Crypto whales are individuals or institutions that own a significant quantity of a particular cryptocurrency. The title also applies to funds capable of making large purchases of a crypto asset either before it becomes publicly available or after it.

Just as mammalian whales can create waves that affect fish in the ocean, the actions of crypto whales can potentially affect crypto traders in the market too. It, therefore, becomes necessary for investors to know how the actions of crypto whales affect them.

This guide covers the following topics:

- Who Are Crypto Whales?

- How Do Crypto Whales Make Money?

- How Much Do You Need to Become a Crypto Whale?

- Are Crypto Whales Buying or Selling?

- What is Crypto Whale Tracking?

- Tools You Can Use to Follow Crypto Whales

- Conclusion

Who Are Crypto Whales?

Crypto whales are individuals or institutions that have large units of a particular cryptocurrency. Whales are key players in the crypto market because their buy or sell actions can either cause an increase or decrease in the price of the underlying cryptocurrency. The term also refers to anyone with funds large enough to make astronomical deals on the market.

To illustrate, imagine Bob owns 25% of the total supply of a particular cryptocurrency. If Bob sells most of the cryptocurrency, a price decline of the asset will ensue. On the other hand, if Bob buys a large quantity of a particular cryptocurrency at once, the cryptocurrency’s price will increase.

Crypto whales also exist in the non-fungible tokens (NFT) market. Most NFTs belong to a collection. So any entity with many NFTs under the same project can make trades that can impact the floor price of that token. The floor price is the minimum price an NFT can sell for on the market.

The idea of crypto whales is not new. It is applicable in traditional markets such as the stock market. If a high-net-worth individual such as Warren Buffett or Charlie Munger reveals investment in a specific stock, the asset’s price will record upticks. The exact opposite occurs when they sell off investments in a particular stock.

How Do Crypto Whales Make Money?

Crypto whales make money from buying or selling in large volumes. These occur through a buy wall and a sell wall.

Buy Wall

A buy wall refers to a large buy order or a group of large buy orders within the same price range on the order book of a particular crypto asset. Whales typically use buy-wall orders to increase a cryptocurrency’s price, as it creates the impression that there is a high demand for the asset.

Sell Wall

A sell wall refers to a large sell order or group of large sell orders with the same price on the order book of a particular cryptocurrency. When crypto whales want to take a position in a cryptocurrency and consider its price too expensive, they can set up sell walls. It helps to bring down the asset’s price, making it cheaper for the whale(s) to buy.

How Much Do You Need to Become A Crypto Whale?

Being called a crypto whale varies from cryptocurrency to cryptocurrency since they all sell at different prices. For a cryptocurrency like Bitcoin, most entities called crypto whales own a minimum of 1000 BTC in their wallet. At publication time, the equivalent of 1000 BTC is $24.5 million.

On the other hand, smaller cryptocurrencies require less money to become a crypto whale. For example, consider a cryptocurrency with a trading price of $0.001 and a total supply of 100 million. Someone would need only $1 million to take a sizeable whale position in that cryptocurrency.

Most smaller cryptocurrencies today come to the market through marketing schemes such as initial coin offerings (ICOs) or crypto airdrops. With fewer funds, anyone can make strategic moves and become a crypto whale in that asset.

Are Crypto Whales Buying or Selling?

Crypto whales are actively buying and selling cryptocurrencies like other traders in the market. There are buy and sell actions carried out by crypto whales that have both reflected and not reflected on the crypto market. Here are some notable examples:

-

Tesla’s Bitcoin Investment

In February 2021, the electric car-making company Tesla revealed a $1.5 billion investment in Bitcoin. The trade likely occurred over the counter (OTC). An OTC trade is a scheme where crypto gets sent from one wallet to another at a predetermined price. Crypto whales use the strategy when making trades without attracting the market’s attention.

After disclosing its investment in Bitcoin, Tesla added the asset as payment for its products. Bitcoin’s price rallied at the time. However, the company later withheld from using BTC as a payment method.

