In the fast-paced world of cryptocurrency investments, Ethereum exchange-traded products (ETPs) have recently seen a notable surge in performance compared to their Bitcoin counterparts.

This upswing comes just as the financial markets anticipate the launch of the first spot Ethereum exchange-traded funds (ETFs) in the United States, an event that has attracted significant attention from investors.

Decline in Bitcoin ETPs

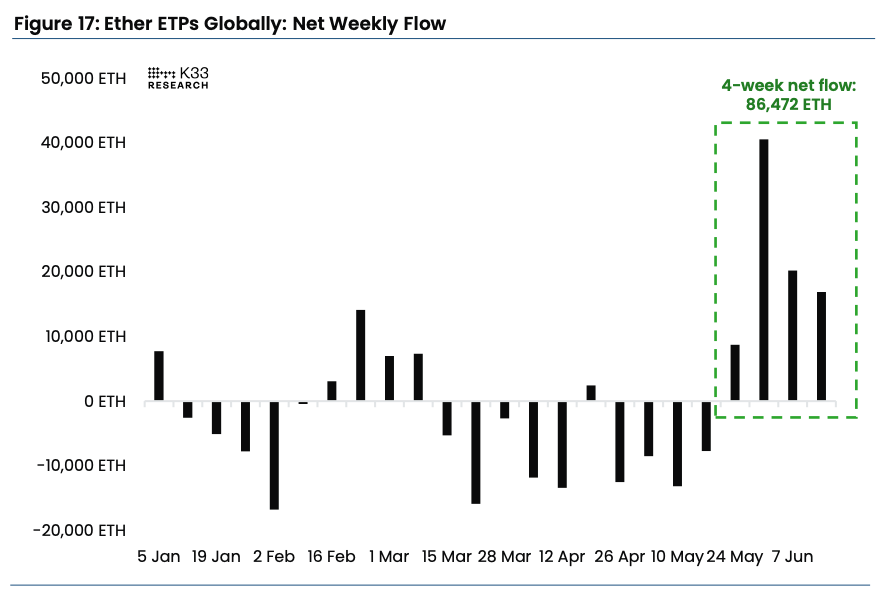

According to data from K33 Research, Ethereum ETPs have enjoyed four weeks of net inflows totaling 86,472 ETH, approximately valued at $300 million. This recent influx mirrors the substantial $1.25 billion surge in Bitcoin ETPs observed in November 2023, prior to the introduction of spot Bitcoin ETFs in the U.S.

Conversely, Bitcoin ETPs are currently experiencing a downturn, with net outflows of 12,523 BTC last week—marking it as the third-worst performance on record.

The outflows from U.S. spot Bitcoin ETFs primarily drove this decline. K33 analysts Vetle Lunde and David Zimmerman indicated in a recent report that these figures suggest that the forthcoming U.S. spot Ethereum ETFs could capture about 25% of the investment flows that Bitcoin ETFs initially attracted.

The regulatory path for Ethereum ETFs is progressing, with the U.S. Securities and Exchange Commission (SEC) recently approving 19b-4 forms for eight Ethereum ETFs from leading financial entities such as BlackRock and Fidelity on May 23.

However, these issuers are awaiting the effective date of their S-1 registration statements, a mandatory step before trading can commence. The approval process is expected to take several weeks, but there is optimism in the air.

Last week, SEC Chair Gary Gensler hinted that the S-1 approvals might be finalized by the end of this summer.

Forecast and Optimism for Ethereum ETF Launch

Bloomberg ETF analysts Eric Balchunas and James Seyffart have updated their forecast for the Ethereum ETF launch to as soon as July 2, citing light comments from SEC staff on the S-1 documents and a proactive approach to clearing regulatory hurdles ahead of the holiday weekend.

As the potential launch date approaches, Matt Hougan, Chief Investment Officer at Bitwise—which launched its own spot Bitcoin ETF earlier this year—is advocating for the inclusion of Ethereum ETFs in investment portfolios.

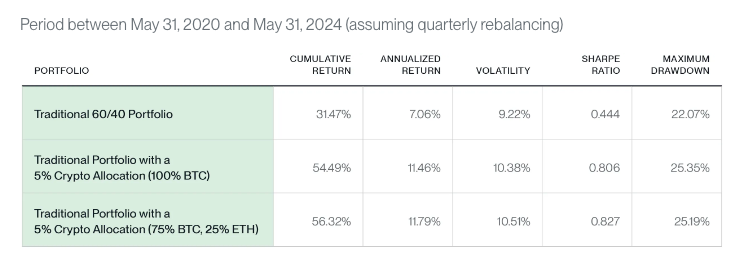

In a memo to clients, Hougan outlined three compelling reasons for investors to consider Ethereum alongside Bitcoin. He pointed out the benefits of diversification, Ethereum’s broader utility beyond just being a form of money, and historical data supporting improved returns and risk-adjusted performance when Ethereum is added to traditional portfolios.

Hougan noted that most investors typically do not limit themselves to a single stock but rather invest in a basket of assets. Applying this strategy to cryptocurrency, he suggests an allocation that reflects Ethereum’s substantial market presence: about one-third the size of Bitcoin’s.

Given Ethereum’s $420 billion market cap compared to Bitcoin’s $1.3 trillion, a starting investment ratio of 75% Bitcoin to 25% Ethereum seems prudent.

Advantages of Ethereum’s Blockchain

Ethereum’s blockchain facilitates a wide array of applications from stablecoins to decentralized finance—opportunities that Bitcoin’s architecture does not inherently support. This versatility makes Ethereum an attractive option for investors looking to leverage the broader potential of public blockchains.

While Hougan champions the addition of Ethereum for its diversified benefits, he also acknowledges reasons for investors to maintain a Bitcoin-focused strategy.

He highlighted Bitcoin’s potential as the dominant form of new money, underpinned by its decentralized nature, regulatory strength, and vast market reach. For those primarily concerned with the devaluation of fiat currencies or economic issues such as debt and deficits, Bitcoin might still be the preferable choice.

These developments are poised to significantly influence investor strategies and enhance the acceptance and integration of cryptocurrencies into diverse financial portfolios.

With these ETFs, investors will have new opportunities to engage with digital assets in a regulated and potentially more stable environment.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us