Australia has reached a new milestone in the cryptocurrency sector by becoming the third-largest host of Bitcoin ATMs worldwide. As of April 24, data from Coin ATM Radar shows that Australia hosts 1,008 active crypto-fiat machines, accounting for 2.7% of the global distribution.

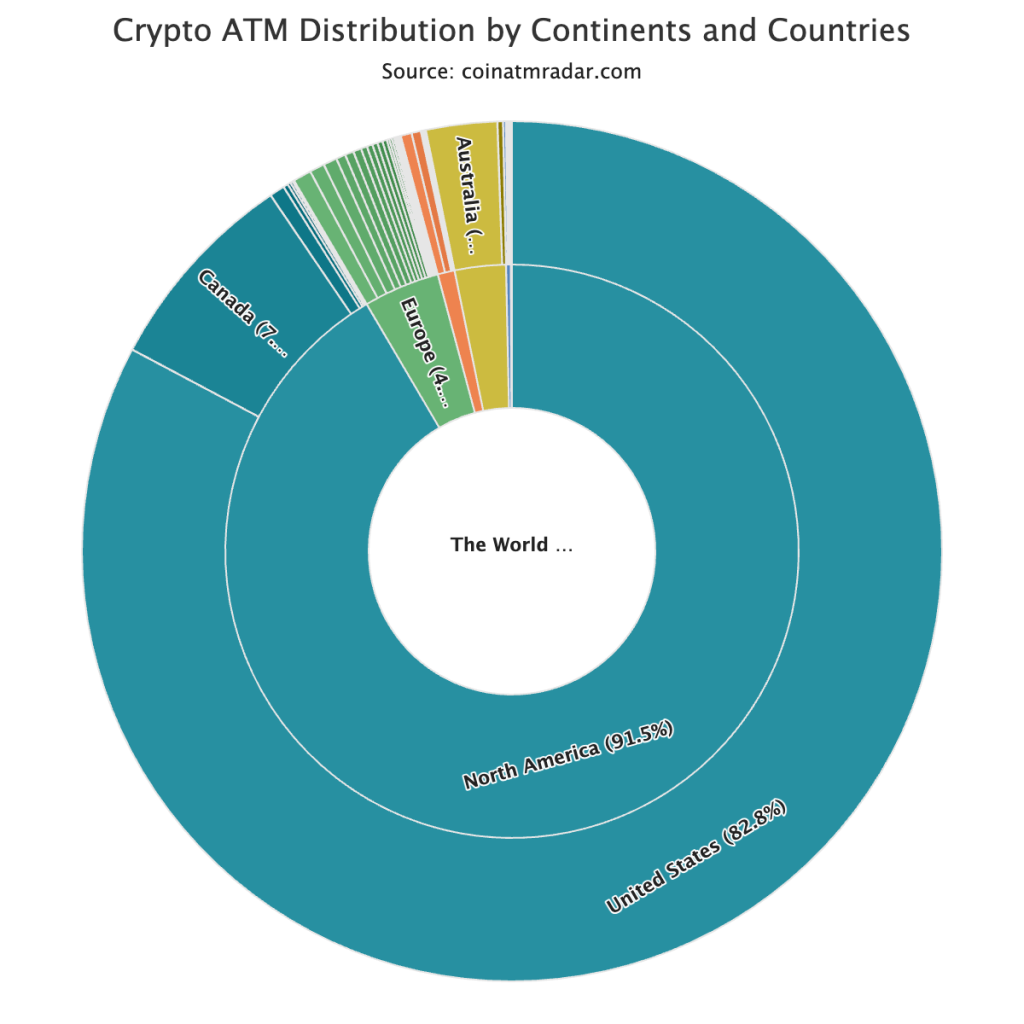

This places Australia behind the United States and Canada in the deployment of these ATMs. The United States remains the dominant leader, hosting 31,179 crypto ATMs, which makes up 82.8% of the global share. Canada holds the second position with 2,918 ATMs, representing 7.7% of the total.

