A U.S. federal court has cleared cryptocurrency-focused fund manager Grayscale to launch the first spot Bitcoin exchange-traded fund (ETF). The latest developments may well end a nearly ten-year wait for a spot Bitcoin ETF in the United States and pave the way for everyday investors to access Bitcoin.

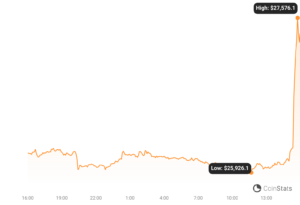

The price of Bitcoin (BTC) jumped over 5% on the news, which many industry experts view as a watershed moment. The leading cryptocurrency currently trades at approximately $27,300.

(Source: CoinStats)

Grayscale’s Year-Long Pursuit

According to a court document dated August 29th, the case was presided over by a three-judge appeals panel.

Grayscale has been in pursuit of a spot Bitcoin ETF for over a year now. In June 2022, the asset manager was faced with a roadblock when the U.S. Securities and Exchange Commission (SEC) denied approval for the conversion of Grayscale’s GBTC into a Bitcoin ETF.

The American financial agency had previously approved investment companies like Coinbase to offer futures Bitcoin ETF, whereas it continued to deny Grayscale and a cohort of investment firms the green light to offer spot Bitcoin ETF.

Capitalizing on this decision by the SEC, Grayscale queried the regulatory watchdog in July. The company questioned the agency’s continued refusal for a spot Bitcoin ETF since both financial products were similar.

In support of Grayscale’s view on the matter, Judge Neomi Rao, one of the presiding judges, wrote:

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products.”

Will the SEC Give Approval?

The latest decision by the U.S. federal court does not guarantee that the SEC will approve Grayscale’s spot Bitcoin ETF.

In fact, the financial watchdog may take up to 45 days to file for an en banc hearing, a type of court hearing where all the judges of a court come to hear the case instead of a single judge or a small panel of judges. Whichever the case, approval for Grayscale’s spot Bitcoin ETF will likely mean similar action for BlackRock, Fidelity, and others, with pending approval for the same product.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us