The computing power of Bitcoin’s network, known as its hashrate, has been on a relentless rise, reaching new all-time highs. However, this growth is expected to decelerate as extreme summer temperatures impact mining operations in North America.

Bitcoin miners, who operate highly potent machines that generate significant amounts of heat, face increased operational challenges during the summer.

Operational Challenges During Summer

Analysts at Blockware Intelligence have emphasized that heat mitigation is the primary operational challenge for these miners. ASICs, the machines used for mining, can reach dangerously high temperatures without proper cooling measures in place.

This seasonal increase in temperatures complicates operations further, requiring miners to use additional power to cool their devices. Alternatively, they might have to reduce operations due to the surge in residential energy consumption, which triggers demand response clauses in their power purchase agreements.

Blockware noted that during the summer months, the combination of overheating issues and heightened residential power use often leads to reduced miner activity.

Historically, the hashrate has declined during the summer, leading to a decrease in the difficulty of mining a Bitcoin block.

Colin Harper, head of content and research at Luxor Hashrate Index, indicated in a June 17 report a keen interest in observing whether the hot weather would necessitate similar curtailments this year, as was the case in the summers of 2022 and 2023.

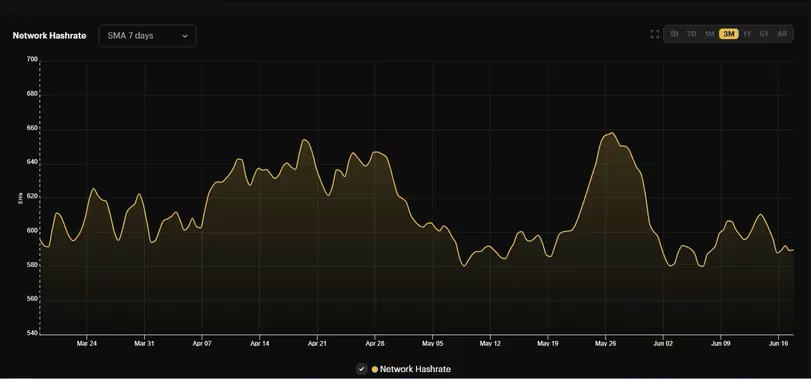

Indeed, data shows a downturn in hashrate since it peaked in March. On May 25, the hashrate climbed to a record high of 658 exahash per second (EH/s), according to Luxor’s Hashrate Index data. However, by mid-June, there was a notable 10% decrease to 589 EH/s.

Given that a significant portion of Bitcoin mining operations, roughly 37% according to the University of Cambridge, are situated in the U.S.—with a substantial concentration in the particularly hot region of Texas—the impact of North American operations curtailing activity is significant on the overall hashrate.

Drivers of Hashrate Growth and Potential Benefits

The primary drivers behind the continuous growth in hashrate have been previously purchased mining rigs coming online and miners upgrading their fleet with more efficient machines to maintain profitability after the halving, which cut their mining rewards by 50%.

This halving event squeezed profit margins in an already overcrowded sector, making efficiency upgrades essential. The lower hashrate and decreased mining difficulty during the summer could benefit some miners by reducing competition.

Additionally, companies like Riot Platforms (RIOT) might see an opportunity to generate additional revenue from the power grid by reducing their mining operations under their power purchase agreements.

This strategy can be particularly advantageous during peak electricity demand periods when miners can earn extra income by curtailing their operations.

Potential for Difficulty Adjustment and Industry Impact

As the industry braces for potential declines in hashrate due to seasonal conditions, miners might welcome a possible negative adjustment in mining difficulty, providing some relief in an increasingly competitive sector.

Harper expressed hope for such an adjustment, underscoring a potential respite for miners during the challenging summer months. While the hashrate of Bitcoin’s network has seen significant growth, the approaching summer heatwaves in North America are likely to slow this trend.

This seasonal phenomenon, coupled with high residential energy demands, is expected to reduce mining activity, potentially leading to a decrease in mining difficulty and offering a much-needed break for miners facing squeezed profit margins.

The situation underscores the dynamic and challenging nature of Bitcoin mining, particularly as environmental factors increasingly influence operational strategies.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us