Popular cryptocurrency exchange Binance has settled charges of money laundering and fraud brought against the company by U.S. authorities. The total settlement sum is worth around $4.3 billion, with the plea agreement including that CEO Changpeng Zhao steps down from his role.

In a post following the announcement, Changpeng Zhao (a.k.a CZ) confirmed he has now stepped down as Binance CEO after being at the helm for over six years. The company has appointed its former Global Head of Regional Markets, Richard Teng, as CEO, hoping to begin a new chapter.

Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.

Binance is no longer a baby. It is…

— CZ 🔶 BNB (@cz_binance) November 21, 2023

CZ and Binance Pleads Guilty to Charges

In its announcement of the indication, the United States Department of Justice (DOJ) notes that Binance and its CEO pleaded guilty to charges of “money laundering, unlicensed money transmitting, and sanctions violation.” The imposed settlement amount is the largest paid by a company executive for criminal charges.

It is noteworthy that the crimes for which Binance has been indicted largely linked to its operations in its early years. The exchange implemented loose know-your-customer and anti-money laundering requirements (KYC/AML) and violated sanctions laws to grow its market share.

Commenting on this approach, Attorney General Merrick Garland claimed: “Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed – now it is paying one of the largest corporate penalties in U.S. history.”

Meanwhile, Binance, in its defense, notes that it has taken “responsibility for this past chapter.” The exchange is embracing regulatory safeguards under its new leadership. Additionally, the complaints against the company are only alleged violations of financial laws. U.S. authorities did not find Binance ‘guilty’ of misappropriating user funds or manipulating markets,’ the company said.

BNB Reacts to Settlement News

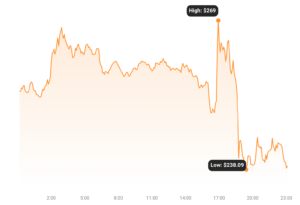

The price of Binance’s native coin, BNB, has seen significant volatility in the wake of news that the exchange has reached a settlement with U.S. authorities. BNB briefly rose to near $270 following the rumors but has since backslid to around $236 at the time of writing.

BNB maintains a $37 billion market cap as investors continue to speculate on its role in Binance’s new chapter.

Tags

Binance- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us