As the cryptocurrency market faces substantial downturns, Bitcoin (BTC) recently plummeted to its lowest point since February. Meanwhile, the Ethereum-based Azuki has surged to unprecedented levels within the non-fungible token (NFT) sector, recording sales of $1.13 million, which crowned it as the leading NFT collection of the day, based on data from CryptoSlam.

While the Crypto Market Continues to Decline, Azuki’s Sales Are Booming

In a striking 24-hour period, Bitcoin dropped approximately 6.3%, falling below the critical $60,000 support level. Experts predict this drop could have a domino effect, with analysts warning that a breach of this level could trigger further sell-offs and exacerbate the current downturn. Ethereum (ETH) also experienced a dip, decreasing by about 5% and dropping below $3,000.

Other major altcoins, including Solana (SOL) and Avalanche (AVAX), suffered similar losses of around 6%. Consequently, the overall market capitalization of cryptocurrencies diminished by more than $20 billion, exacerbated by a $540 million outflow from US spot Bitcoin exchange-traded funds (ETFs) since April 20.

This decline has some investors questioning the long-term viability of cryptocurrencies. Research from 10x indicates that the average entry price for holders of US Bitcoin ETFs is around $57,300, which might now act as a crucial support level if the downward trend persists. Markus Thielen, CEO of 10x Research, suggested that the presence of temporary investors or “TradeFi tourists” in the crypto space has diminished.

He noted that as Bitcoin falls below the average ETF purchase price, further price drops could lead to a correction of -25% to -29% from its $73,000 peak, potentially pushing prices down to between $52,000 and $55,000 over the last three weeks. This correction could weed out these short-term investors and pave the way for a more stable market driven by long-term believers in the potential of blockchain technology.

In Stark Contrast To The Volatile Cryptocurrency Market, The NFT Sector Is Thriving

And that can be seen with Azuki emerging as the only collection to surpass $1 million in sales in a single day. This surge in sales highlights the growing popularity of NFTs and their potential to represent a distinct asset class with its own market dynamics, less coupled to the fluctuations of the broader cryptocurrency market.

Analysts speculate that the appeal of Azuki stems from its unique blend of artistic style, cultural relevance, and potential utility within a planned metaverse experience. This combination creates a sense of value and exclusivity that is attracting collectors even as traditional cryptocurrencies experience a downturn.

Other NFT Collections, Such As Dmarket And Dokyo, Have Also Seen Significant Sales Volumes

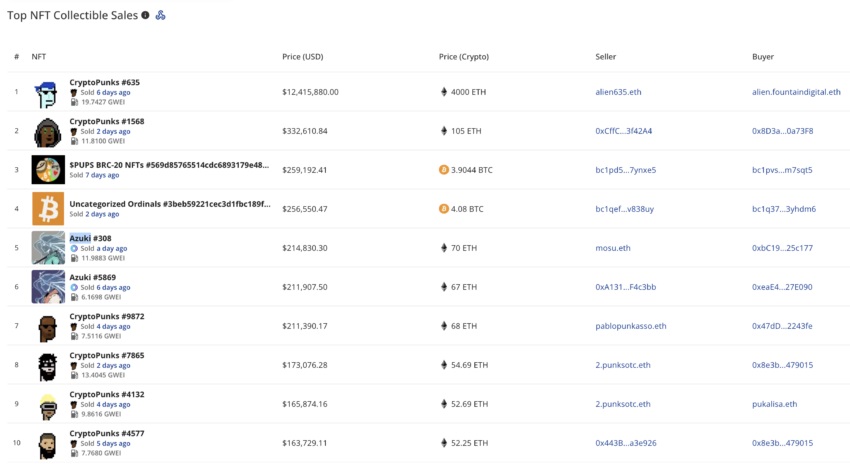

DMarket, which offers in-game items on the Mythos network, accumulated nearly $887,880 in sales, while Dokyo, operating on the Avalanche network, gathered about $716,860 from 948 transactions. But they still remain behind Azuki. Notably, other prominent NFT collections like Bored Ape Yacht Club (BAYC) and CryptoPunks each recorded just over $500,000 in sales, demonstrating resilience in a challenging market environment.

These sales figures reflect a growing divergence where select NFT collections continue to attract significant investment despite broader market challenges, indicating a robust and enduring interest in high-value NFTs such as Azuki, even as traditional cryptocurrencies experience significant volatility.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us