On Wednesday (April 24), Fireblocks, a cryptocurrency custodian, unveiled two new products designed to enhance DeFi protection and security for institutional participants in the decentralized finance market. The dApp Protection and Transaction Simulation tools are engineered to safeguard institutions from scammers, phishing sites, and compromised decentralized applications (dApps).

These products provide a rigorous examination of dApps across more than 40 blockchains, employing WalletConnect, Fireblocks’ browser extension, and MetaMask Institutional. This initiative by Fireblocks aims to mitigate the risks associated with engaging suspicious smart contracts and bolster the overall safety of DeFi transactions for institutional users.

According To Fireblocks, DeFi Protection Has Never Been More Critical

Since December of last year, Galaxy and FlowDesk have been beta testing two new products that have recently been launched to enhance the security of decentralized applications (dApps) on more than 40 blockchains. These applications are now able to utilize Fireblocks’ APIs, including WalletConnect and MetaMask Institutional, to conduct safety checks on dApps. Fireblocks emphasized the critical need for proactive security measures in the rapidly growing DeFi sector in a blog post published on Wednesday.

We're thrilled to launch the latest proactive security features as part of Fireblocks DeFi suite: dApp Protection and Transaction Simulation!

These new threat detection and transaction clarity capabilities are designed to defend against evolving on-chain threats, providing:…

— Fireblocks (@FireblocksHQ) April 24, 2024

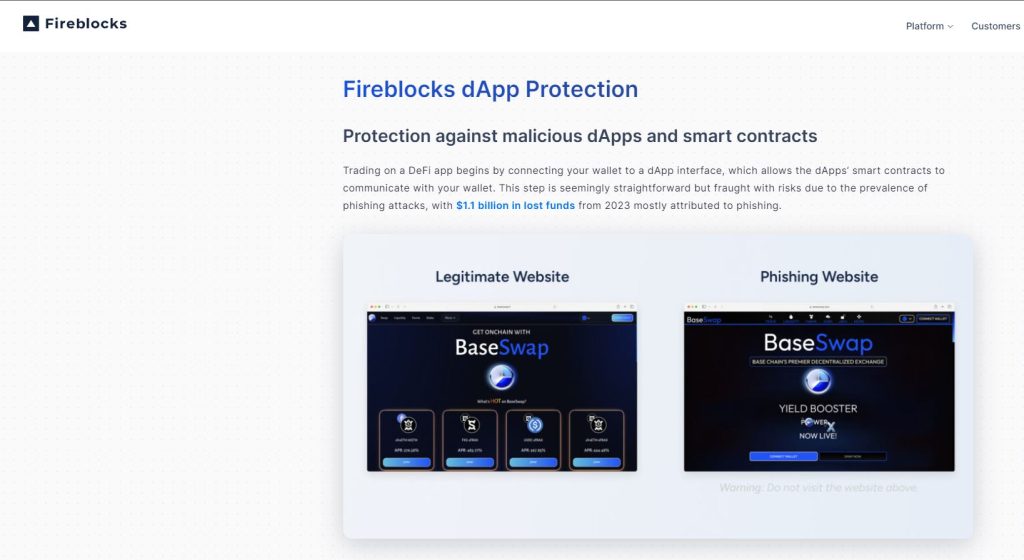

The expansion of the DeFi sector over recent years has been accompanied by an increase in funds lost to hacks and scams, as criminals devise more sophisticated smart contract tools to defraud users of their digital assets. Data from Chainalysis indicates that the amount stolen from DeFi hacks decreased from $3.1 billion in 2022 to $1.1 billion in 2023. Despite this decline, CertiK’s data shows a resurgence in thefts, with losses amounting to $500 million in the first quarter of 2024 alone, driven by phishing websites, dApp takeovers, and supply chain attacks.

Fireblocks’ DeFi Protection Tool Provides Real-Time Threat Detection Alerts

The complex and often opaque nature of contract calls in the DeFi sector demands that users have access to automated tools to detect malicious or deceptive smart contracts before engagement. While a few Fireblocks customers maintain their own internal Web3 security teams, the majority do not possess the resources necessary to employ cybersecurity experts to manage these challenges effectively.

To address these challenges, Fireblocks has introduced a dApp and DeFi protection tool that offers real-time threat detection alerts. This tool warns users before they interact with phishing websites or potentially compromised decentralized applications. Additionally, Fireblocks provides a transaction simulation feature, which previews the estimated change to a user’s token balance resulting from a smart contract interaction before the transaction is executed.

Andrew Taubman, Deputy Chief Operations Officer at Fireblocks, highlighted the importance of these tools, stating that deploying on-chain trading strategies introduces new security considerations. He noted that Fireblocks’ dApp Protection and Transaction Simulation features are essential for staying ahead of evolving on-chain threats and providing transparency in the transaction approval process.

The DeFi sector is witnessing significant growth, with the total value locked in DeFi protocols surging from $54 billion at the beginning of 2024 to $94 billion today, according to DeFiLlama. This increase underscores the growing enthusiasm in the broader crypto markets.

Moreover, during a March webinar, experts from Chainalysis raised concerns about potential security threats. They suggested that hackers could increasingly use artificial intelligence and large language models (LLMs) to identify vulnerabilities in smart contracts, potentially leading to more DeFi-related crimes.

Experts Say That New Crypto Users Shouldnn’t Rush Into DeFi

The growing concerns about security in the cryptocurrency space have not dampened the overall user growth, with a report from Crypto.com indicating that the number of crypto users surged to approximately 580 million by December 2023, marking a 34% increase since January of the same year. Despite the prevalence of hacks, experts in crypto security are guiding new entrants on how to navigate this market safely.

Luciano Ciattaglia, the director of services at cybersecurity firm Hacken, advises newcomers to steer clear of decentralized finance (DeFi) and decentralized exchanges (DEXs) initially. He emphasizes the majority of digital asset holders rely on centralized exchanges and wallets, which he views as a safer starting point due to their established trust and reliability in handling user funds. Ciattaglia also highlights the importance of choosing platforms with a strong security track record and robust fund availability.

Echoing Ciattaglia’s advice, Ronghui Gu, co-founder of CertiK, also recommends that new investors prioritize security by opting for reputable exchanges and wallets. Gu advocates for the adoption of hardware wallets, which provide enhanced security by storing private keys offline, thereby reducing the risk of online hacking attempts. He stresses the importance of new users educating themselves about key aspects of crypto security, such as secure private key management, the use of strong passwords, and enabling multifactor authentication across all crypto-related accounts.

Additionally, Gu warns new entrants about the risks of sharing personal information online and advises vigilance against phishing scams. His recommendations aim to fortify the security framework for individuals venturing into the digital asset space, ensuring they are well-prepared to protect their investments against potential threats.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us