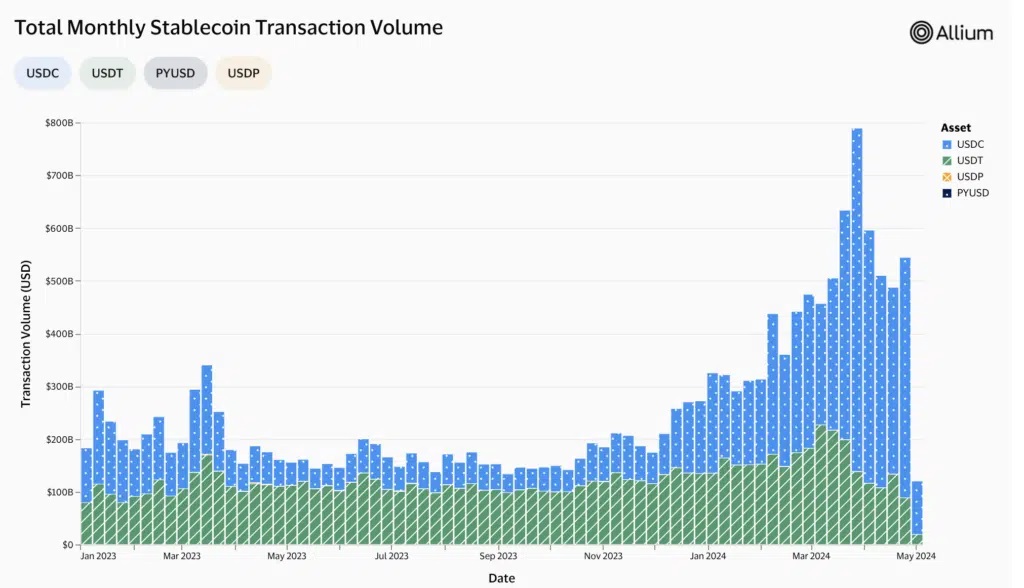

In a significant development in the stablecoin market, the Circle stablecoin USDC has outstripped Tether’s USDT in terms of transaction volume.

According to data from Visa, which was released in collaboration with Allium Labs on April 29, USDC’s transaction volume reached $455.5 billion last week, far surpassing USDT’s volume of just over $88.5 billion.

Despite The Increase In USDC Transaction Volume, Tether Is Still The Dominant Force In The Stablecoin Market

Recent data analysis reveals that Circle’s USDC stablecoin has been significantly expanding its presence in the stablecoin market. Since January, USDC has captured half of the total stablecoin transaction share. Although the specific causes for USDC’s increased transaction volume were not detailed in the report, its growth can’t be ignored.

Despite USDC’s impressive performance, Tether continues to lead the stablecoin sector. USDT holds a dominant 68% market share with a market capitalization exceeding $100 billion. Crypto analyst Noelle Acheson provided Bloomberg with insights, noting the geographical preferences for these stablecoins: USDT is predominantly utilized outside the United States as a dollar-based store of value, while USDC is more commonly used within the U.S. for transactions.

Stablecoin USDC Will Leverage The Support Of Giants In The Payments Sector

The digital payment sector is seeing a notable rise in the adoption of stablecoins, particularly USDC, driven by several key developments. Stripe, a significant player in online payment systems, has re-introduced cryptocurrency payments, emphasizing the USDC stablecoin. This integration is scheduled for rollout in the summer of 2024. This move by Stripe aligns with actions from other major firms like PayPal, which has launched its own stablecoin PYUSD, and Shopify, which now accepts payments in stablecoins, signifying a broader shift toward mainstream acceptance of these digital assets.

In another significant development, Binance has converted its $1 billion Secure Asset Fund for Users (SAFU) into USDC. This conversion, completed on April 18, aims to enhance the fund’s reliability and stabilize its value against market fluctuations.

Amid these industry shifts, the US Congress is actively considering legislation specific to stablecoins, which could further accelerate their adoption by establishing a more defined regulatory framework. This potential legislative progress suggests that stablecoins like USDC may continue to gain traction in financial transactions.

The Stablecoin Market Seems To Be On The Spotlight This Year

Visa is actively working to track transactions involving stablecoins, which are typically pegged to the dollar, at a time when regulators in both the United States and Europe are intensifying efforts to oversee this segment of the cryptocurrency market. This initiative aligns with global regulatory movements aiming to mitigate risks associated with digital currencies.

In the United Kingdom, Economic Secretary Bim Afolami recently disclosed that the British government is drafting legislation to regulate stablecoins along with crypto staking, exchanges, and custody services. This new regulation, expected to be introduced by mid-year, will for the first time bring activities such as operating an exchange and taking custody of customer assets under regulatory oversight. The government had previously announced plans to bring fiat-backed stablecoins under the regulatory frameworks of the Bank of England, Financial Conduct Authority, and Payment Systems Regulator to minimize customer harm and address potential risks, especially when stablecoins are used for payments.

Simultaneously, in the United States, Senators Kirsten Gillibrand (D-N.Y.) and Cynthia Lummis (R-Wyo.) have proposed legislation that would impose strict requirements on stablecoin issuers, including maintaining one-to-one reserves and prohibiting both unbacked algorithmic stablecoins and their illicit use. The proposed law aims to establish both state and federal regulatory frameworks for stablecoin issuers, supporting the existing dual banking system. This marks the third attempt by the senators to introduce rules for crypto regulation since 2022

The Lummis-Gillibrand Act Still Has A Few Challenges Ahead

The legislative process faces significant challenges, as noted by Seiberg, who heads TD Cowen’s Washington Research Group, including securing ongoing support from the White House and integration into a larger legislative package. According to Seiberg, the negotiations between House Financial Services Chair Patrick McHenry and Representative Maxine Waters are likely to provide the foundation for the final draft of the bill. He believes that the Lummis-Gillibrand bill would benefit stablecoin issuers by setting clear regulatory guidelines, marking a symbolic victory for the broader cryptocurrency sector as it would represent the first proactive crypto legislation from Congress.

Despite these legislative efforts, stablecoins could continue to prosper even without specific actions from the U.S. Congress. They have gained popularity as an alternative to unstable currencies in various countries, providing a more stable dollar substitute, highlighted by Timothy Massad, former chairman of the Commodity Futures Trading Commission. He also pointed out that the inclusion of stablecoins within the U.S. regulatory framework would be preferable to exclusion, suggesting a broader recognition of the need for formal oversight within the financial system.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us