Deutsche Bank, a German multinational investment bank, is collaborating with Singapore’s central bank on asset tokenization, marking a significant step in the financial sector’s evolution towards digital assets. The bank has joined the Monetary Authority of Singapore’s (MAS) Project Guardian, which aims to explore asset tokenization in wholesale funding markets and decentralized finance (DeFi) applications.

Deutsche Bank’s Role and Collaboration

In this collaboration, Deutsche Bank will test an open architecture and interoperable blockchain platform to service tokenized and digital funds. Additionally, the bank will propose protocol standards and determine the best approach to contribute to the industry’s advancement. Leading the project for Deutsche Bank is Boon-Hiong Chan, the Asia Pacific head of securities and technology. The bank will closely collaborate with Memento Blockchain, a software-based platform specializing in DeFi and digital asset management.

Deutsche Bank and Memento Blockchain have a history of successful collaboration. In 2022 and 2023, they completed a proof-of-concept known as Project DAMA (Digital Assets Management Access), which aimed to create a more efficient, secure, and flexible solution for digital fund management and investment servicing. The new efforts under Deutsche Bank aim to introduce DAMA 2, with the development involving Interop Labs, the initial developer of the Axelar network, a major interoperable blockchain.

The importance of secure blockchain interoperability has been highlighted by several major cryptocurrency firms, including Ripple, which announced a collaboration with Axelar in February 2024. This partnership aims to tokenize real-world assets (RWA) on the XRP Ledger, made interoperable through Axelar. Sergey Gorbunov, co-founder of Axelar and CEO of Interop Labs, emphasized that secure blockchain interoperability is essential to unlocking the trillion-dollar potential in asset tokenization. He noted that Deutsche Bank and Project Guardian are leading innovation toward establishing open systems that will enable this technology, with Axelar playing a crucial role in institutional adoption.

Project Guardian’s Initiatives and Goals

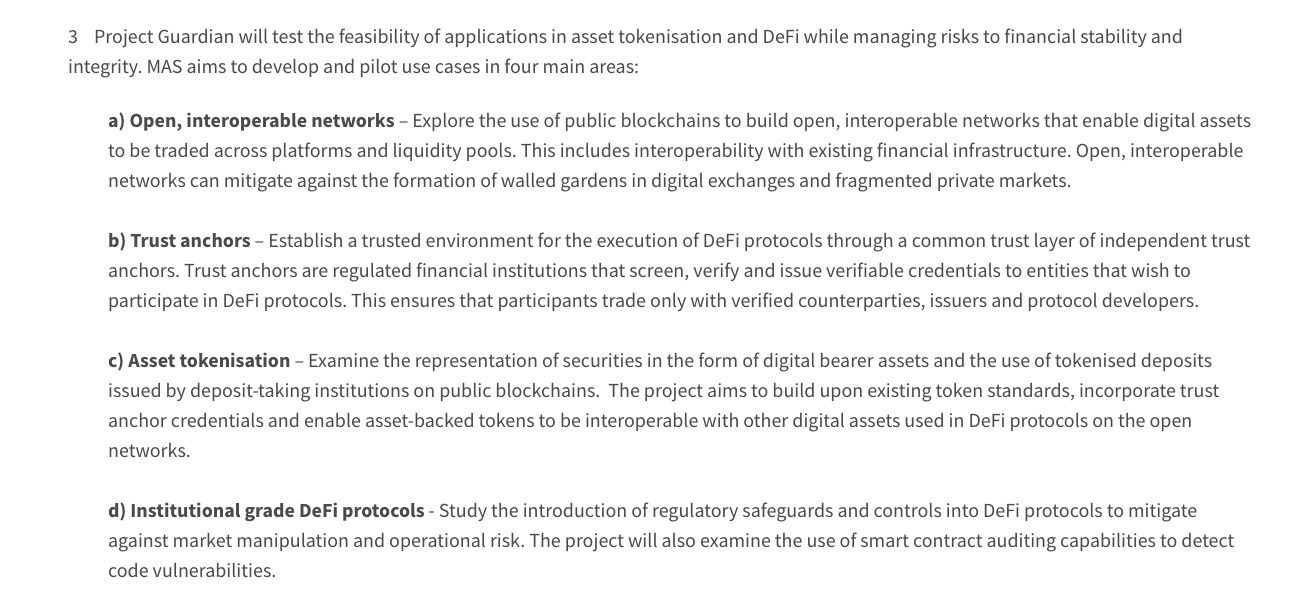

Project Guardian, initiated by MAS in 2022, is a collaborative initiative designed to develop new financial infrastructure using DeFi elements. The latest initiatives under Project Guardian aim to develop foundational capabilities to scale tokenized markets. MAS explained that these developments will catalyze the institutional adoption of digital assets, aiming to free up liquidity, unlock investment opportunities, and increase the efficiency of financial markets.

Among the 17 financial institutions that are members of Project Guardian, Citi, T. Rowe Price, and Fidelity International are testing bilateral digital asset trade mechanisms, exploring real-time post-trade reporting, and analytics of digital asset trades. Ant Group is testing a treasury management solution to enhance global liquidity management funding. BNY Mellon and OCBC are responsible for testing a cross-border foreign exchange payment solution across heterogeneous networks. Franklin Templeton is testing the issuance of a tokenized money market fund through a variable capital company (VCC) structure, while JPMorgan and Apollo are collaborating to streamline asset servicing processes using digital assets.

In addition to these pilots, MAS launched Global Layer One to explore the design of an open digital infrastructure to host tokenized financial assets and applications. The central bank has also worked with the financial industry to develop an Interlinked Network Model, a common framework for exchanging digital assets across independent networks among financial institutions. Furthermore, the International Monetary Fund has been included as one of Project Guardian’s policymakers.

Deutsche Bank’s Recent Report and Tether’s Response

Deutsche Bank’s entrance into Singapore’s tokenization project coincides with the bank’s recent report on stablecoins, which raised questions about the transparency of major issuers like Tether. In response, Tether criticized Deutsche Bank’s claims, arguing that the report lacked substantial evidence or concrete data.

Tether’s USDT stablecoin remains a major component of the cryptocurrency market, accounting for its largest share in terms of trades. It is also the world’s largest stablecoin with a total market value of nearly $111 billion. This development underscores the growing importance and scrutiny of digital assets and their integration into the global financial system.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us