Block, the fintech company previously known as Square, has announced on May 6 its intention to issue $1.5 billion in senior notes via a private placement targeted at qualified institutional investors.

Terms and Investors for the Senior Notes

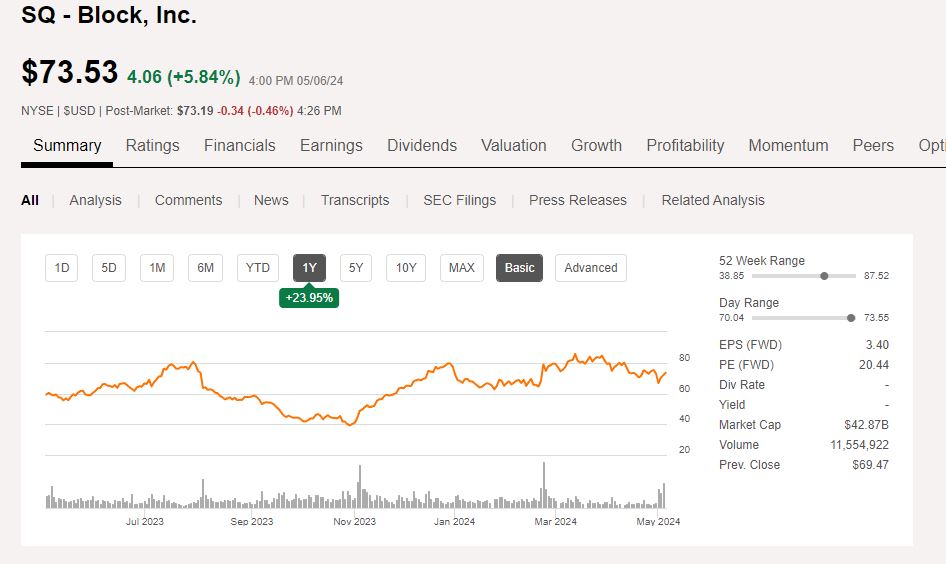

The terms of these notes, including their interest rates and maturity dates, are still under negotiation with the initial purchasers. Eligible investors for this round include entities like pension funds, banks, mutual funds, and high-net-worth individuals. Following the announcement, shares of Block (NYSE: SQ) saw an increase of over 4%, reaching $72.40.

A private placement typically involves the sale of securities to a select group of investors instead of the public market. Block intends to use the proceeds from this sale for several purposes including the repayment of existing debt, potential acquisitions and strategic transactions, capital expenditures, investments, and bolstering its working capital.

Block’s Strong Financial Position and Debt Strategy

Fitch Ratings has recognized the fintech company as being strongly positioned to benefit from growth in the payments and consumer financial services sectors. Fitch also highlighted that since its IPO, Block has primarily utilized the convertible debt market for its external funding requirements. As of March 2024, Block reported about $2.15 billion in outstanding convertible notes, a $775 million revolving credit facility available until June 2028, and $2 billion in senior unsecured notes due in 2026 and 2031.

The addition of the new debt from this latest issuance is expected to aid in refinancing obligations maturing in 2025 and 2026, while also enhancing the company’s solid balance sheet. Jack Dorsey, co-founder of Block, has been a pioneer in integrating Bitcoin into the company’s balance sheet. In a recent shareholder letter, Dorsey disclosed that Block commits to allocating 10% of its gross profit from Bitcoin-related products to further Bitcoin purchases every month. This strategy has led to the acquisition of $220 million worth of Bitcoin between the fourth quarter of 2020 and the first quarter of 2021.

Strong Q1 2024 Performance For The Fintech Company

Block’s financial performance has surpassed market expectations in the first quarter of 2024. The company’s Bitcoin-related gross profit stood at $80 million, which constitutes 3% of its total $2.73 billion Bitcoin revenue. Moreover, its mobile payments and cryptocurrency platform, Cash App, recorded $1.26 billion in gross profits for the quarter, marking a 25% increase from the previous year.

Overall, the company achieved a gross profit of $2.09 billion in the first quarter, a 22% increase from the same period last year, with total revenues reaching $5.96 billion and per-share earnings of $0.85, exceeding analysts’ forecasts.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us