Defunct crypto exchange, Mt. Gox, might be gearing up for another set of creditor repayments as it has been spotted moving small amounts of Bitcoins in several transactions. The timing and number of these transfers are particularly noteworthy as it comes a few days after the alleged ‘brute force attack’ attempt on users’ accounts.

Not only has the latest transfer caught market attention, but it has also raised speculations about the potential impact a possible repayment distribution will have on the price of Bitcoin given that the coin is currently witnessing a marginal price uptick.

Mt. Gox Moves 0.16 BTC to Internal Wallets

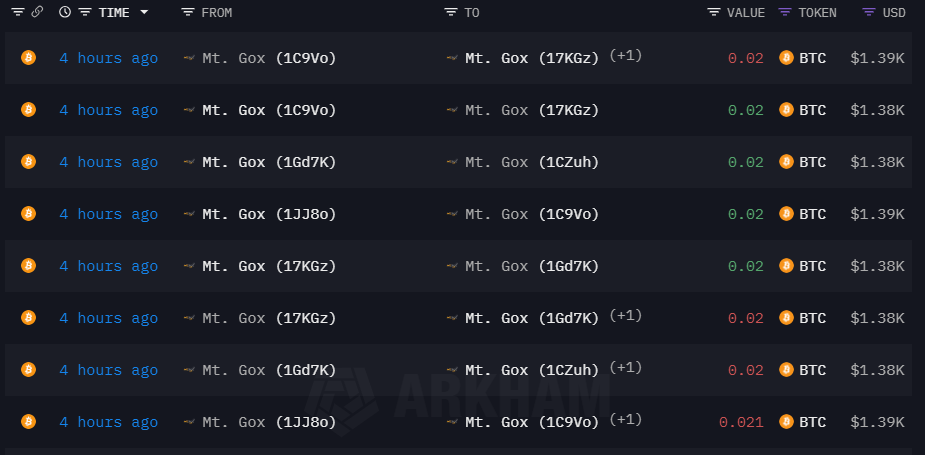

In the early hours of today, Arkham Intelligence, a sophisticated blockchain analytics platform, reported that the former exchange company has made about eight transactions, moving $0.02 BTC (approximately $1.38k) per transfer to several internal wallets. These transfers have been viewed by observers as a possible precursor to larger transfers intending to continue their creditor’s repayment plan. The total amount of Bitcoins moved amounted to 0.16 BTC, valued at about $11,040

This is not the first time Mt. Gox has moved small amounts of BTC. About six days ago, the failed exchange shifted the same $0.02 BTC to internal cold wallets right before it moved several large amounts to repayment addresses. Hence, observers believe that the recent transfers could mirror the just-mentioned ones. At the time of writing, Arkham Intelligence data show that Mt. Gox still holds about 90.3k BTC, worth $6.09 billion.

On July 18, Mt. Gox creditors took to the ‘r/mtgoxinsolvency’ subreddit to complain about several unauthorized failed login attempts on their accounts. At the time, some users shared screenshots of the automatic login notification sent to their email. Following the attempts, the rehabilitation website has been down for maintenance.

Will Bitcoin Price Drop Following Mt. Gox Repayment

Since the announcement of the commencement of the scheduled repayments, Bitcoin investors have expressed their worries about the potential impact this could have on the market. Some speculate that the majority of the creditors who receive their repayments will go on to sell off their holdings which could trigger FUD and cause the price of the coin to crash as low as $45k. However, several experts and analysts urged investors to remain calm, stressing that Bitcoin can withstand the selling pressure if it comes to that.

Over the past week, the price of the flagship cryptocurrency, Bitcoin, has seen improved performance in its movements. According to fresh data, Bitcoin is now trading at $67,357, representing a 0.79% increase in one day. In the weekly and monthly charts, BTC has gained 7.70% and 4.80% respectively. At this time, it is difficult to predict what the outcome will be following the next batch of repayments, however, crypto participants are closely observing.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us