In July 2022, Tesla stated in its quarterly financial earnings report that it sold 75% of its BTC holdings. The deal, worth billions, left $218 million worth of bitcoin on the company’s balance sheet at the time. Tesla recorded losses from the trade as it sold BTC at a lower price.

Tesla’s sell action triggered a price decline for Bitcoin amid a broader market decline.

-

MicroStrategy’s Bitcoin Purchases

In 2020, the American-based business intelligence company, MicroStrategy, became known for its Bitcoin-buying policy. The idea came to life under the administration of its then-CEO, Michael Saylor.

For over two years, MicroStrategy remained committed to a Bitcoin purchasing spree. Reports confirm that the firm has 132,500 BTC.

On one occasion, however, the business intelligence firm broke its buy-only commitment to Bitcoin. In December 2022, the company sold 704 BTC worth $11.8 million for tax settlement purposes.

MicroStrategy’s bitcoin sale left the crypto market largely unaffected. That could suggest that the deals get closed over the counter.

-

Fantom Massive Selloff

Fantom is a smart contract blockchain that offers low fees and fast transactions. The network has FTM as its native cryptocurrency.

On January 1, 2023, FTM traded at $0.1. Before the month ended, FTM rallied over 400%, bringing its price to $0.45. The price surge likely triggered a massive selloff later.

An analysis shared by the analytics platform Santiment on February 15 showed that whale addresses holding between 10,000 FTM and 100 million FTM “dumped heavily” within the previous four weeks. The whales sold off $259.7 million worth of the coin.

Despite the selloff, FTM proved resilient as it continued to trade around $0.4. At press time, the coin traded at $0.49.

What Is Crypto Whale Tracking?

Crypto whale tracking is a process of monitoring the actions of crypto whales and sometimes offering investment choices for retail users based on these actions. Put simply, it includes tools that reveal how to see what crypto whales are buying.

When a crypto whale buys a particular cryptocurrency, the supply of that asset reduces on crypto exchanges, increasing its demand and price. On the other hand, when a large quantity of cryptocurrency enters a crypto exchange, it shows that a crypto whale may be looking to exit their position. Such an action may result in a price drop.

However, it is not in all cases that the movement of whales’ funds signals a price manipulation. Sometimes, they may be changing the location of their holdings.

Blockchain’s transparency makes it easy for crypto traders and investors to know the quantity of cryptocurrency a crypto whale has in their wallet. Several blockchain explorers label crypto whales’ wallets with their identities. This way, investors know these entities’ names and wallet balances while speculating on the effects of their actions on the crypto market.

Using the right crypto whale tracking tools, crypto traders will discern when to buy or sell cryptocurrencies.

Tools You Can Use to Follow Crypto Whales

Here are some crypto whale trackers that you can use to follow crypto whales:

-

Blockchain Explorers

A blockchain explorer functions as a search engine for cryptocurrencies. It enables anyone to trace transaction details such as wallet addresses involved in the trade, cryptocurrencies involved, and amounts. Most blockchain explorers also allow investors to see the balance of any wallet, thanks to the blockchain’s transparency.

