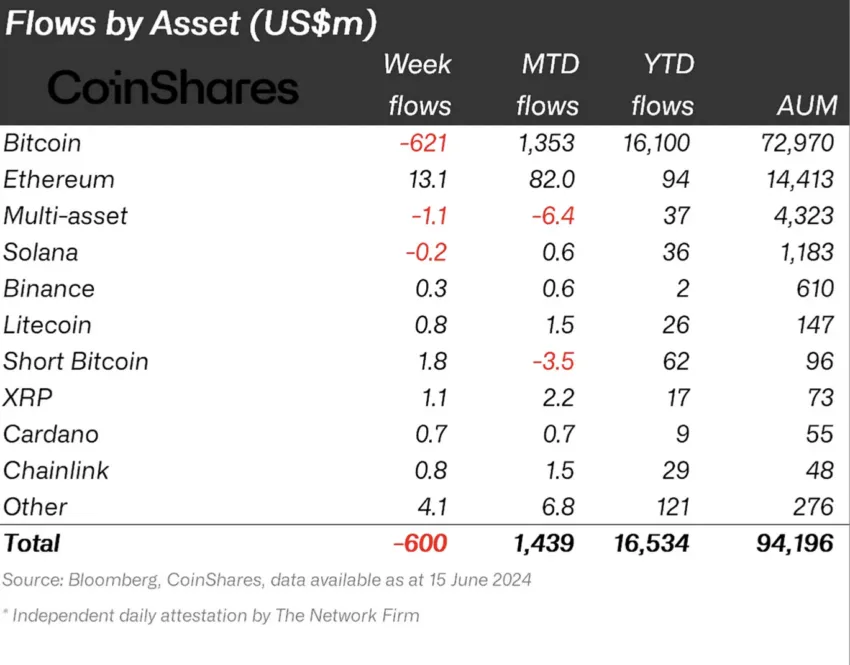

Last week saw a significant retreat from cryptocurrency investments, with digital asset products recording outflows of $600 million—a high not observed since March 22, as detailed in a report by CoinShares.

This departure from cryptocurrencies was predominantly seen in Bitcoin, which experienced outflows amounting to $621 million. In stark contrast, altcoins such as Ethereum (ETH) and Ripple (XRP) registered net inflows of $13 million and $1 million, respectively.

Impact of Federal Open Market Committee (FOMC) Meeting

Analysts at CoinShares attributed this dramatic outflow to the Federal Open Market Committee (FOMC) meeting’s unexpectedly hawkish outcomes, which altered investor expectations and dampened the risk appetite across the cryptocurrency market.

Initially, a softer U.S. Consumer Price Index report on June 12 had buoyed the market, allowing digital assets to recoup some earlier losses. However, the sentiment rapidly shifted following the Fed’s indication that it would not pursue an accommodative policy stance in the near term.

The updated Fed projections, now forecasting fewer rate cuts than previously anticipated, have direct implications for cryptocurrencies, as they suggest less market liquidity and diminished speculative appeal compared to traditional investments.

In terms of geographical distribution, the United States accounted for the majority of the outflows, with investors withdrawing $565 million.

Other countries also experienced withdrawals, with Canada, Switzerland, and Sweden seeing outflows of $15 million, $24 million, and $15 million, respectively. Following these shifts, the total assets under management for cryptocurrencies dropped from over $100 billion to $94 billion within a week.

Despite the general bearishness in the crypto market, Ethereum showed resilience and even growth, with positive net inflows of $13 million. This uptick in Ethereum investments is largely fueled by the anticipation surrounding the potential launch of ETH spot Exchange-Traded Funds (ETFs).

Bloomberg analyst Eric Balchunas provided a speculative timeline for the launch, suggesting that the ETF could be operational by July 2, based on recent light regulatory feedback which might expedite the approval process.

This sentiment was echoed by U.S. Securities and Exchange Commission Chair Gary Gensler, who noted in a Senate hearing that the approval process for these ETFs could conclude over the summer, paving the way for their launch.

Challenges in Corporate Adoption of Cryptocurrencies

Marc Degen, co-founder and chairman of Trust Square, a blockchain-focused technology hub, expressed concerns over the level of corporate engagement with digital assets.

Speaking at the Web3 Corporate Innovation Day, Degen described the corporate adoption of cryptocurrencies as an “utter failure” and akin to “amateur league against the pros.”

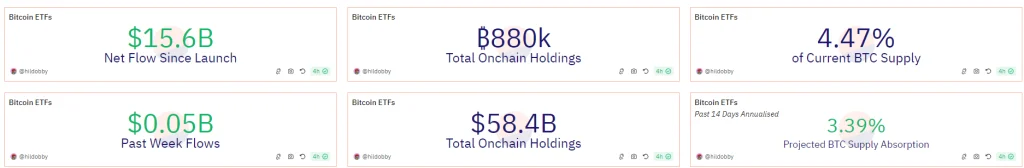

He highlighted the discrepancy between the inflows into the spot Bitcoin ETFs, which stood at approximately $60 to $70 billion year to date, and the inflows managed by traditional finance entities like JPMorgan, which alone has drawn a record $489 billion in net new client inflows in 2023.

Degen emphasized that the slow adoption rate is largely due to a prevailing distrust in the crypto market among mainstream consumers. According to a 2023 study by the Pew Research Center, around 75% of those who are aware of cryptocurrencies do not trust their reliability and safety.

He argued that only with greater corporate involvement could the crypto industry hope to foster a significant degree of trust among mainstream users. The dominance of centralized exchanges (CEXs) over decentralized exchanges (DEXs) underscores this point.

Recent data shows that Binance, the world’s largest centralized exchange, recorded a trading volume of $17.6 billion in the last 24 hours, nearly five times the $3.86 billion handled by all DEXs combined.

The contrasting fortunes of Bitcoin and Ethereum, alongside the variances in regional investment flows and the ongoing debates over corporate adoption, paint a complex picture of the current state of the cryptocurrency market.

As the industry continues to evolve, the engagement of established financial entities and the implementation of regulatory frameworks will play critical roles in shaping its trajectory and broader acceptance.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us