The Bitcoin decentralized application (DApps) ecosystem is witnessing a resurgence, driven by the advent of native protocols such as Ordinals and Inscriptions. Amid this revitalization, the omnichain yield-generating protocol SolvBTC has made significant strides.

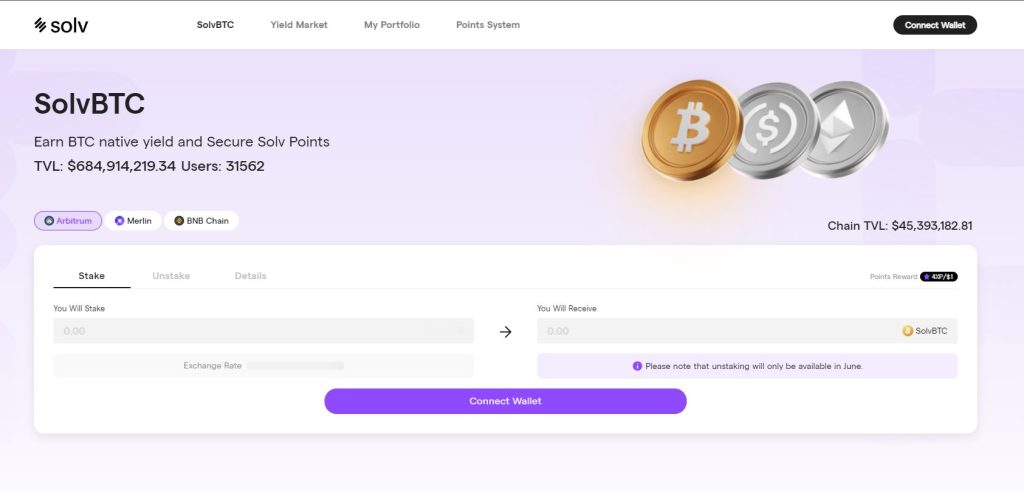

It has secured a total value locked (TVL) of $700 million, with its yield-bearing Bitcoin offerings on Arbitrum, Merlin, and BNB Chains capturing the interest of the market. According to developers, SolvBTC recently achieved a milestone with over 10,000 BTC staked and drew in more than 92,000 participants shortly after its launch this month.

SolvBTC: Bridging Bitcoin and DeFi Through DApps

SolvBTC’s founder, Ryan Chow, highlighted the protocol’s role in the broader Bitcoin financial ecosystem, suggesting that enhancing liquidity is crucial for the sector’s growth. He also revealed plans to expand SolvBTC’s reach by launching on additional networks and bridging connections between Bitcoin users, chains, and protocols.

The protocol employs Bitcoin as collateral to source staking and decentralized finance (DeFi) yields from various blockchains, including Ethereum and BNB Chain, projecting annual returns of 5% to 10% for its users.

BEVM, a Layer-2 Solution Launched in March 2024, Has Garnered Attention

The Bitcoin layer-2 solution BEVM, which commenced operations with its mainnet on March 28, has attracted significant attention. Having rapidly grown to over 700,000 user addresses and hosting more than 30 ecosystem projects, BEVM recently received an investment from the Chinese Bitcoin mining rig manufacturer Mitmain.

Gavin Guo, a core builder at BEVM, announced plans to delve into the exploration of Bitcoin’s hash rate and proof of work (PoW) ecosystem applications on BEVM. This initiative aims to facilitate the migration of PoW hash rate assets and a considerable amount of Bitcoin to the platform. BEVM, built on the Taproot consensus, uses Bitcoin for gas fees and powers its cross-chain and liquidity provision platforms, currently valued at $200 million.

Simultaneously, the Bitcoin decentralized exchange (DEX), Orders Exchange, and sidechain MicroVisionChain disclosed their 2024 roadmap, which includes integrating with Web3 wallets from two major exchanges and developing a marketplace for Bitcoin non-fungible tokens. Orders Exchange has also integrated with the Bitcoin Runes protocol to support the issuance of fungible tokens and constructed a Bitcoin asset bridge with MicroVisionChain, enabling the swapping of BRC-20 tokens.

Despite Recent Market Downturns, the Bitcoin Ordinals Market Has Expanded to a Valuation of $2.3 Billion

The growth was propelled by ecosystem developments, a surge in memecoin interest, and listings on significant exchanges like Binance. Notably, BRC-20 tokens achieved a market capitalization of $1 billion on May 9, 2023, soon after their creation, underscoring the vibrant growth within the Bitcoin DApp sector.

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- 10 Best Meme Coins To Invest in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us