Cryptocurrency wallet company Tangem is advancing a strategic partnership with Visa to integrate self-custody with mainstream payment systems.

This collaboration aims to introduce a new hardware wallet technology that seamlessly merges with Visa payment cards, setting a new standard for facilitating transactions in the digital currency realm.

Tangem’s Recent Achievements and Innovations

The new product, expected to be available under the Tangem brand by the end of the year, represents a significant innovation aimed at enhancing user convenience and security in digital asset transactions.

Andrey Lazutkin, Chief Technology Officer at Tangem, highlighted the company’s recent achievements which include obtaining certification from Visa and securing a patent for their novel payment technology.

This technology, approved by Visa in February 2022, supports Tangem Pay, a new payment solution allowing users to spend cryptocurrency directly from their self-custodial wallets.

Transactions can be conducted at physical merchant payment terminals or through online payment systems, making digital currencies more accessible and practical for everyday use.

The innovative Tangem Pay is rooted in smart contract technology and designed to operate seamlessly with any self-custodial wallet, importantly, without requiring a seed phrase.

Lazutkin elaborated that the initial rollout of this technology would provide a business-to-consumer (B2C) solution open to all wallet users as a “standard Web3 service.” This approach not only democratizes access but also extends Tangem’s reach beyond its own user base.

Expanding further, Tangem plans to develop a software-as-a-service (SaaS) platform. This ambitious move will allow other wallets to issue cards under their brand, potentially transforming the landscape of digital payments.

According to Lazutkin, this expansion will enable banks to integrate cryptocurrency solutions into their traditional product lines and will allow blockchains to evolve into fully functional payment platforms.

Lazutkin also stressed the interoperability of Tangem Pay, noting that it could be connected to any digital wallet, including prominent ones like MetaMask, Ledger, and Trust Wallet.

He assured that if the Tangem Pay card is lost or damaged, users could still access their accounts through the main wallet interface. This feature underscores Tangem’s commitment to security and continuous access, ensuring that users can manage their digital assets without interruption.

Visa’s Crucial Role in the Partnership

Visa’s role in this partnership is crucial, as pointed out by Cuy Sheffield, the head of crypto at Visa. Sheffield expressed strong support for the initiative, viewing the collaboration as pivotal for the future of payments.

He is optimistic about working with Tangem to facilitate effortless digital currency transactions, emphasizing that these solutions are designed with robust security measures to safeguard user assets.

The Tangem Wallet itself, launched in 2021, is a testament to Tangem’s innovative approach to digital asset storage. The wallet, which resembles a card, is a self-custodial cold wallet that allows users to store cryptocurrencies like Bitcoin.

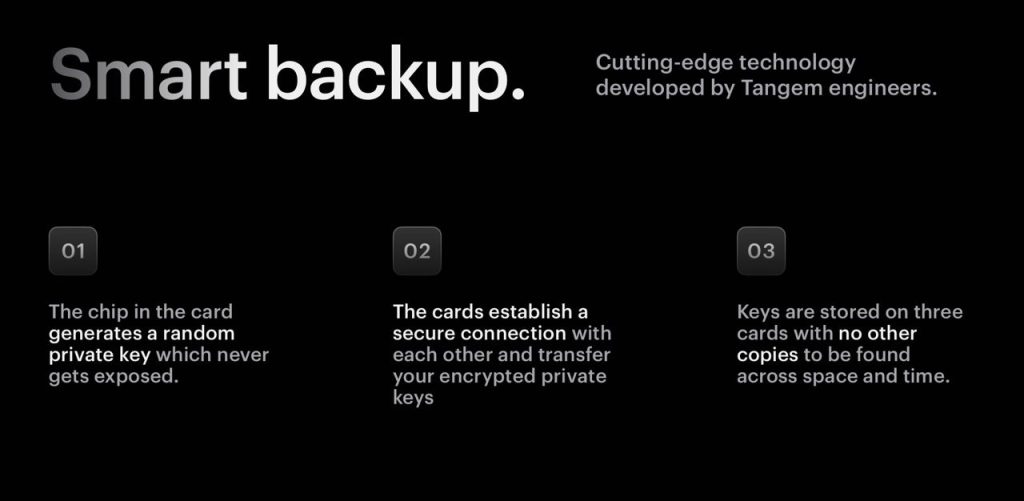

Users can choose between using a seed or a seedless activation method for their wallet, with the company noting that 80% of activations occur without a seed phrase, utilizing Tangem’s smart backup technology.

Each Tangem Wallet can be linked to up to three identical Tangem cards, providing redundancy and ease of access similar to having multiple keys to a room. This feature enhances the flexibility and security for users, accommodating various user preferences and scenarios.

Global Reach and Future Prospects

Since its inception, Tangem has produced over one million cards and currently serves users in at least 160 countries. Plans are underway to expand these services into new jurisdictions, signaling Tangem’s commitment to broadening the accessibility and usability of cryptocurrencies worldwide.

Tangem’s collaboration with Visa represents a significant leap forward in bridging the gap between traditional banking and the burgeoning world of digital assets.

By making cryptocurrencies more accessible and secure, Tangem and Visa are setting new benchmarks in the financial technology sector, paving the way for a future where digital and traditional banking coexist seamlessly.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us