The launch of spot Bitcoin exchange-traded funds (ETFs) in Hong Kong has yielded a muted reception compared to their U.S. counterparts. In their first week following the April 30 introduction, three Bitcoin ETFs in Hong Kong amassed $262 million in assets under management (AUM), primarily from pre-listing subscriptions.

However, they witnessed modest inflows of under $14 million, a stark contrast to the billions that poured into similar U.S. funds earlier in January.

Hong Kong vs. US: A Tale of Two Markets

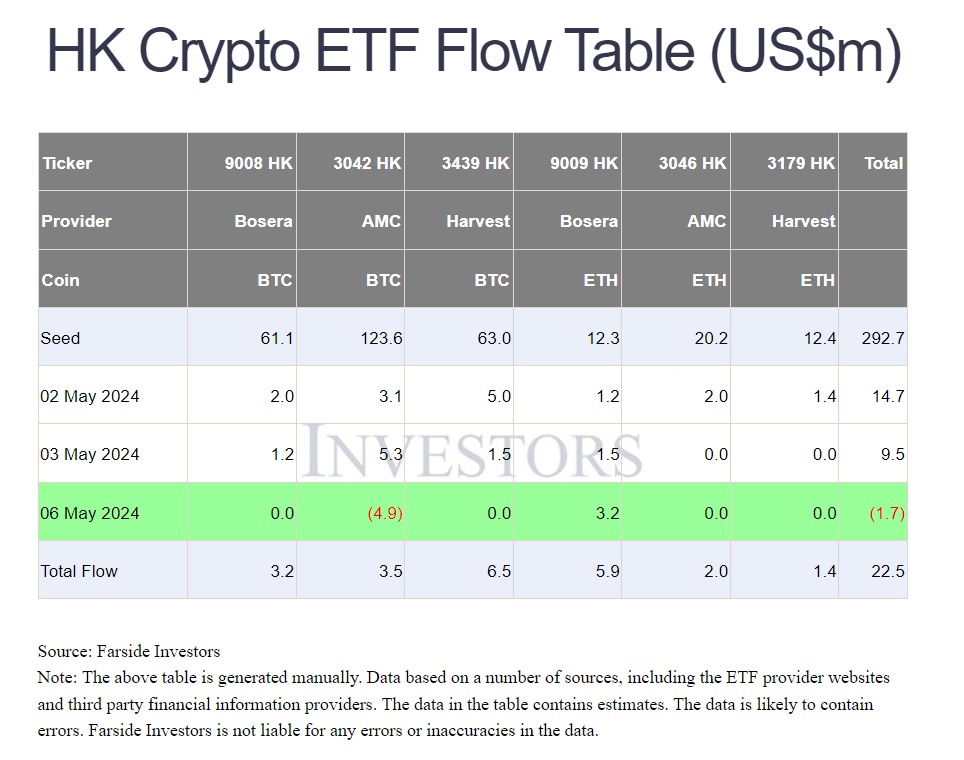

Industry experts at Farside Investors have remarked that the introduction of both Bitcoin and Ethereum ETFs in Hong Kong did not create the same market impact as those in the U.S., suggesting a less significant moment for the Asian financial hub. Alongside Bitcoin, Hong Kong also debuted the world’s first spot Ether ETFs, which similarly underperformed with $54.2 million in AUM and only $9.3 million in inflows by May 6.

Despite these figures, the Hong Kong ETFs present notable advancements over their American counterparts. They are unique in that they are denominated in three different fiat currencies and allow in-kind transfers, enabling investors to buy and redeem units directly with Bitcoin or Ether.

Eric Balchunas, a senior ETF analyst at Bloomberg, noted that although the Hong Kong ETFs’ figures might seem modest in comparison to U.S. standards, when adjusted for market size, their $310 million valuation is proportionately equivalent to a $50 billion valuation in the U.S. market. This highlights their relative significance within the local market context.

The Hong Kong equities sector itself is significantly smaller and more illiquid than that of the U.S., with a total market cap of $4.5 trillion compared to the U.S.’s $50 trillion. The slowdown in mainland China’s economic growth since 2022 has also contributed to the lower liquidity levels in Hong Kong’s market.

High Interest, Restricted Access

Research from the crypto exchange OSL indicates a high level of interest among Hong Kong’s crypto-savvy investors, with nearly 80% planning to invest in the new spot Bitcoin and Ether ETFs. However, access to these assets is restricted; mainland Chinese investors, unless they hold Hong Kong residency, are excluded from participating.

SoSoValue researchers have highlighted additional challenges, including restrictive investor qualifications and the high management fees of the Hong Kong crypto ETFs, which range from 0.85% to 1.99% annually, significantly above the 0.25% average in the U.S. These fees make the ETFs less attractive for institutional investors with long-term views on the crypto market.

Moreover, the potential for mainland funds to access these ETFs through the southbound Hong Kong Stock Connect has been ruled out in the near future, further limiting the participation of mainland Chinese investors. Consequently, transaction volumes have remained low, influenced by these stringent regulations and the lack of accessibility for a significant segment of potential investors.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us