The Surge In Bitcoin ATMs Across Australia Reflects A Growing National Interest In Cryptocurrency

The proliferation of Bitcoin ATMs is a growing trend across the globe, with several countries hosting a significant number of these machines. Spain leads with 261 Bitcoin ATMs, followed closely by El Salvador with 215, Poland with 211, Germany with 194, and Hong Kong with 157. These ATMs enable users to buy or sell Bitcoin and other cryptocurrencies using cash or debit and credit cards, connecting directly to cryptocurrency exchanges or platforms for transactions.

A report by Coin ATM Radar in April 2023 highlighted that the Asian continent hosted 355 crypto machines, constituting 1% of the global total. In contrast, Australia reported having 225 machines as of June 2023, making up 0.6% of the worldwide distribution. This surge in Australian Bitcoin ATMs mirrors the country’s growing enthusiasm for cryptocurrencies. Data from Statista indicates that nearly one in four Australian adults own a cryptocurrency asset, a figure that correlates with heightened trading volumes on exchanges and an increase in daily active users of cryptocurrency wallet apps.

Despite this interest, the integration of cryptocurrencies into mainstream commercial activities remains limited in Australia. Few businesses across various industries have either installed a crypto ATM or accepted cryptocurrencies as a payment method in-store.

The Biggest Development Worldwide Was Bitcoin ATMs Supporting Other Cryptocurrencies

A recent report by Coin ATM Radar, dated April 18, highlighted a modest uptick in the growth of Bitcoin ATMs, anticipating a global increase in installations as more cryptocurrency users boost demand for these machines. In the latest statistics for March, the United States led the expansion with an addition of 360 machines, marking a 1.2% increase. Australia and Canada were not far behind, with 44 new ATMs (a 4.9% increase) and 41 new devices (a 1.4% increase), respectively. Luxembourg also made its entry into the Bitcoin ATM market with its inaugural installation at Épicerie Damas.

Moreover, the adaptability of these ATMs is on the rise, with 61.4% now supporting various cryptocurrencies beyond Bitcoin. In terms of specific currencies, Tether saw the most significant addition in March 2024, with 3,640 new machines accommodating it, reflecting a 77.73% surge. Ether and Litecoin also saw notable increases, with 949 (5% increase) and 911 (4.66% increase) new installations, respectively. Other altcoins like Dogecoin and Bitcoin Cash were added to 541 (6% increase) and 154 machines (1.73% increase), while Ripple was notably suspended from 22 ATMs.

Industry-wide figures for March 2024 revealed by the Bitcoin ATM map tracker included 669 new installations versus 192 closures, culminating in a net growth of 507 machines, which corresponds to a growth rate of 1.4%.

How Bitcoin ATMs Work?

Bitcoin ATMs or simply crypto ATMs provide a bridge between physical cash and digital currencies, facilitating the conversion of deposited cash into cryptocurrency through a direct connection to a cryptocurrency exchange. These ATMs process all transactions on the blockchain, a secure digital ledger used for recording financial transactions in cryptocurrency. Users interact with the ATM by scanning a QR code from their digital wallet, depositing cash, and then transferring the newly purchased cryptocurrency directly into their wallet.

In addition to direct crypto purchases, some crypto ATMs enhance user convenience by offering voucher-based transactions. These ATMs allow users to deposit cash, choose the cryptocurrency they wish to purchase, and print a voucher. The voucher can then be scanned using a mobile app to redeem the cryptocurrency, which is deposited directly into the user’s digital wallet.

While the majority of crypto ATMs currently support only one-way transactions—permitting purchases of cryptocurrency but not sales—a growing number feature two-way transaction capabilities. These ATMs enable users to both buy and sell cryptocurrencies. Selling involves scanning a QR code from their digital wallet at the ATM, selecting the amount of cryptocurrency to sell, and receiving cash once the transaction is completed. This type of transaction typically requires photo ID verification to enhance security.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us