This year, Solana (SOL) has demonstrated remarkable growth, surging by almost 800%, surpassing the gains of both Bitcoin and Ethereum.

Over the past 12 months, despite a recent decline to the $141 level, Solana’s value has increased by more than 770%, as reported by CoinMarketCap. In comparison, Bitcoin and Ethereum have registered gains of 100% and 82% respectively, within the same period.

The substantial growth of Solana has solidified its position as one of the top three cryptocurrencies in the market, alongside Bitcoin and Ethereum. This recognition of Solana’s market performance has prompted two firms to file for Spot Solana ETFs just this week, highlighting its increasing relevance in the cryptocurrency space.

Solana’s Strong Position Among Crypto Giants

Throughout 2024, the United States has approved two cryptocurrency-based ETFs, with expectations for more approvals on the horizon. Solana has notably emerged as a strong candidate for such an investment product, thanks in part to its impressive 800% annual gains, which have surpassed those of both Bitcoin and Ethereum.

According to a recent report from GSR Markets, SOL has solidified its position within the “Big Three” of the cryptocurrency market, suggesting that it’s only a matter of time before a SOL ETF is established. This development would elevate Solana alongside Bitcoin and Ethereum in a select group of assets benefiting from ETF products.

Recent filings by 21Shares and VanEck indicate significant interest in launching a Solana investment product. This reflects not only Solana’s potential as a lucrative investment but also indicates a shift in the regulatory landscape in the United States. The broader implications hint at an overarching change in the financial sector.

Bloomberg has noted that Bitcoin’s performance is increasingly being overshadowed by Ethereum and Solana as excitement around ETFs grows. The potential approval of a Solana ETF could substantially benefit both the industry and the token itself, enhancing its market position and value.

Growth in Staked SOL Despite Market Downturn

Amid intense market volatility and a general downturn in cryptocurrency values, core Solana investors have maintained a resiliently bullish posture, suggesting an imminent price resurgence for SOL. Despite past underperformance, Solana’s stakers and node validators have consistently exhibited optimism.

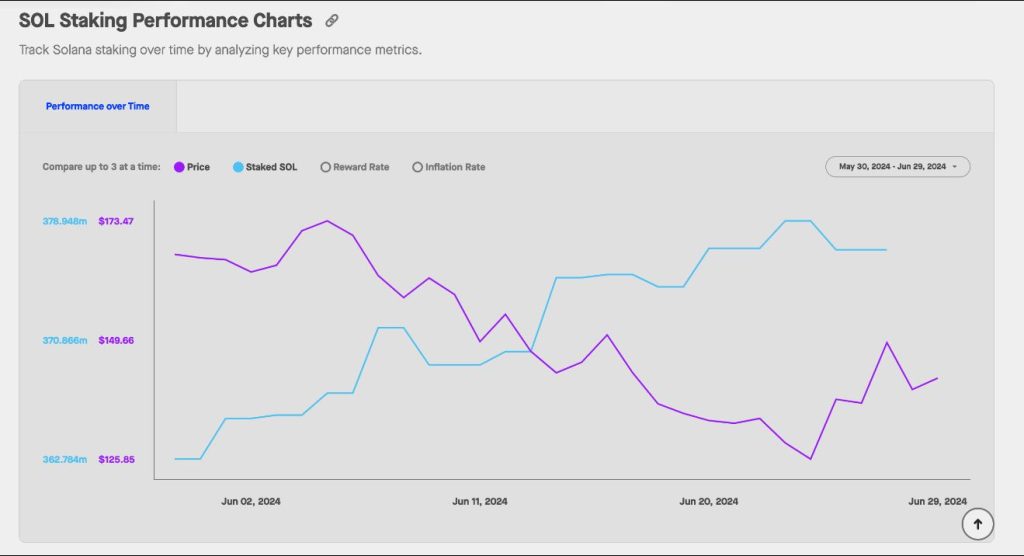

Recent data from StakingRewards.com, a staking data aggregator, shows real-time shifts in the volume of SOL coins deposited into smart contracts. These deposits serve the dual purpose of generating passive income and enhancing the security of the Solana blockchain network. On May 20, at the onset of the market downturn, Solana stakers had 368.8 million SOL in smart contracts. However, by June 29, this number had increased to 375.3 million SOL, despite prevailing market fears, uncertainty, and doubt.

This increase of 6.5 million SOL, valued at approximately $884 million, has elevated the total value of staked SOL to $50.1 billion. This strategic move by Solana’s core investors highlights their strategy to withstand the bearish market by staking coins for passive income, anticipating future price gains.

The behavior observed on the trend chart where stakers increase their deposits during a bearish market phase indicates a positive long-term outlook on SOL’s price potential. Furthermore, staking reduces the short-term market supply of SOL, easing selling pressure and potentially hastening a price breakout when market sentiments turn bullish.

Moreover, a 0.22% drop in the inflation rate during this period, influenced by SOL’s tokenomics, further incentivizes stakers to increase their deposits moving forward. These strategies reflect the robust approach of Solana investors to navigate the current bearish market, balancing book-value preservation with passive income generation, in preparation for the next market recovery.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us