Bitfarms Ltd., a player in the Bitcoin mining industry, is embroiled in a lawsuit filed by Geoffrey Morphy in the Superior Court of Ontario.

The claim, initiated on Friday, seeks $27 million in damages for alleged breach of contract, wrongful dismissal, and aggravated and punitive damages. Bitfarms has rejected the allegations, asserting that they are without merit and vowing to defend against them vigorously.

Geoffrey Morphy, who was appointed interim president and CEO in late 2022, was announced to be leaving the company on March 25, 2024. However, this transition did not go as planned. On Monday, Bitfarms stated that Morphy had been terminated effective immediately and was no longer a director of the company. The lawsuit claims that Morphy’s dismissal was wrongful and a breach of contract. Bitfarms, in response, emphasized their intention to contest the claims robustly.

Morphy’s departure from Bitfarms and subsequent legal action have added to the company’s existing challenges. As a figure in the company’s leadership, Morphy’s sudden exit and the lawsuit could have implications for Bitfarms’ operations and market performance.

Leadership Transition Amid Legal Dispute

Following Morphy’s termination, Nicolas Bonta, chairman and co-founder of Bitfarms, has been appointed as the interim president and CEO. Bonta will hold this position while the company completes its search for a permanent replacement, which is expected in the coming weeks. Bitfarms is keen on ensuring stability and continuity in its leadership during this transitional period.

This leadership change comes at a challenging time for Bitfarms, as the company faces multiple industry headwinds. The ongoing legal dispute and the need for a new CEO add complexity to the firm’s efforts to navigate these issues.

Industry Challenges in 2024

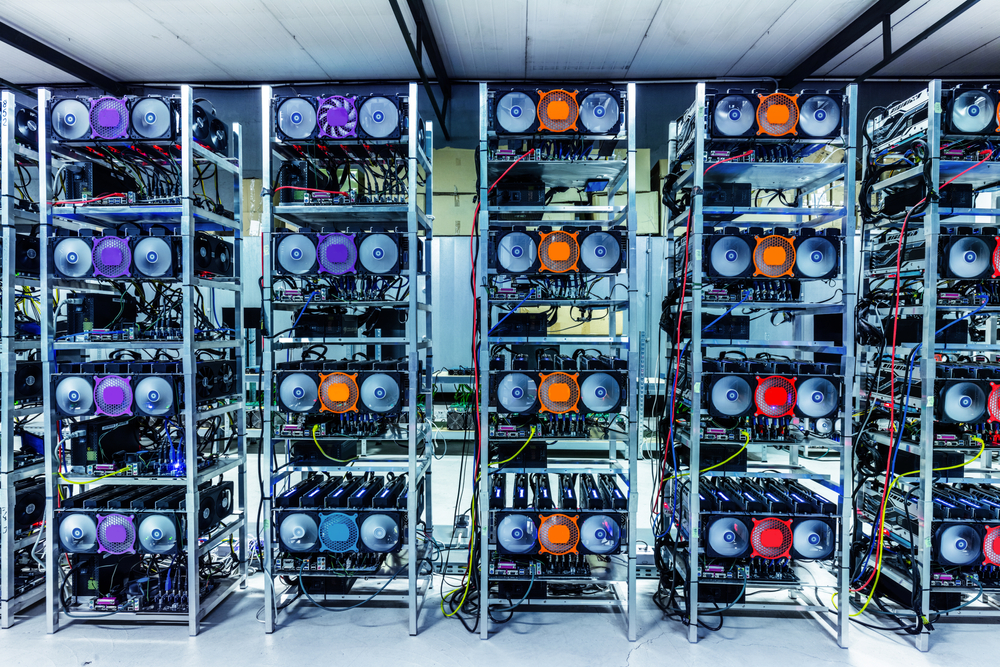

The Bitcoin mining industry, including Bitfarms, is confronting several significant challenges in 2024. Rising energy costs and increased competition have strained operations. Additionally, an April software code update known as the “halving” has drastically reduced Bitcoin miners’ primary revenue source. This update has led to a sharp decline in the production of new coins despite Bitcoin prices soaring in the first quarter of the year.

Mining difficulty, which measures the computing power required to generate Bitcoin tokens, has surged, compounding the industry’s challenges. This increased difficulty means higher operational costs and lower profitability for miners like Bitfarms.

Bitfarms’ financial performance has been impacted by these industry challenges. The company’s shares have experienced a significant decline, falling around 40% this year. The stock closed at $1.73 on Friday, reflecting investor concerns over the company’s prospects amid the ongoing legal and operational challenges.

Following the announcement of Morphy’s dismissal and the lawsuit, Bitfarms’ stock price further dropped to $1.55, indicating a decline of over 10%. This downturn adds to a year-to-date loss exceeding 50%. The market reaction underscores the uncertainty and potential risks facing the company in the current environment.

Rescheduling of Q1 Conference Call

In light of recent events, Bitfarms has rescheduled its first-quarter conference call, originally set for May 13, to May 15 at 8 a.m. ET. This rescheduling allows the company to address the recent developments and provide updated information to investors and stakeholders.

The conference call will be a critical opportunity for Bitfarms to communicate its strategy and reassure investors amidst the ongoing legal dispute and industry challenges. Stakeholders will be keen to hear about the company’s plans for leadership transition, operational adjustments, and strategies to mitigate the impact of the current headwinds.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us