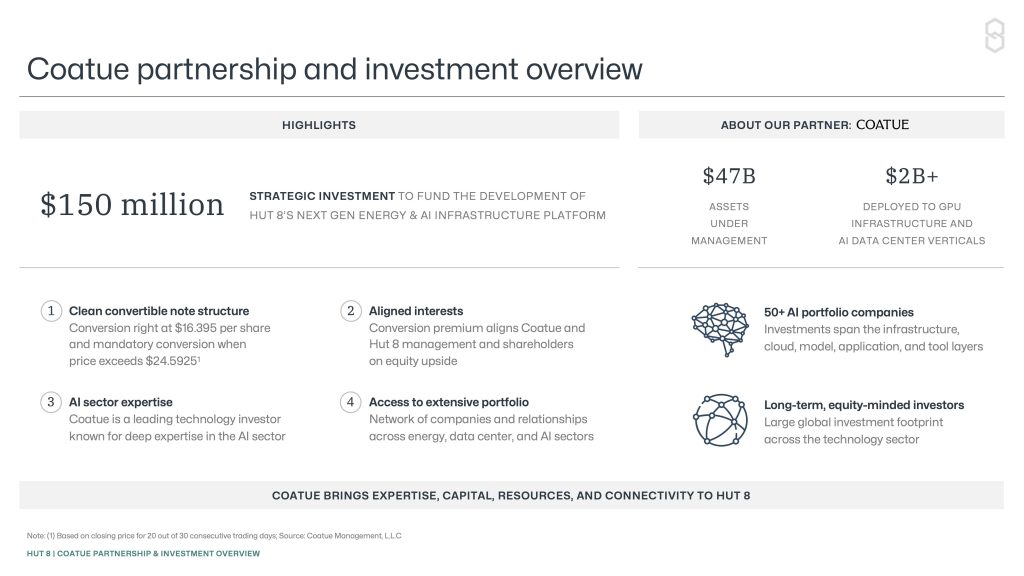

Coatue Management, a tech-focused investment firm led by billionaire Philippe Laffont, has announced a significant $150 million investment in Hut 8 Corp, a prominent Bitcoin (BTC) miner.

This investment comes as investors increasingly seek to capitalize on the artificial intelligence (AI) boom, recognizing the strategic intersection of AI and high-performance computing (HPC) with cryptocurrency mining.

Hut 8’s Market Position and Future Prospects

The investment, structured through a convertible note, is set to mature over a period of five years, offering an 8% annual return.

This financial instrument, classified as a senior unsecured obligation, provides Coatue Management with the flexibility to extend the maturity through three additional one-year periods.

The arrangement underscores Coatue’s commitment to fostering innovation in AI, which the firm views as essential for substantial growth across the digital ecosystem.

Hut 8 Corp, recognized for its robust computing power and a market capitalization of $1.1 billion, has positioned itself as a key player in this evolving sector.

The company revealed details of this transaction in a recent filing with the United States Securities and Exchange Commission, with completion expected by July 11.

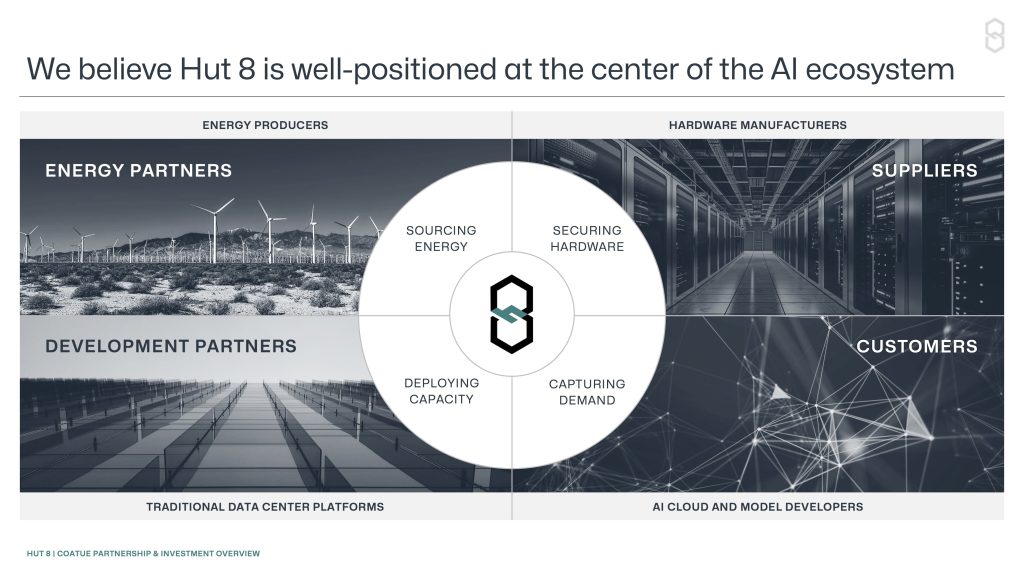

This investment is timely as AI and HPC sectors are increasingly turning to the Bitcoin mining industry to satisfy their needs for substantial computing power.

Bitcoin miners, like Hut 8, typically possess the necessary infrastructure and power supply agreements that make them attractive partners for AI and HPC initiatives.

For instance, cloud computing firm CoreWeave recently engaged in a 200 megawatt deal with miner Core Scientific for AI-related services and even proposed acquiring the entire company for over $1 billion—a proposal Core Scientific declined, citing undervaluation.

Impact on the Broader Market and Industry Trends

Coatue Management’s investment in Hut 8 and CoreWeave illustrates a growing trend where the infrastructural capabilities of Bitcoin miners are leveraged to support the demanding requirements of AI services.

This strategic utilization is poised to stimulate a new era of mergers and acquisitions in the mining sector, especially for entities with advantageous power agreements.

Moreover, the investment has buoyed the broader Bitcoin mining and data center market, notably impacting other companies within the space. Following the announcement, shares of Soluna Holdings surged nearly 17%, and Applied Digital saw a 10% increase.

These market movements highlight the sector’s positive response to investments linking cryptocurrency mining with AI and HPC applications.

Future Collaborations and Technological Innovations

Robert Yin, a partner at Coatue, emphasized the broader market’s growing appreciation for the scarcity of high-quality power assets. With Hut 8’s extensive and expandable asset pipeline, the company is well-positioned to meet the increasing demand for AI compute capacity.

This demand is further driven by traditional data center operators struggling to keep pace with the rapid surge in AI applications, hindered by power shortages, lengthy timelines for bringing new capacities online, and the extensive upgrades required to support the latest generation of high-density compute.

Hut 8 has expressed confidence in its ability to bridge these gaps, reaffirming its strategic position within the market.

The company’s proactive expansion into self-mining operations and diversified revenue streams also reflects its adaptive strategy in an industry where technological advancements are rapidly reshaping business models and operational frameworks.

As the landscape of technology continues to evolve, the intersection of AI capabilities and traditional industries like Bitcoin mining is creating new opportunities for innovation and growth.

This trend is not only reshaping the cryptocurrency mining sector but also setting the stage for future collaborations that could redefine the technological capabilities of various industries.

With strategic investments like those made by Coatue Management, companies like Hut 8 are at the forefront of this transformative wave, promising to deliver solutions that meet the complex demands of modern digital applications.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us