Several cryptocurrency wallets associated with prominent figures and entities in the digital asset space have substantial amounts locked in decentralized finance (DeFi) bridge contracts, as per a recent report from Arkham Intelligence.

Among these, a notable wallet linked to Ethereum co-founder Vitalik Buterin has over $1 million immobilized for more than seven months. This incident underscores the operational challenges and user interface issues that can arise within the DeFi ecosystem.

GM

There are dozens of accounts with 6-7 figures stuck in bridge contracts, forgotten about.

These include prominent DeFi whales and even an account connected with @vitalikbuterin.

If you’re on this list, you may have misplaced a few million dollars.

Don’t worry – it happens. pic.twitter.com/YaLb5pjtzF

— Arkham (@ArkhamIntel) April 22, 2024

DeFi bridges are essential for enabling asset transfers across different blockchain platforms, facilitating interoperability and functionality in the broader cryptocurrency market. Despite their importance, these bridges vary in their operation, some requiring manual intervention to retrieve funds, which can lead to assets being inadvertently left in limbo if not promptly addressed.

Industry-Wide Issue of Stuck Assets

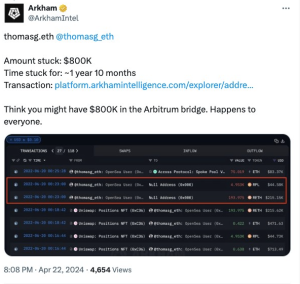

The report from Arkham Intelligence highlights that numerous crypto whale wallets are facing similar predicaments, with assets ranging from six to seven figures stuck on various bridge contracts for extended periods. Some wallets have been in this state for up to two years, including one associated with “thomasg.eth” which reportedly has $800,000 locked on the Arbitrum Bridge for nearly two years.

Additionally, a wallet linked to Bofur Capital contains 27 wrapped bitcoins valued at approximately $1.8 million, which have been stuck for over two years.

These incidents illustrate a broader issue within some segments of the DeFi infrastructure, where the lack of automatic reminders and the requirement for manual retrieval can lead to significant sums being forgotten on bridges. The challenge is further compounded by the technical nature of blockchain and the necessity for users to keep track of their transactions across multiple platforms.

Response from Arkham Intelligence

In response to these findings, Arkham Intelligence has taken proactive steps to notify the owners of these wallets, emphasizing the need to recover their assets. The firm has reached out to individuals and companies alike, including a wallet believed to be owned by Coinbase, which reportedly has $75,000 worth of assets stuck on the Optimism bridge for nearly six months. The situation with Coinbase is a case of a forgotten transfer attempt involving USD Coin converted to Ethereum.

Arkham’s efforts to address these issues highlight the need for enhanced user interfaces and better transaction tracking mechanisms within the DeFi sector. By bringing these instances to light, Arkham hopes to not only aid in the recovery of funds but also to encourage the development of more user-friendly systems that can prevent such occurrences in the future.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us