Blockchain project Floki is expanding its ecosystem with the launch of a tokenization platform and a new token. On October 27, Floki plans to unveil its new platform, TokenFi, and a token, TokenFi (TOKEN), which will underpin the new project.

Notably, TokenFi is an attempt by Floki to tap into the potential that blockchain-based tokenization brings to the financial economy. The project cites public research that estimates the tokenization industry will eventually be valued at over $16 trillion by 2030.

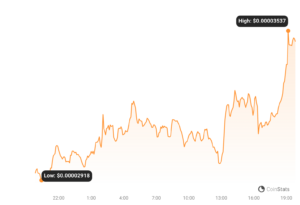

Hence, TokenFi hopes to capitalize on this opportunity and bring immense value to its community. The price of FLOKI, which is listed on Binance, jumped 18% following news of the upcoming token’s release.

Relationship Between Floki and TokenFi

According to Floki, the new TokenFi platform and its token will co-exist with the FLOKI token. Following its release on October 27, users can participate in a new staking program where they can stake FLOKI to earn TOKEN rewards. Floki plans to distribute 56% of TokenFi’s (TOKEN) supply through the staking program over the next four years.

The project also shared additional details about the new token. For instance, it will have a maximum supply of 10 billion coins evenly issued on the Ethereum and BNB Chain networks. Additionally, Floki will provide initial liquidity for the asset on Uniswap and Pancakeswap, giving it an initial circulating market cap of $50,000 and a fully diluted value of $500,000.

Floki also plans to introduce additional measures to ensure a smooth launch. The project will implement a 20% tax on buyers and sellers within the first hour of the new token’s release. Additionally, no individual can purchase more than 1% of the token’s supply (100 million tokens) at launch.

Meanwhile, Floki noted that it will only release a new website for the TokenFi platform on October 27. However, the project is already in its advanced development stage, with many core products live on testnet and due to launch before the end of the year’s final quarter.

Tags

Crypto News- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us