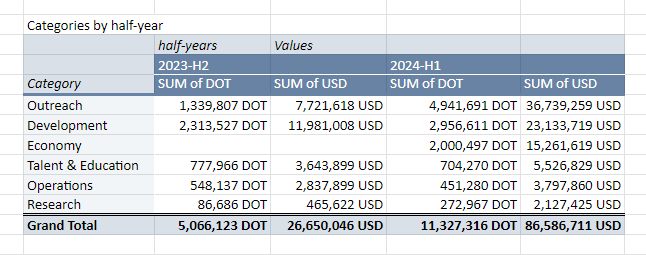

In the first half of this year, Polkadot, an early competitor of Ethereum in the cryptocurrency industry, has significantly increased its spending, allocating $87 million worth of DOT tokens to various activities.

This represents a more than 125% increase from the nearly $25 million expended in the latter half of 2023, according to a recent treasury report released by community representatives of the blockchain.

Financial Sustainability and Robust Model

The report further indicated that the treasury still possesses about $245 million in DOT tokens. At the current expenditure rate, these funds are expected to sustain the blockchain’s activities for approximately two more years.

This budget is continually replenished due to the inflationary mechanism inherent in the DOT token, suggesting a sustainable financial model despite the increased outlays.

Web3 Foundation CEO Fabian Gompf emphasized the robustness of Polkadot’s financial model. Contrary to concerns about potential insolvency, Gompf clarified on the social platform X that the treasury benefits from continuous inflows, essentially securing an indefinite operational period.

This stance was supported by other community leaders who pointed out that the treasury is poised for growth even before factoring in net spending over the coming years.

Amidst these financial disclosures, the Polkadot community faces criticism over internal dynamics and marketing strategies. Victor Ji, co-founder of Manta Network, voiced significant concerns about the professional environment within the Polkadot ecosystem.

Ji highlighted an incident during the Polkadot Academy event in Hong Kong, where he observed a lack of diversity among participants and questioned the network’s engagement with Asian stakeholders despite the event’s location in Asia.

This event, which cost over a million dollars, also revealed a gap in awareness among Polkadot’s leadership about key developments within its community, as Ji pointed out that Gavin Wood, a prominent figure in Polkadot, was unaware of Manta’s progress.

Broader Community Disillusionment

Ji’s criticisms extend beyond interpersonal interactions to include broader accusations of incompetence and a failure to genuinely decentralize or support developers building on the Polkadot stack.

These grievances are echoed by the broader community, which is increasingly vocal about their disillusionment, particularly in light of a decline in ecosystem revenues during the first half of 2024.

The treasury report from June 28, penned by Tommi Enenkel and Ignus, highlighted the allocation of $37 million to marketing efforts within the same timeframe.

However, this substantial investment has been met with backlash from the community, who argue that it failed to attract new users, developers, or businesses effectively. Despite these challenges, some members of the Polkadot community remain optimistic.

Giotto de Filippi, a Polkadot activist, countered the pessimistic outlooks regarding the treasury’s longevity, noting that the treasury continuously receives a significant portion of token inflation, which is split between staking rewards and treasury replenishment.

Future Prospects and Governance Evolution

This ongoing financial strategy not only ensures the treasury’s sustainability but also aligns user incentives with the network’s goals. Recent data from DefiLlama, which shows a 5% increase in Polkadot’s Total Value Locked (TVL) since June 30, underscores the potential long-term benefits of this approach.

In addition, Björn Wagner, co-founder of Parity Technologies—the company behind Polkadot—recently remarked on the debate over treasury spending.

While acknowledging the community’s concerns about the return on investment from recent expenditures, Wagner highlighted the sophistication and rapid evolution of Polkadot Governance.

He noted that both the Web3 Foundation and Parity possess considerable financial independence from the Polkadot on-chain treasury, which continues to benefit from robust inflows.

This complex situation within Polkadot reflects the challenges and growing pains of a major decentralized network as it scales and adapts to a rapidly evolving digital asset space.

The ongoing debates and financial maneuvers within the community indicate a dynamic interplay between governance, financial sustainability, and strategic positioning in the competitive world of blockchain technologies.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us