Cryptocurrency data aggregator CoinGecko recently disclosed a data breach affecting its third-party email management service, GetResponse. This incident, confirmed on June 5, led to unauthorized access and export of personal information for over 1.9 million users from CoinGecko’s database.

Compromised Data and CoinGecko’s Reassurance

The breach was a result of a compromised account belonging to a GetResponse employee, which was first brought to light in a company announcement on June 7.

The compromised data included users’ names, email addresses, IP addresses, locations of email opens, and other metadata such as sign-up dates and subscription plans. Despite this breach, CoinGecko assured its users that their accounts and passwords remained secure and uncompromised.

CoinGecko disclosed that while their main email domain remained secure, the attackers managed to send 23,723 phishing emails. The phishing emails were sent from another GetResponse client’s account, identified as alj.associates.

These phishing attacks aim to steal sensitive information such as cryptocurrency wallet private keys. Some attacks, known as address poisoning scams, trick investors into sending funds to fraudulent addresses resembling those they have previously interacted with.

Hakan Unal, a senior blockchain scientist at on-chain security firm Cyvers, advised users to double-check the authenticity of emails and ensure two-factor authentication (2FA) is enabled on all crypto platforms.

He emphasized the immediate risk to individuals receiving these compromised emails and recommended robust verification and security measures to safeguard against such phishing attempts.

Rising Threat of Phishing and Private Key Leaks

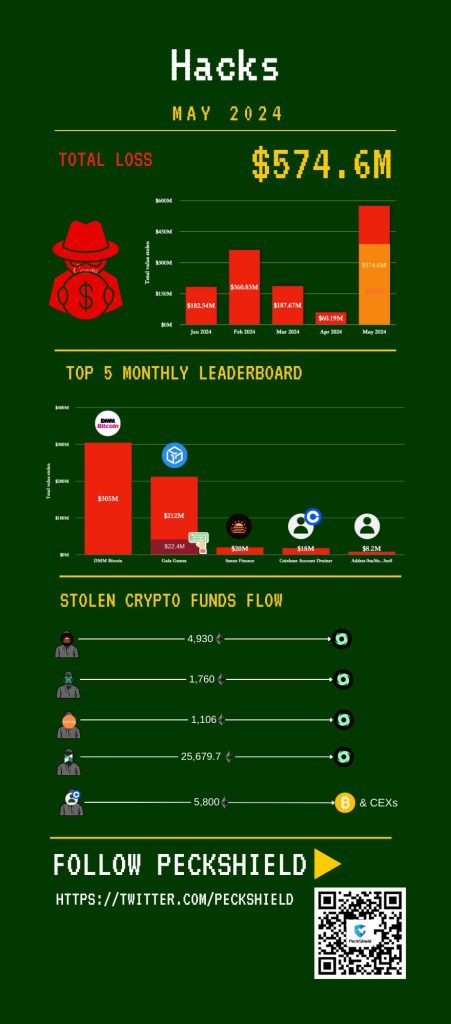

In the first quarter of 2024, hackers stole digital assets valued at $542.7 million, a 42% increase compared to the same period in 2023. Mriganka Pattnaik, co-founder and CEO of crypto risk and intelligence platform Merkle Science, noted that hackers continually shift their attack vectors and seek easier targets.

He highlighted that while smart contract vulnerabilities remain a concern, hackers increasingly target areas outside smart contracts, such as private key leaks. These leaks, often due to phishing attacks or insecure storage practices, have resulted in significant losses.

Phishing attacks, specifically designed to steal sensitive information like crypto wallet private keys, continue to pose a severe threat. Address poisoning scams, another form of phishing, aim to deceive investors into sending funds to fraudulent addresses resembling legitimate ones they have interacted with previously.

In May, a high-profile phishing attack resulted in a trader losing $71 million worth of cryptocurrency. The attacker managed to deceive the trader into sending 99% of their funds to the attacker’s address.

Interestingly, the unknown thief returned the $71 million to the victim over a week later, after the incident attracted the attention of blockchain investigation firms and the attacker’s location was eventually identified.

Decline in Smart Contract Vulnerabilities

Historically, smart contract vulnerabilities were among the most targeted infrastructures by hackers. However, the Merkle Science 2024 HackHub report revealed a significant decrease in funds lost to smart contract vulnerabilities, dropping 92% to $179 million in 2023, down from $2.6 billion in 2022.

This shift indicates that private key and personal data leaks have become the primary reason behind cryptocurrency-related hacks.

Private key leaks remain the biggest vulnerability in the crypto space. According to Merkle Science’s 2024 HackHub report, over 55% of hacked digital assets were lost to private key leaks during 2023.

Pattnaik reiterated that the rapid increase in losses due to private key leaks is the most significant security concern. He explained that hackers may be looking for easier targets requiring less technical knowledge to exploit, such as stealing private keys.

In response to these evolving threats, the cryptocurrency community is urged to enhance security measures. This includes enabling multi-factor authentication, regularly updating security protocols, and educating users about the risks associated with phishing attacks and private key leaks.

The recent CoinGecko breach serves as a stark reminder of the persistent threats in the cryptocurrency space and the need for vigilant security practices to protect valuable digital assets.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us