Grayscale Investments, the largest crypto asset manager globally, recently announced a leadership transition. Peter Mintzberg will take over as Chief Executive Officer starting August 15, 2024, and will simultaneously join the company’s Board of Directors.

Mintzberg is set to replace Michael Sonnenshein, who is stepping down to explore new opportunities. Edward McGee, the current Chief Financial Officer, will serve as the principal executive officer until Mintzberg assumes his new role.

Extensive Experience and Educational Background

Mintzberg brings with him a robust portfolio of experience, spanning over two decades in leadership roles at some of the world’s top asset management firms. His career includes significant positions such as Global Head of Strategy for Asset and Wealth Management at Goldman Sachs, as well as strategic and leadership roles at BlackRock, OppenheimerFunds, and Invesco. His extensive experience is supported by his academic credentials—an engineering degree from Universidade Federal Rio de Janeiro and an MBA from Harvard University.

Before joining Grayscale, Mintzberg had been recognized for his leadership and contributions to the finance industry, including being named a Latino leader in Finance by The Alumni Society and being selected as a David Rockefeller Fellow by the Partnership for New York City. His professional journey began at McKinsey & Co., where he focused on the financial services and technology sectors across various global cities including New York, San Francisco, and São Paulo.

Leadership Transition at a Pivotal Time

Barry Silbert, Founder and CEO of Digital Currency Group, Grayscale’s parent company, expressed enthusiasm about Mintzberg’s leadership qualities and his proven track record. Silbert highlighted that Mintzberg’s global expertise and strategic vision are crucial for steering Grayscale into its next growth phase. This transition comes at a time when Grayscale aims to further expand its innovative investment product suite.

Mintzberg himself is excited about his new role, acknowledging Grayscale’s pioneering position in crypto asset management and expressing eagerness to join a team known for its innovation and talent. He believes this period is pivotal for Grayscale as it continues to build on the momentum within the crypto asset class.

Achievements and Challenges

Michael Sonnenshein, the outgoing CEO, joined Grayscale in 2014 and became CEO in 2021. Under his leadership, the company’s assets under management soared from about $60 million to approximately $30 billion. Sonnenshein was pivotal in navigating the company through significant milestones, including a historic court victory against the U.S. Securities and Exchange Commission. This legal triumph allowed Grayscale to list the first spot Bitcoin ETF on NYSE Arca, placing it alongside major traditional financial players.

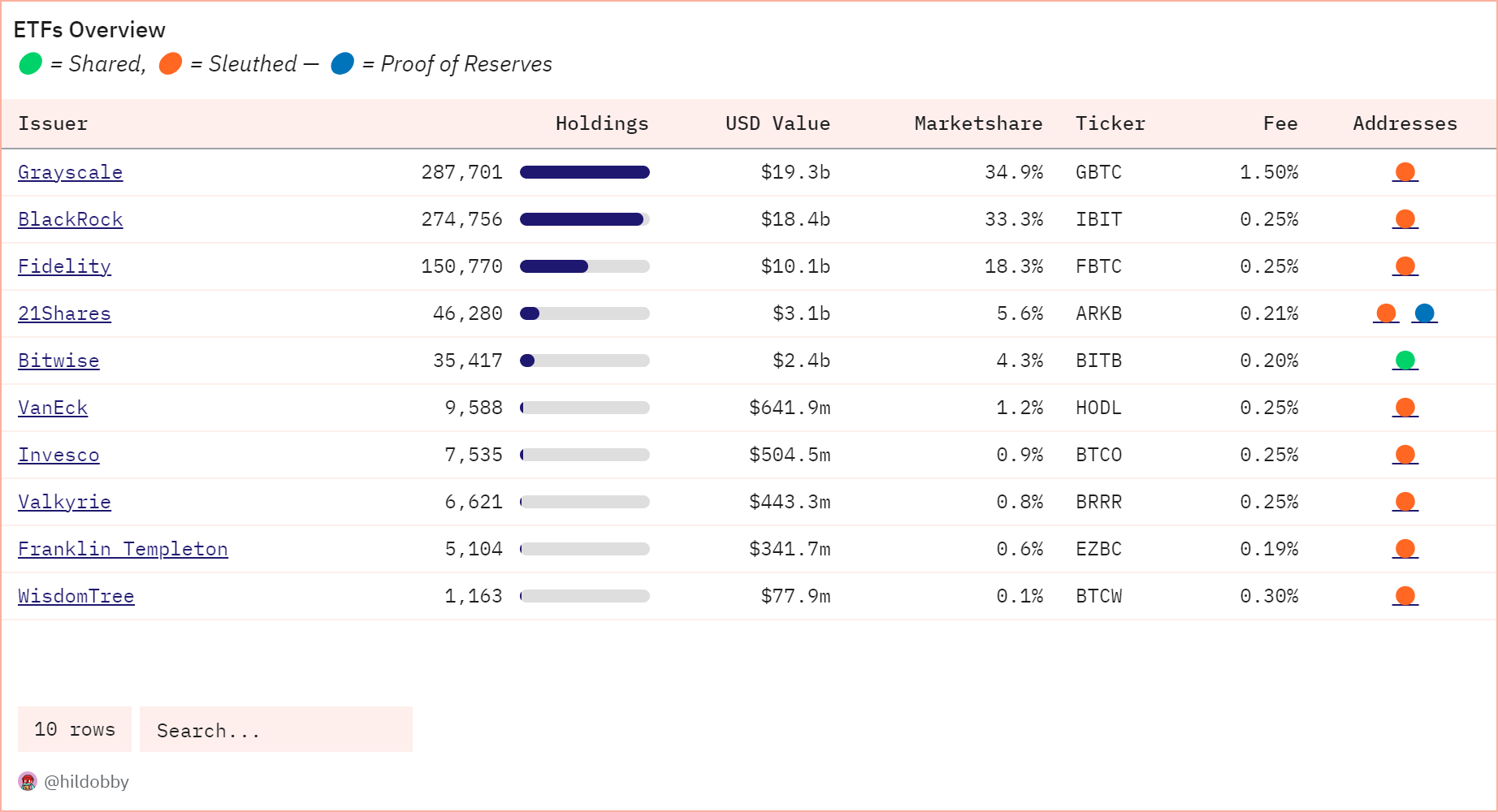

Despite these successes, Grayscale has faced challenges under Sonnenshein’s stewardship, notably the Grayscale Bitcoin Trust (GBTC) experiencing over $17 billion in outflows since its conversion to an ETF in January. This has been attributed to the fund’s relatively high management fees compared to its competitors.

Grayscale’s Broad Impact

The landmark court decision last year marked a significant victory for the crypto industry, clearing the path for the approval of several new Bitcoin ETFs at the start of this year from other investment giants like BlackRock and Fidelity. This was a major achievement in Grayscale’s efforts to integrate crypto assets into the regulatory framework while simultaneously expanding its suite of investment products.

Grayscale’s influence extends beyond just managing assets; it serves as an educational resource, works closely with policymakers and regulators, and strives to enhance public understanding of crypto assets. Over the past decade, Grayscale has launched nineteen crypto investment products, providing investors with regulated, familiar, and transparent access to the burgeoning asset class.

As Grayscale approaches this new chapter, Sonnenshein reflects on his tenure with gratitude, especially appreciating the opportunity to work with visionary partners and a passionate team. He expresses confidence in Mintzberg’s abilities to lead Grayscale towards greater achievements in the ever-evolving crypto landscape.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us