One of the most common arguments against Ethereum as a decentralized blockchain network is the fact that a majority of Ether (ETH) supply is being controlled by a few minorities who participated in the project’s initial coin offering (ICO) in 2014.

A new study of the top 10,000 ETH addresses by Adam Cochran, Partner at Metacartel Ventures, further confirmed the uneven distribution of the cryptocurrency among the top ETH addresses but also argues that the distribution is even when ETH’s primary use case for smart contracts is considered.

Per the research, roughly 17% of the coin (16.6M ETH) is held by the top ten addresses on the network with the top 100 and 1000 addresses holding 37.8M ETH, and 70.7M ETH, respectively

The distribution gets further skewed by the fact that just the 10,000 top ETH addresses account for 91.7M ETH (82%) out of the 110M ETH reportedly in circulation at the time of writing this report. On the other hand, 95.6 million distinct ETH addresses exist according to data from Etherscan.

Yet ETH is evenly distributed

In comparing ETH’s distribution to that of other top cryptocurrencies, including Bitcoin, a section of the research identifies the reason for Ether’s supposed uneven distribution, that is, the coin’s primary use case for deposit in smart contracts.

Given that most Ethereum-based decentralized applications (dApps), including protocols, require such ETH deposits in smart contracts to run successfully, removing coins used for this purpose provides another unique insight into ETH’s distribution.

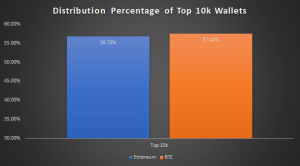

For instance, it would reveal that the top 10,000 ETH addresses would hold only 57.2M ETH. (56.7%), a figure that is slightly less than Bitcoin’s 10.54M BTC (57.44%) for the top 10,000 addresses.

In comparison with other cryptocurrencies too, the study found that 55% of ETH and BTC’s supply distribution between at least 10,000 addresses is unique.

In XRP, just 16 addresses hold 55.2% of XRP. In Bitcoin Cash (BCH) 1100 addresses hold 56.8% of the coin’s circulating supply. In Litecoin 300 addresses hold 54.3% of LTC, while for Tron (TRX) 1031 addresses hold 51.1% of TRX.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us