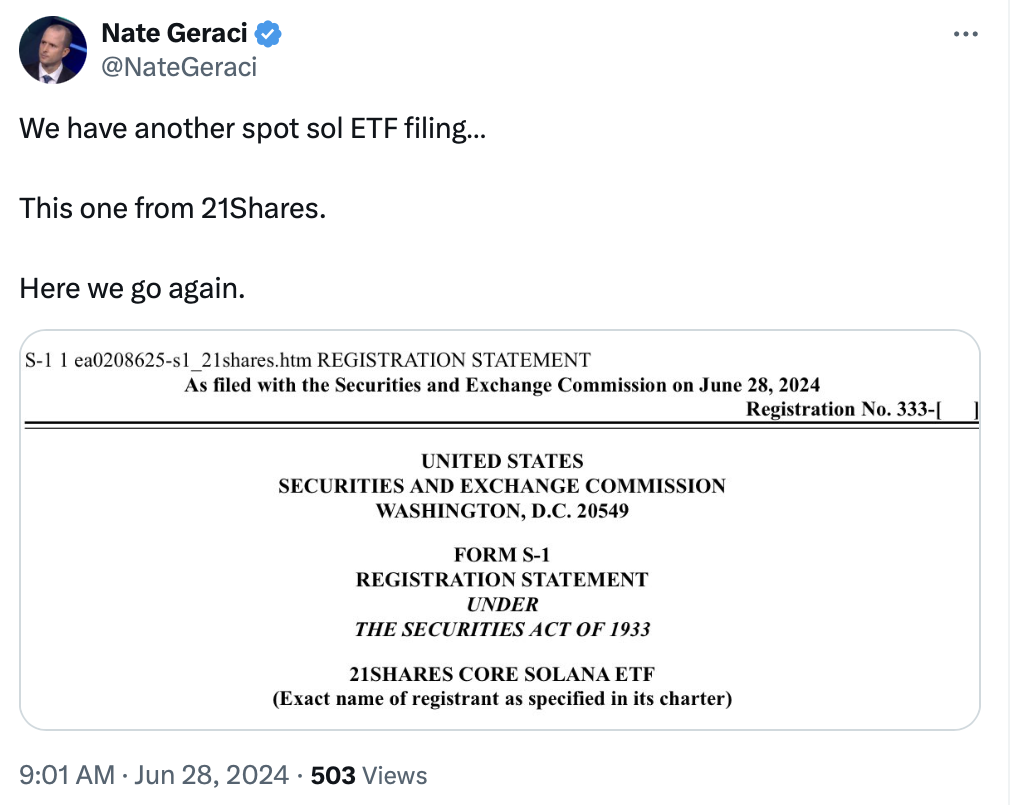

Investment firm 21Shares has made headlines by submitting an S-1 registration form to the U.S. Securities and Exchange Commission (SEC) for a Spot Solana ETF.

This filing, completed on Friday, highlights the firm’s strategic efforts to tap into the rising interest in Solana as the cryptocurrency market eagerly anticipates the launch of Ethereum ETFs in July.

General Interest in Solana ETF

The 21Shares Core Solana ETF, designed to be listed on the Cboe BZX Exchange, offers investors a straightforward and cost-effective method to gain exposure to Solana’s native token, SOL, without the need for direct investment. The ETF is intended to track SOL’s performance, with daily valuations based on an index.

The Trust supporting the ETF will be sponsored by 21Shares, with CSC Delaware Trust Company serving as the trustee and Coinbase Custody Trust Company acting as the custodian responsible for safeguarding the SOL assets.

In parallel, VanEck, a trailblazer in the realm of spot Bitcoin ETFs in the United States, has also moved to enter the Solana ETF space. Matthew Sigel, head of digital assets research at VanEck, announced via X on June 27 that the firm has filed for a Solana ETF with the SEC.

The proposed VanEck Solana Trust aims to leverage Solana’s decentralized architecture, high utility, and economic viability. Sigel emphasized that SOL functions as a digital commodity, much like Bitcoin and Ether, being used for transaction fees and computational services on the Solana blockchain.

VanEck’s Solana Trust, pending SEC approval, is set to be listed on the Cboe BZX Exchange and aims to mirror the price performance of Solana, excluding operational expenses.

The trust’s daily share values will be determined using the MarketVector Solana Benchmark Rate index, which compiles data from the leading SOL trading platforms. These filings from 21Shares and VanEck mark a pivotal moment in the cryptocurrency investment landscape.

The SEC’s recent approval of spot Ether ETFs in the United States on May 23, 2024, which effectively ended the debate over ETH’s classification as a commodity rather than a security, has opened the door for similar products focusing on Solana.

This regulatory shift was further underscored when the SEC closed its investigation into whether Ether constitutes a security on June 19, solidifying its status as a commodity.

Potential Impact of Solana ETFs

The approval of Solana ETFs by the SEC, should it occur, would provide investors with a regulated and accessible avenue to engage with Solana’s digital assets.

This would not only cater to the increasing demand for such investment products but also potentially set the stage for a broader acceptance and inclusion of digital assets in mainstream investment portfolios.

The move could herald a new wave of ETF filings by major asset managers, akin to the earlier surge seen with Bitcoin and Ethereum ETFs. Despite these promising developments, the market’s reaction has been cautious.

Following VanEck’s announcement, the price of SOL experienced a brief surge, recovering by 9% to reach $150 after a previous dip to $121 earlier in the week. However, this enthusiasm was short-lived, as SOL’s price corrected by 4% in the past 24 hours, stabilizing at $142.

This volatility reflects the market’s tempered optimism as investors await further regulatory clarity and the potential approval of these ETFs.

The filings by 21Shares and VanEck underscore a significant shift in the cryptocurrency investment ecosystem, demonstrating a robust interest in Solana amidst the backdrop of regulatory advancements.

These developments point towards a future where digital asset ETFs become a standard component of investment strategies, offering a regulated and efficient way to participate in the growth and dynamics of the cryptocurrency market.

As the SEC deliberates on these proposals, the market remains watchful, anticipating the potential ripple effects on Solana’s valuation and the broader digital asset landscape.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us