In its recent Signals report issued on April 22, Fidelity Digital Assets has adjusted its medium-term forecast for Bitcoin (BTC) to “neutral” from “positive.” This revision follows the first quarter’s evaluation, where various metrics indicated a shift in Bitcoin’s valuation.

Previously deemed affordable, Bitcoin now faces potential selling pressures, making it less attractive at current prices. The report highlights the use of the Bitcoin Yardstick, also known as the Hashrate Yardstick, which serves a similar purpose to the price-to-earnings ratio in stock evaluations but is tailored to assess whether Bitcoin is undervalued.

99% Of Bitcoin Addresses Are In Profit And Could Start A Sell-Out

Fidelity reported that during the first quarter, the Yardstick indicated Bitcoin fluctuated between a negative one and zero deviations from its mean of 51%, highlighting the absence of days in which Bitcoin was considered “cheap.” Consequently, the investment firm now regards Bitcoin as trading at “fair value” and has adjusted its medium-term outlook for the cryptocurrency to neutral.

This revised stance is supported by several factors, including increased selling pressure from long-term holders and the fact that 99% of Bitcoin addresses are currently in profit, a situation that may encourage selling. Additionally, other on-chain indicators such as the Net Unrealized Profit/Loss (NUPL) ratio and the MVRV Z-Score, which evaluate whether Bitcoin is overvalued or undervalued relative to its “fair value,” also play a crucial role in this neutral assessment.

Despite this neutral medium-term forecast, Fidelity maintains a positive outlook in the short term. The firm acknowledges the potential for short-term profit-taking as Q1 2024 concludes but notes the absence of extreme indicators typically associated with bull market peaks.

Fidelity’s Research Director Says We Are In The Middle Of The Bull Cycle

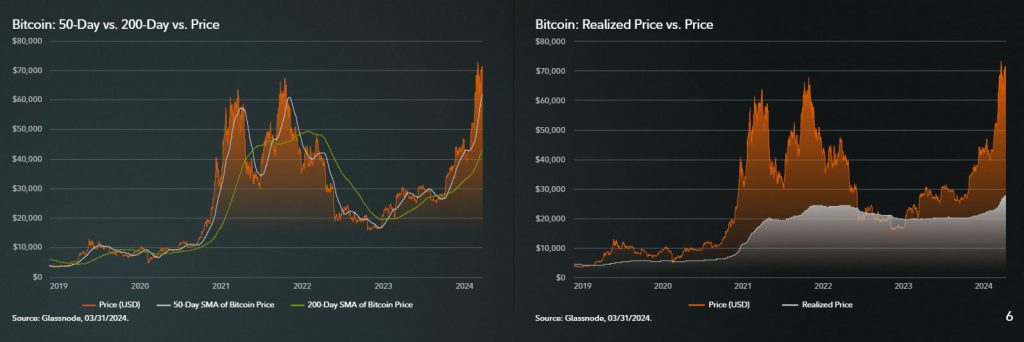

Throughout the first quarter, Bitcoin demonstrated bullish momentum as its price consistently traded above its 50-day and 200-day moving averages, a scenario often referred to as a “golden cross” on its chart. Chris Kuiper, the director of research for the firm, expressed a positive outlook in an April 23 post on X, noting that on-chain indicators had risen significantly from previously observed lows or extreme bottoms.

The firm’s report also highlighted Bitcoin’s realized price, which is designed to estimate the average cost basis for all current holders of the cryptocurrency. As of the end of Q1, the realized price was approximately $28,000, serving as a solid support level since mid-January.

Further data indicated robust on-chain accumulation by smaller investors, with the count of addresses holding Bitcoin valued at $1,000 or more increasing by 20% since the start of the year, reaching new all-time highs.

Additionally, the report noted a decrease in exchange balances as more investors opted for self-custody, which in turn reduced selling pressure.

Kuiper further clarified that the market was not approaching the historical extreme highs yet, positioning it at a midpoint in the market cycle. He highlighted that historically, most price gains have occurred in the latter half of these cycles.

This leaves us in a middle-ground or halfway point.

However, it should be noted cyclical and valuation-type indicators do not map to price action.

In fact, historically, a disproportionate amount of price gains occur in the latter half of the cycle.

— Chris Kuiper, CFA (@ChrisJKuiper) April 22, 2024

After maintaining a range-bound state since late February, oscillating between $72,000 and $60,000, Bitcoin has recently seen a modest uptick. Following the weekend’s halving event, it achieved a ten-day high of $66,863, per the latest data from CoinGecko.

- Crypto Price Update July 24: BTC Maintains $66K, ETH at $3.4K, XRP, TON, and ADA Rallies

- Bitcoin Falls to $65K as Mt. Gox Transfers $2.8 Billion BTC to External Wallet

- News of Marathon Digital’s $138 Million Fine for Breach of Non-Disclosure Agreement Triggers a Bearish 2.5% of Its MARA Stock

- Are $530M Bitcoin ETF Inflows a Blessing or Caution?

- Metaplanet Teams with Hoseki for Real-Time Bitcoin Holdings Verification

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us