standing at only 1,700 Ether.

While CryptoPunks NFTs have become more valuable and significant, other once-popular NFT collections like Azuki and Doodles have faced substantial declines in their lowest prices, indicating a shift in the NFT market landscape. The Bored Ape Yacht Club’s lowest price point has now reduced to just above $40,000, a significant fall from its high in 2022.

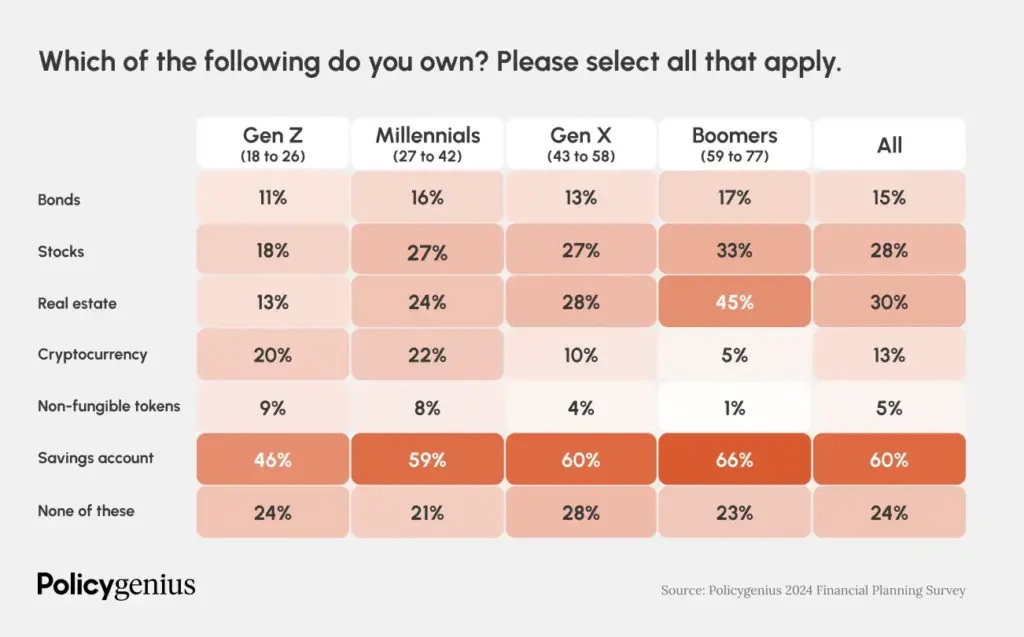

Rising Popularity of NFTs Among Gen Z and Millennials

A recent Policygenius survey reveals that a notable segment of younger generations—9% of Gen Z and 8% of Millennials—are exploring the realm of Non-Fungible Tokens (NFTs). These digital certificates, which authenticate ownership of diverse items ranging from artwork to sports highlights, are actively traded on platforms such as OpenSea and Rarible.

The growing interest in NFTs among these younger cohorts underscores a generational divide in the adoption and understanding of emerging technologies. Unlike Baby Boomers and Gen X, who are less engaged, younger individuals perceive NFTs as avenues for both cultural expression and potential financial opportunities.

An example of how NFTs are being integrated into new platforms is the web 3.0 game, Chainers. This game offers users the chance to collect free NFTs daily, which they can then utilize within the game for various activities such as playing, socializing, creating augmented reality content, and trading within the game’s ecosystem. This illustrates the evolving role of NFTs from mere collectibles to dynamic tools for engagement and value creation in digital spaces.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us