Last week, the crypto market saw significant activity, with $130 million flowing into crypto investment vehicles, primarily in the United States, which accounted for the bulk of inflows totaling $135 million.

This marked a pivotal moment as Grayscale, a major player in the digital asset management space, experienced its lowest weekly outflows since January, amounting to $171 million. Switzerland also witnessed a boost in crypto investments with inflows reaching $14 million.

Regional Investment Trends in The Crypto Market

In Asia, Hong Kong stood out with $19 million in inflows, coming off a week of record-setting investment figures, largely attributed to seed capital following the debut of Bitcoin ETFs. On the other hand, Canada and Germany reported outflows of $20 million and $15 million, respectively, contributing to a cumulative outflow of $660 million for the year to date. This downturn in investment was echoed by a significant drop in ETF trading volumes, which plummeted from a weekly average of $17 billion last month to $8 billion, signaling a cooling interest in crypto ETFs.

In the United States, regulatory interactions, or the lack thereof, between the Securities and Exchange Commission (SEC) and ETF issuers regarding a potential spot Ethereum ETF stirred crypto market speculation. This uncertainty led to $14 million in outflows from Ethereum-related products, underscoring investor caution amidst regulatory ambiguity.

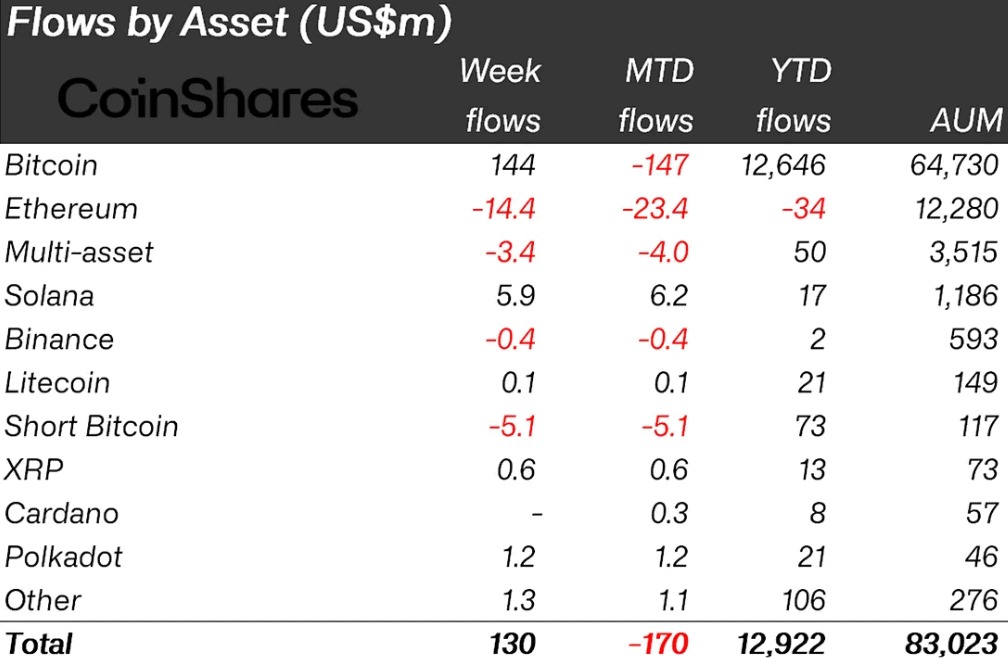

Bitcoin, however, bucked the trend by attracting $144 million in inflows, rebounding from a previously weak performance. Concurrently, short-bitcoin exchange-traded products (ETPs) saw outflows of $5.1 million, totaling $18 million over the past eight weeks, indicating a shift in investor sentiment towards Bitcoin.

Ethereum Faces Regulatory Hurdles

CoinShares highlighted the growing regulatory uncertainties impacting Ethereum investment products. The SEC’s hesitance to respond to applications for a spot Ethereum ETF has fueled doubts about the timely approval of these products. This skepticism was further reinforced by the SEC’s delay in ruling on related matters, heightening concerns that approval might not be forthcoming.

The Bitcoin halving event, a significant occurrence in the cryptocurrency sector, encouraged more efficient operations and capital deployment, presenting lucrative opportunities for well-capitalized miners to scale up their operations. Despite the crypto market’s overall retracement, Bitcoin continued to draw investor interest, a sentiment that was not mirrored by Ethereum, the second-largest crypto asset by market cap, which experienced a further $14 million in outflows.

James Butterfill, an analyst at CoinShares, linked the outflows from Ethereum to the ongoing regulatory scrutiny in the U.S. He noted that enforcement actions against Ethereum-related entities such as Consensys and Uniswap, along with broader actions against platforms like Robinhood, have solidified concerns regarding the regulatory landscape.

Meanwhile, prominent Bitcoin advocate Michael Saylor has expressed views that align with the SEC’s historical skepticism towards Ethereum and other altcoins, suggesting they might be considered unregistered securities. This stance has contributed to the uncertainty surrounding Ethereum’s classification as either a commodity or a security.

Looking Forward: Legislation and Innovation

Experts are now eyeing legislative developments, with potential bills and proposals in Congress that could clarify regulatory oversight of the cryptocurrency industry. These legislative actions, alongside significant events such as the launch of Runes Protocol on Bitcoin and shifts in miner focus towards AI computing due to declining revenues, are expected to influence the trajectory of Bitcoin and the broader crypto market.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us