The debate around whether Ether is a security has taken center stage in the crypto ecosystem as the United States Securities and Exchange Commission (SEC) deadline for deciding on whether to approve a spot Ether exchange-traded fund (ETF) approaches. The final decision on VanEck’s spot Ether ETF application is due by May 23.

Uncertain Outlook for Ether ETF

Ether, the second-largest cryptocurrency after Bitcoin, is nearing a crucial milestone, with much hinging on whether the SEC views it as a commodity or a security. The SEC approved spot Bitcoin ETFs on January 10, solidifying Bitcoin’s status as a commodity.

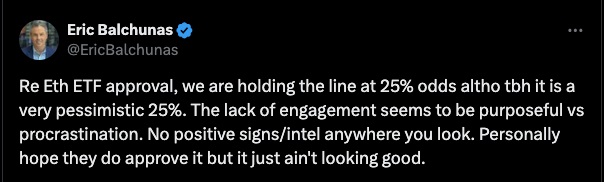

However, the outlook for an Ether ETF is less certain. The SEC is again scrutinizing whether Ether qualifies as a security, leading many analysts to adopt a more pessimistic view on the ETF’s approval chances. Bloomberg ETF analyst Eric Balchunas, who previously estimated a 70% chance for the approval of a spot Ether ETF, now places the odds at a mere 25%.

The primary obstacle to spot Ether ETFs is an ongoing investigation by Gurbir Grewal, head of the SEC’s Division of Enforcement, into Ether’s status as a security. According to new filings in March, the SEC established a five-member commission approved by the Division of Enforcement’s “Ethereum 2.0” investigation on April 13, 2023. In April, Consensys, a blockchain and Web3 software company, sued the SEC, challenging its authority to regulate Ether as a security.

SEC Chair Gary Gensler played a key role in the approval of spot Bitcoin ETFs, leading to speculation that his vote was crucial in their approval. However, internal documents suggest that Gensler considers Ether a security, which could influence the decision against approving a spot Ether ETF. Finance lawyer Scott Johnsson highlighted that the SEC is considering the security question for Ether in the upcoming spot ETF order.

This is evident from the inclusion of a “notice of the grounds for disapproval” in the SEC’s decision, a clause absent in the Bitcoin ETF decision. Johnsson believes this clause indicates the SEC may deny the ETF on the grounds that the spot filings are improperly filed as commodity-based trust shares and do not qualify if they hold a security.

Staking and Ether’s Classification

The SEC and Gensler have consistently maintained their stance that all digital tokens, apart from Bitcoin, are securities. A financial instrument is considered a security if there is an expectation of profit from a passive investment based on the efforts of others in a common financial enterprise. Ether’s early stage pre-mining, its initial coin offering, and the presence of the centralized Ethereum Foundation make it closer to a security in the eyes of regulators.

Additionally, the ability for Ether holders to earn staking rewards from the network contributes to the SEC’s belief that it could be classified as a security. With Ethereum’s proof-of-stake (PoS) protocol, validators are selected to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. Rewards are distributed based on the amount staked.

While this move to PoS introduces elements that could align with the Howey test criteria for an investment contract, it does not necessarily mean that Ether will be classified as a security. Amendments to the fund’s proposal added clear language stating that the Fund’s Ether cannot be staked by anyone, according to Bloomberg ETF analyst James Seyffart.

Potential Impact of Presidential Elections

Many experts and market pundits believe that the upcoming U.S. presidential election could play a crucial role in deciding the fate of spot Ether ETFs. Cryptocurrency has become a significant issue this election season, especially given former president Donald Trump’s advocacy for crypto assets and recent votes in the U.S. House of Representatives and Senate to overturn the SEC’s Staff Accounting Bulletin No. 121 (SAB 121).

A change in government could potentially usher in a new era for cryptocurrency and regulations amid growing institutional demand. However, experts caution that Trump’s advocacy might not significantly impact the post-election regulatory landscape.

Some in the crypto community initially celebrated Gensler’s appointment as SEC chair, citing his background and understanding of the crypto space. However, as SEC chair, Gensler has taken a stringent stance against the industry.

A new administration could alter policy priorities and regulatory approaches, potentially influencing how the SEC and other regulators view Ether. Shifts in key regulatory positions and the overall political climate could lead to a reevaluation of current stances, making the regulatory environment for cryptocurrencies more dynamic and subject to change.

The decision on whether to approve a spot Ether ETF is poised at a critical juncture, influenced by regulatory interpretations of Ether’s status as a security, ongoing investigations, and the broader political landscape. The outcome will have significant implications for the crypto market and the regulatory framework governing digital assets.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us