The World Economic Forum, in collaboration with Accenture, released a detailed report concerning CBDCs entitled “Modernizing Financial Markets with Wholesale Central Bank Digital Currency”. The report offers a thorough exploration of the worldwide movement toward adopting Central Bank Digital Currencies (CBDCs) by the year 2030.

Additionally, it emphasizes the initiatives of central banks around the globe to launch 24 operational CBDCs, which are expected to significantly enhance the security, efficiency, and accessibility of financial markets.

The Impact of CBDCs on Global Financial Markets

In an era marked by rapid technological innovation, central banks worldwide are making significant strides toward the adoption of Central Bank Digital Currencies. By 2030, it is projected that 24 live CBDCs will be operational, potentially transforming the landscape of global financial markets through enhanced security, efficiency, and accessibility.

The integration of CBDCs into the financial ecosystem addresses both current and emerging challenges within the sector, including the need for more secure and efficient transaction mechanisms and the demand for broader financial inclusion. CBDCs are designed to modernize the capabilities of and improve access to central bank money, which is crucial for fostering stable and efficient economic environments.

A primary motivation for the development of CBDCs is their potential to improve systemically important payment systems between financial institutions. These digital currencies are not just theoretical constructs but are being piloted and tested in real-world scenarios across various continents.

Real Case Scenarios Where CBDCs Are Already In Practice

For instance, in Switzerland, a live wCBDC (wholesale CBDC) was recently used to settle a digital bond transaction, marking a significant milestone in the practical application of CBDCs in mainstream financial operations.

Also, the ongoing projects extend beyond single-nation applications. In Asia and the Middle East, initiatives like Project mBridge are redefining cross-border payments, expanding their observing members to include 25 central banks and institutions. This reflects a growing trend towards multilateral cooperation in the development and deployment of CBDCs, highlighting their role in facilitating international trade and economic integration.

Moreover, the European Central Bank and other major financial entities are exploring the use of distributed ledger technology (DLT) for CBDCs to enhance securities and foreign exchange transactions. These advancements highlight the dual potential of CBDCs to innovate payment systems and reinforce financial stability across jurisdictions.

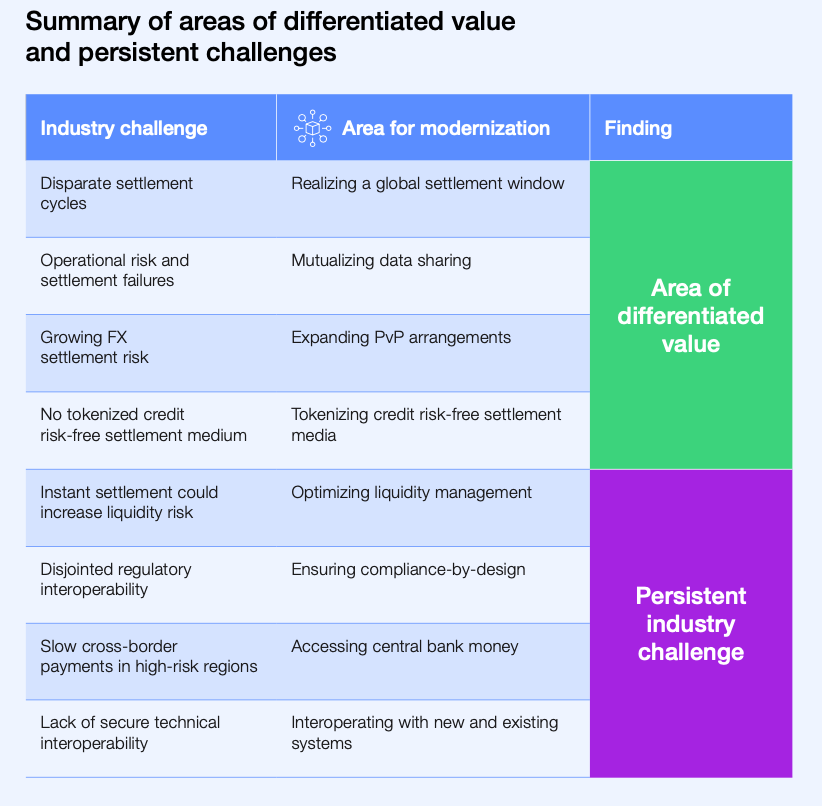

How Wholesale CBDCs Would Address The Current Challenges?

Interestingly, most real-time gross settlement (RTGS) systems that facilitate cross-border securities settlement operate within restricted hours. The Bank for International Settlements (BIS) notes that there is a maximum overlap during a five-hour window from 6 to 11 AM GMT.

However, to establish such a global settlement window comprehensively, significant modifications to the operating hours of RTGS systems are necessary. Accenture has proposed that a wholesale CBDC could complement RTGS systems by functioning nearly around the clock.

Moreover, the industry faces a growing problem with settlement failures, especially as securities settlement periods decrease from T+2 to T+1. Implementing a shared distributed ledger technology (DLT) infrastructure as a unified source of truth could mitigate these failures. A wholesale CBDC could then serve as the settlement asset.

One of the highly praised advantages of DLT is the provision of atomic settlement in securities transactions, which removes counterparty risk. However, when traditional finance sectors began to explore DLT about six to seven years ago, they recognized a critical issue: atomic settlements demand high liquidity at specific times during the day. This requirement contrasts with traditional systems that facilitate liquidity through mechanisms such as netting, queuing, and offsetting.

Thus, it remains uncertain whether a wholesale CBDC can effectively tackle these liquidity risk challenges.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us