Recent transactions involving significant bitcoin amounts by the U.S. government have made waves in the digital currency markets.

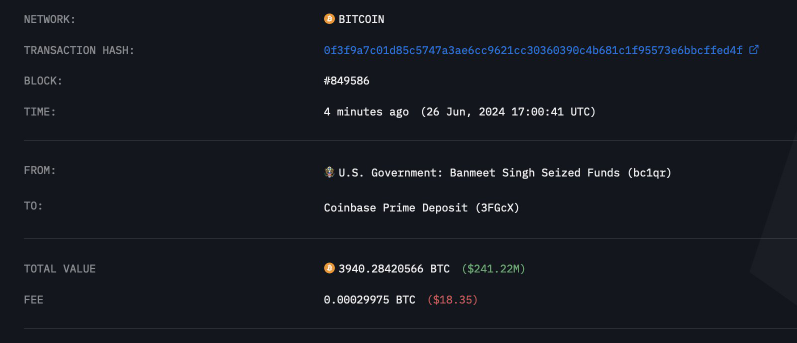

On-chain analysis by Lookonchain revealed that a wallet associated with the U.S. government recently transferred approximately 3,940 bitcoins, valued at about $241 million, to the cryptocurrency exchange Coinbase.

The U.S. as a Major Bitcoin Holder

This sizable movement followed disclosures that these bitcoins had been initially seized from Banmeet Singh, an Indian national who, in 2024, was convicted of distributing controlled substances and money laundering. At the time of forfeiture, these cryptocurrencies were valued at roughly $150 million.

The U.S. is one of the largest bitcoin holders globally, possessing 213,546 bitcoins, valued over $13 billion at current market prices, as reported by Bitcoin Treasuries.

This substantial holding reflects a common practice among governments to liquidate cryptocurrencies acquired through criminal investigations or asset seizures.

A notable instance of this was in 2014 when Tim Draper, a well-known billionaire in the bitcoin community, bought nearly 30,000 bitcoins that had been seized from the Silk Road darknet market by the U.S. Marshals Service.

The recent large-scale transfer to Coinbase Prime has raised concerns among traders about the potential sale of these assets, influencing market dynamics.

Bitcoin (BTC), which had been showing signs of recovery from a previous drop associated with the Mt. Gox issue this week, experienced a downturn.

The cryptocurrency slipped below $61,000 as news of the transfer broke but has since made a slight recovery to $61,100, marking a 1% decrease over the past 24 hours. The broader market reaction also saw Ether declining by 1.6% on the same day.

Germany’s Position in Global Bitcoin Holdings

The German government has also been active in the cryptocurrency market. A wallet linked to the German Federal Criminal Police Office (BKA) was reported to have moved $24 million worth of bitcoin in two transactions to the exchanges Kraken and Coinbase during the European morning hours.

These movements are part of a larger pattern that includes a transfer of another $30 million in BTC to a new wallet, which, as of the last report, has not been identified as associated with any exchange.

In addition, the German government executed transfers amounting to $195 million in BTC to exchanges on June 19 and June 20. Germany stands as the fourth-largest sovereign holder of bitcoin in the world, trailing behind China and Great Britain, with a total of 46,359 coins.

This ranking highlights the strategic position of digital assets within national reserves, indicating the increasing integration of cryptocurrencies into the financial strategies of sovereign states.

These government-related transactions underscore a significant trend where national entities engage actively in cryptocurrency markets, not only influencing trading patterns but also shaping the strategic reserves of digital assets.

Jameson Lopp, co-founder of Casa and a Bitcoin educator, has tracked U.S. government sales of bitcoin and found that it has seized and subsequently sold at least 195,091 bitcoins, amassing over $366 million since 2014.

This demonstrates a proactive approach by governments in managing seized assets in a way that significantly impacts the cryptocurrency ecosystem.

The ongoing activity by the U.S. and German governments in the cryptocurrency market continues to be a critical factor in the market dynamics of Bitcoin and other digital currencies.

These movements, whether for the purpose of liquidation or strategic asset reallocation, are likely to remain a significant influence, potentially guiding market sentiments and trader strategies in the ever-evolving landscape of digital finance.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us