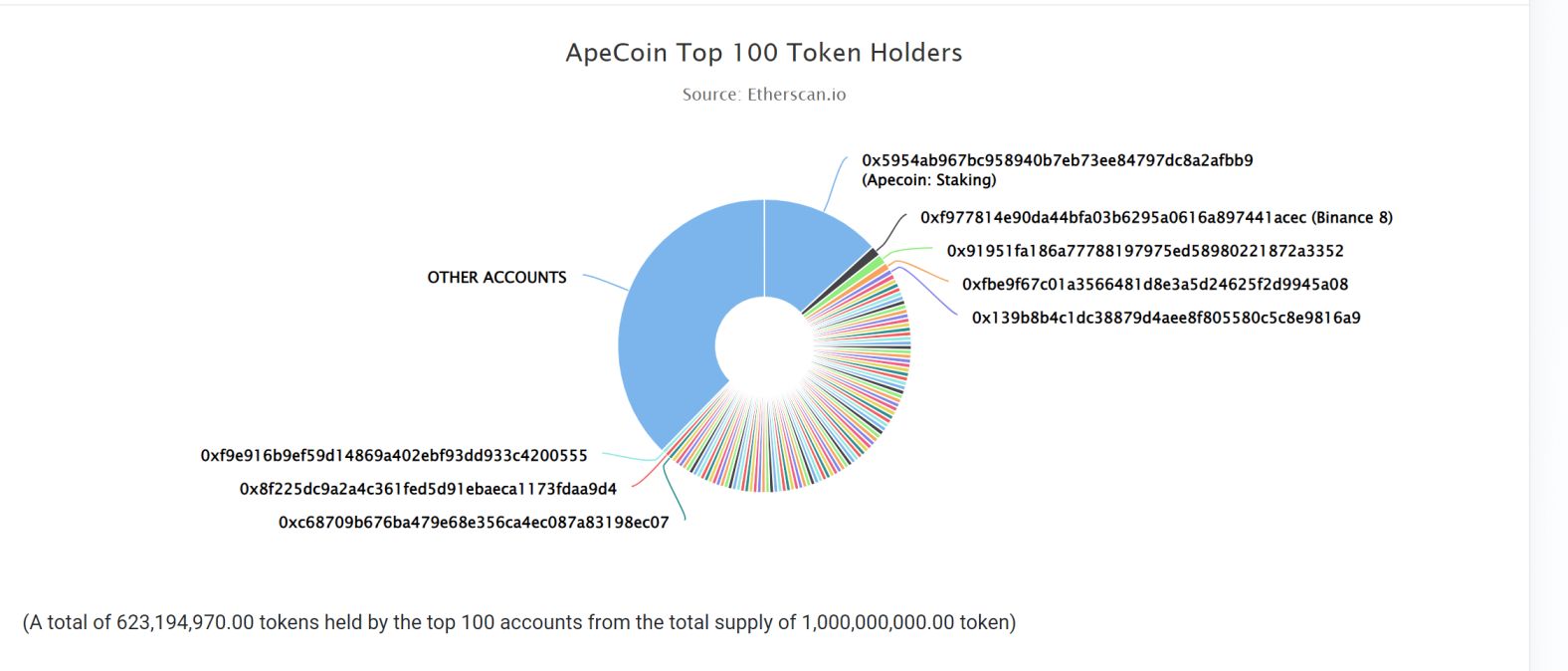

A simple hack on Etherscan, Ethereum’s most popular blockchain explorer, is the option to via the top holders of a particular token. Users can easily find the top addresses by opening the token’s contract address and checking the Holders section.

Features like the above make blockchain explorers a vital tool for crypto whale tracking activities. Users can review transactions between whale addresses to find trading patterns. Other examples of blockchain explorers include BitInfoChart, Solscan, and BscScan.

-

Whale Alert

Whale Alert is a dedicated blockchain platform that provides insights into large transactions as they occur. Its official website shows that it tracks on-chain trades across nine blockchain networks. These networks include Bitcoin, Ethereum, Solana, Tron, and Avalanche. The platform also tracks over 200 existing assets on these blockchains.

Whale Alert has a Twitter and Telegram account used to inform the public about whales’ on-chain movements.

-

Paid Analytics Platform

Some blockchain analytics platforms that offer insights into crypto trading activities may require a subscription fee for users to access their resources. Plans may vary from daily, weekly, monthly, or annual subscription fees. Some of these resources are vital to those seeking crypto whale trackers.

Examples of such paywalled platforms include Nansen and IntoTheBlock.

Play safe with crypto whales

This article discussed who a crypto whale is, what it takes to be one, and how to see what crypto whales are buying. It also gave insight into crypto whale trackers and their importance to crypto traders and investors. While whales’ actions cannot be predicted, investors need to adopt the necessary tools to know the appropriate measures to take when whales trade.

Tags

Guides- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us