In May, the nonfungible token (NFT) market experienced a significant decline, with overall sales dropping by 54%. Despite this downturn, Bitcoin-based digital collectibles reached a significant milestone, as highlighted by recent data from CryptoSlam.

On June 4, CryptoSlam reported that NFTs on the Bitcoin blockchain surpassed a cumulative sales volume of $4 billion, combining $3.97 billion in NFT sales and $82 million in wash sales.

Bitcoin NFTs Lead in 30-Day Sales Volume

Over the past 30 days, Bitcoin-based NFTs achieved a sales volume of $171 million, making Bitcoin the leading blockchain in terms of NFT sales volume for the period. Ethereum followed closely with $159 million in sales, and Solana came in third with $90 million.

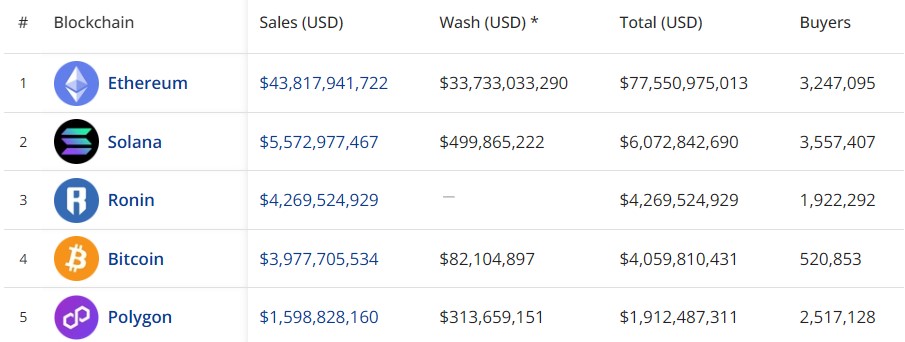

However, despite the impressive 30-day sales volumes, Bitcoin remains the fourth-largest blockchain in terms of all-time NFT sales. The Ronin blockchain holds the third position with $4.2 billion in sales, while Solana occupies the second spot with $5.5 billion. Ethereum continues to dominate the NFT market, boasting an all-time sales volume of $43.8 billion.

The broader NFT market, which had shown signs of recovery in April 2024, faced a slowdown in May. According to CryptoSlam, the global NFT sales volume for May was $624 million, a stark contrast to April’s figure, which exceeded $1 billion. This decrease in sales was observed across major blockchains like Bitcoin, Ethereum, and Solana.

Bitcoin-based NFTs, despite leading in the 30-day sales volume, experienced one of the steepest declines. CryptoSlam’s data indicated that Bitcoin NFT sales volume dropped by 68% compared to April. This trend of declining sales was not unique to Bitcoin, as other top blockchains also saw reduced volumes.

Standout Performers Amidst the Downturn

Despite the overall decline, some NFT collections managed to grow. The SocialFi project Fantasy Top, for instance, saw significant growth, contributing to the rise of Blast among the top blockchains for NFTs.

Additionally, the Immutable-based blockchain game Guild of Guardians experienced a 69% increase in sales volume, driving a 23% growth for Immutable overall. On Solana, the DogeZuki Collection and Solana Monkey Business were notable gainers, with growth rates of 130% and 74%, respectively.

In addition to the milestone in sales volume, Bitcoin also saw a new record in transaction value. On May 28, Bitcoin transactions reached an estimated value of over $25 billion, the highest in USD terms over the past year.

This on-chain transaction value, representing the total estimated value of transactions on the blockchain, provides insight into Bitcoin trends and aids traders in making informed decisions. Blockchain.com reported that on May 28, approximately 367,000 BTC were moved on the blockchain, the largest volume of BTC moved since June 13, 2022, when over 519,000 BTC were transferred.

Milestones and Optimism for Bitcoin

Amid these developments, trading analyst Peter Brandt predicted a significant price increase for Bitcoin. On June 2, Brandt suggested that Bitcoin could reach $130,000 by 2025. He noted that Bitcoin’s current bull run exhibited patterns similar to previous post-halving cycles.

According to Brandt, if Bitcoin follows the trajectory of previous cycles, it could reach between $130,000 and $150,000 by August or September 2025. He highlighted that historically, Bitcoin’s halving dates often marked the mid-point between the beginning and peak of bull markets. The last bull market began 16 months before the 2020 halving and concluded 18 months after.

While the NFT market as a whole experienced a downturn in May, Bitcoin-based NFTs achieved notable milestones, both in sales volume and transaction value. Despite the broader market’s decline, certain collections and projects managed to grow, highlighting the dynamic and evolving nature of the NFT space.

Additionally, Bitcoin’s transaction value reached a record high, and analysts like Peter Brandt remain optimistic about the cryptocurrency’s future, projecting substantial price increases in the coming years.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us